Netflix wants to be the default video streaming app on millions of smartphones in India, a country with a population of 1.3 billion people. The California-based video streaming giant, which entered the Indian market in 2016, has rolled out a Rs 199 mobile-only monthly plan which it says will help convince a diverse section of users to give a shot at Netflix.

“India is one of those markets where we see so much potential for Netflix,” Ajay Arora, Director, Product Innovation, Netflix, told indianexpress.com on the sidelines of the unveiling of a mobile-tier exclusively for the Indian market. “We are seeing our investment in content paying off because the end consumers are loving our shows, and we want to grow here,” he said.

Arora admits how mobile-centric India has been, and the core reason why Netflix now offers the new subscription plan for Rs 199 ($2.88) per month that is available only to mobile users. He said more users from India now watch their content on mobile and at the same time there has been a surge in signups on mobile. “It’s just off the charts and at another level,” Arora said.

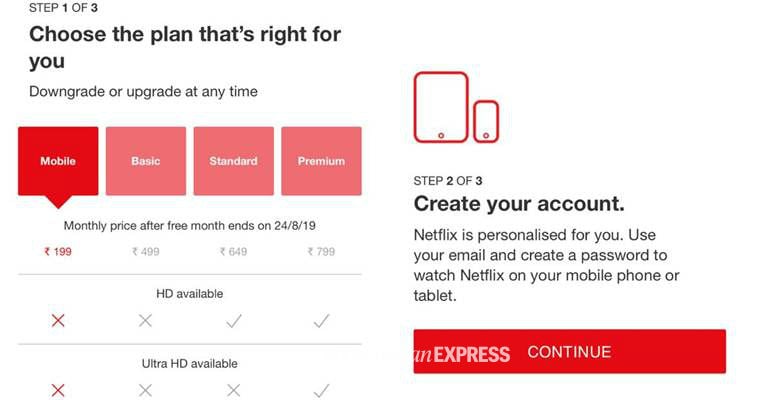

“When you look at the insights around how mobile-centric it is. It’s the concept of like, a mobile-tier, marries those two together. And we are able to tap into the user behaviours of Indian consumers by introducing a plan. So it just worked out that way,” he explained. India is the first market Netflix has ever attempted to create a plan made for mobile users. The Rs 199 mobile-only plan is half the price of the basic plan, which costs Rs 499 a month.

“The beauty of this mobile-tier is that you get the same content that is available with other tiers … all the episodes at one time and no ads,” Arora said the company conducted 400 different tests in the past year before rolling out the Rs 199 plan to Indian customers. “This is the first innovation on mobile tiering and expect more things from Netflix as we continue to kind of broaden the audience in the country,” he adds.

Netflix has 151 million paid subscribers in 191 countries but the growth is slowing down. The streaming giant lost 130,000 subscribers in the US for the second quarter of 2019 – and added fewer than expected international customers. With China being blocked, India is one market where Netflix is looking to increase its subscriber count. Last year, Netflix CEO Reed Hastings predicted that its next 100 million subscribers would come from India.

In many ways, India is a unique market and Netflix is aware of the same. A country like India gives Netflix access to millions of users who own a smartphone and that number is steadily increasing. By 2022, there will be 829 million smartphone users in India, according to Cisco’s 13th annual Visual Networking Index (VNI). With access to smartphones and cheap data, more people now consume video content on their phones than any other device. Also, India is home to Bollywood and regional film industries. All of these factors favour Netflix to increase its footprint in India

Over the past few months, the streaming service has commissioned a number of Indian original movies and TV shows. Last week, Netflix had announced five new Hindi-language original series across genres for the Indian market, including a horror series produced by Bollywood superstar Shah Rukh Khan. Netflix tasted success with its first Indian original, Sacred Games, which became a huge hit globally. Netflix is now preparing for the second season of the critically-acclaimed Sacred Games, which premiers August 15.

Despite a robust lineup of content and a mobile-only plan, it would not be easy for Netflix to make a cut in India’s video streaming market, analysts say. Netflix is still well behind Disney’s Hotstar and Amazon’s Prime Video and the competition is increasing from local players like Jio’s LiveTV, Alt Balaji, and Zee5.

“Netflix will still remain a niche content provider and it would be a lot of dilution of its positioning if it wants to deeply align content suitable for Indian viewing. So, it will stay more of an urban affair,” said Faisal Kawoosa, founder of research firm techARC.

Kawoosa believes whatever gain Netflix has achieved so far in India is primarily through partnerships with operators. The move may have given Netflix a user base, but in reality, those users are actually not paying for the service. The free Netflix subscription comes as part of benefits operators are extending so that consumers stay loyal to the telecom operator.

“Netflix and other OTT platforms have to now look for subscribers than just users. The 199 plan will help them retain some convert some users to subscribers,” he said.

The biggest rival for Netflix in India is Disney-owned Hotstar. The app is best-known for streaming cricket matches during IPL and World Cup. According to the techARC-Unomer MegaInsight study, Hotstar is the leading OTT platform in the country, with a 49 per cent share in terms of smartphone installations.

Meanwhile, Zee5 focuses more on family viewing content, whereas Alt Balaji has more edgy and adult content. Jio’s LiveTV app is also popular among Indian users.

Netflix has one big hurdle to overcome before it can hope to take on the competition in India. Right now, it mostly appeals to the urban audience. Despite partnerships with telecom operators and heavy spending on advertising, the perception of the service being seen as a popular entertainment medium among elites persists among users from tier-2 and tier-3 cities.

For Arora though, the biggest test always remains “how do we encourage consumers to watch Netflix content and sign-up for Netflix?” He said the new mobile-tier is not inspired by what our competitors are doing, instead the new Rs 199 plan will unlock new possibilities as it helps users who like to watch Netflix on the go.

“We just want to create great content. We want to give storytellers a voice and a medium. We want to tell stories that travel the globe. So that hasn’t changed and that’s been kind of division from the beginning and it’s going to continue,” he said.