According to Mohan, Maharashtra is also likely to make Super 30 tax-free

Hrithik Roshan-starrer Super 30 has become a source of inspiration for many. And to inspire more people, as many as five states, including Uttar Pradesh, Bihar, Rajasthan, Gujarat and Delhi have given the film tax-free status.

However, film trade analyst Atul Mohan thinks that the tax-free status is not much of “monetary benefit but the status signals that the film is good and that converts to good footfalls. It also impacts the psychology of the audience that converts into strong footfalls,” he said.

He also explained that the definition of tax-free status after the implementation of goods and services tax (GST) has changed.

“Before GST came into implementation, we had entertainment tax which was state subject. Hence, each state had its own tax slabs; some states had 30 percent while some 40 percent. Earlier what used to happen was if the film gets tax-free status, then ticket prices of the movie would come down 30-40 percent.”

But with GST coming in, taxes on movie tickets have come down by more than half from around 40 percent to now 18 percent and it has become both a state and central subject.

Movie tickets come under two tax slabs, 18 percent for tickets priced above Rs 100 and 12 percent for tickets below Rs 100.

“Mostly it is 18 percent as ticket prices are usually above Rs 100. Now with 18 percent, it is 9 percent state GST and they are leaving off SGST (state goods and services tax) but CGST (central goods and services tax) is still implemented. Earlier, there would be considerable reduction in prices like Rs 100 ticket would come down to Rs 60, but now it is matter of few rupees,” he said.

While Mohan expects the film to score around Rs 150 crore, he thinks that the film would have got a stronger boost had the tax-free status come during the release weekend. Super 30 had hit theatres on July 12.

In addition, he said if the GST is entirely waived off for the film then that would give good footfall. Also, if other states follow suit in giving Super 30 a tax-free status that will also help the film’s business.

According to Mohan, Maharashtra is also likely to make Super 30 tax free.

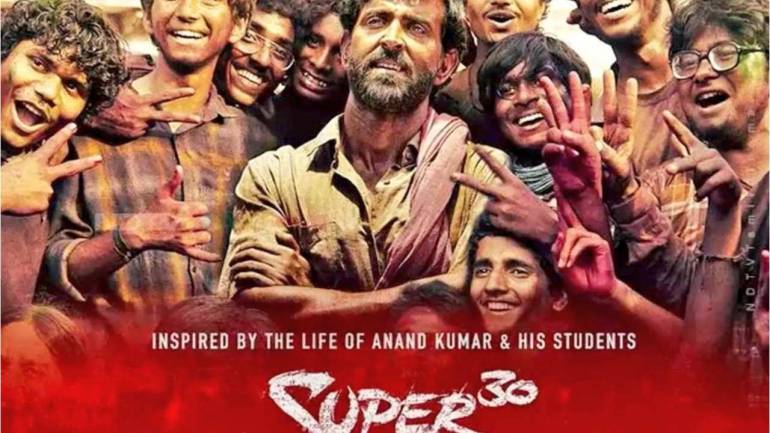

The film is based on the Super 30 programme started by mathematician Anand Kumar in Patna, Bihar in 2002 to to coach underprivileged children for IIT-JEE which is the entrance examination for the Indian Institutes of Technology (IIT).

Super 30 is maintaining a strong grip in its second week, eyeing Rs 113 crore. The tax-free status will lead to longer run and a steady stay at the box office.

Mumbai with over Rs 32 crore, Delhi-Uttar Pradesh with Rs 21.39 crore are key contributors to the film’s business followed by Punjab (Rs 9 crore) and Mysore (Rs 6.45 crore) till second Monday.

The film’s overseas business is also in double digits. In 11 days the film has collected over Rs 28 crore from international markets.