Finance companies may face bank-like restrictions

Highlights

- The RBI may place lending restrictions on some finance companies under a prompt corrective action (PCA)

- This is similar to the PCA framework for banks, where they are not allowed to increase their large risk exposure unless they improve financial ratios in respect of capital adequacy and bad loans

(Representative image)

(Representative image)MUMBAI: After forcing banks to recognise stressed loans as non-performing assets (NPAs) last year, the Reserve Bank of India (RBI) is talking tough to large finance companies on asset quality. The RBI may place lending restrictions on some finance companies under a prompt corrective action (PCA). This is similar to the PCA framework for banks, where they are not allowed to increase their large risk exposure unless they improve financial ratios in respect of capital adequacy and NPAs.

The central bank has asked large non-banking finance companies (NBFCs) to make additional provisions for loans acquired from other lenders where there is a moratorium on repayment. According to sources, the fear is that some of the borrowers are stressed and the sale of loans amounts to ever-greening as the borrowers are being given more time to repay.

The central bank’s supervision department is already looking at the top 50 NBFCs. The focus area is whether there has been regulatory arbitrage by borrowing money from banks and on lending to companies that are not creditworthy enough. After the default in IL&FS and DHFL, the RBI wants to make sure that there is no large default. If stressed NBFCs face lending restrictions, their cash flows will have to be invested in liquid risk-free assets.

Last week in an interview to TOI, RBI governor Shaktikanta Das had said that the days of ‘light touch’ regulation for NBFCs were over, indicating that they will be subjected to the same rules as banks. In the interview, Das had said that the same stringent regulations would be applied for housing finance companies (HFCs) as well. “The decision on regulation of housing finance is also timely because HFCs borrow from banks and NBFCs. So, if there is a crisis in that sector then because of their interconnectedness with banks and NBFCs, the whole financial system gets affected,” said Das.

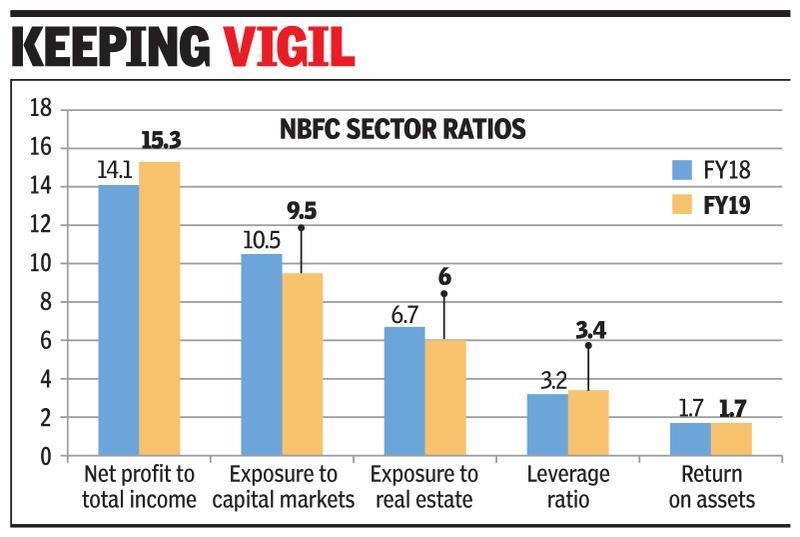

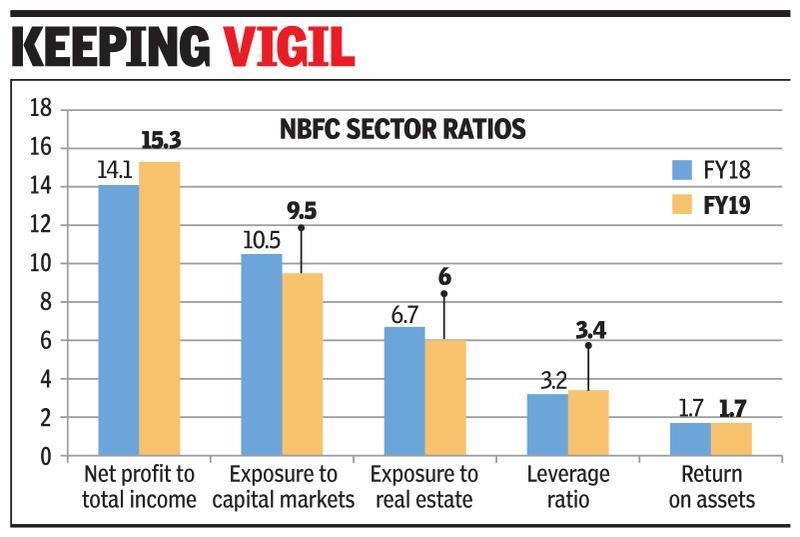

According to the RBI, the top 10 NBFCs accounted for more than 50% of total bank exposure to the sector. Bank borrowings, debentures and commercial papers are the major sources of funding for NBFCs. Bank borrowings have shown an increasing trend as its share to total borrowings have increased from 21.2% in March 2017 to 23.6% in March 2018 and further to 29.2% in March 2019. The share of bonds has dropped from 50.2% in March 2017 to 41.5% in March 2019. After the IL&FS crisis, banks’ exposure to NBFCs increased even as commercial paper as a source of funds dried up.

The central bank has asked large non-banking finance companies (NBFCs) to make additional provisions for loans acquired from other lenders where there is a moratorium on repayment. According to sources, the fear is that some of the borrowers are stressed and the sale of loans amounts to ever-greening as the borrowers are being given more time to repay.

The central bank’s supervision department is already looking at the top 50 NBFCs. The focus area is whether there has been regulatory arbitrage by borrowing money from banks and on lending to companies that are not creditworthy enough. After the default in IL&FS and DHFL, the RBI wants to make sure that there is no large default. If stressed NBFCs face lending restrictions, their cash flows will have to be invested in liquid risk-free assets.

Last week in an interview to TOI, RBI governor Shaktikanta Das had said that the days of ‘light touch’ regulation for NBFCs were over, indicating that they will be subjected to the same rules as banks. In the interview, Das had said that the same stringent regulations would be applied for housing finance companies (HFCs) as well. “The decision on regulation of housing finance is also timely because HFCs borrow from banks and NBFCs. So, if there is a crisis in that sector then because of their interconnectedness with banks and NBFCs, the whole financial system gets affected,” said Das.

According to the RBI, the top 10 NBFCs accounted for more than 50% of total bank exposure to the sector. Bank borrowings, debentures and commercial papers are the major sources of funding for NBFCs. Bank borrowings have shown an increasing trend as its share to total borrowings have increased from 21.2% in March 2017 to 23.6% in March 2018 and further to 29.2% in March 2019. The share of bonds has dropped from 50.2% in March 2017 to 41.5% in March 2019. After the IL&FS crisis, banks’ exposure to NBFCs increased even as commercial paper as a source of funds dried up.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE