Builders cannot pay EMIs on behalf of buyers: NHB

Highlights

- Many developers were allowing buyers to book flats with only 5% payment, and balance on delivery by undertaking to repay the EMIs

- It is largely on high-value luxury properties that developers have been using this route to raise money before completion of the project

(Representative image)

(Representative image) MUMBAI: Real estate developers will no longer be able to incentivise buyers by paying the latter’s home loan EMIs (equated monthly instalments). The National Housing Bank (NHB) has asked mortgage companies to desist from offering loan products that involve servicing of the dues by builders, developers, etc, on behalf of the borrowers. The circular is expected to cut off one of the cheaper sources of funds for builders. Many developers were allowing buyers to book flats with only 5% payment, and balance on delivery by undertaking to repay the EMIs.

NHB had first cautioned against subvention schemes (where builder pays part of the interest) in November 2013. “Several complaints continue to be received by the NHB in relation to the aforementioned housing loan products. Further, instances of frauds having been allegedly committed by certain builders using subvention schemes have also been brought to the notice of the NHB,” the regulator said in a circular dated July 19.

“We have not been extending such loans,” said LIC Mutual Fund MD & CEO Vinay Sah. He added that this was aimed at discouraging risks of developer raising construction finance using home loans.

“This move by NHB throws up a red flag about various subvention schemes promoted by some developers, and will impact their liquidity and also discourage buyers who were largely attracted to a project due to these schemes,” said Anarock Property Consultants chairman Anuj Puri.

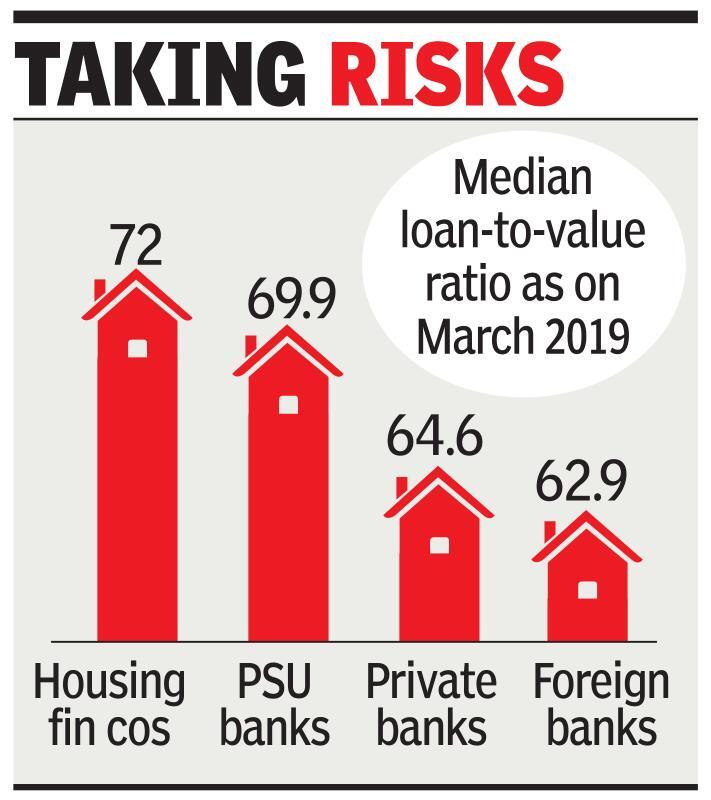

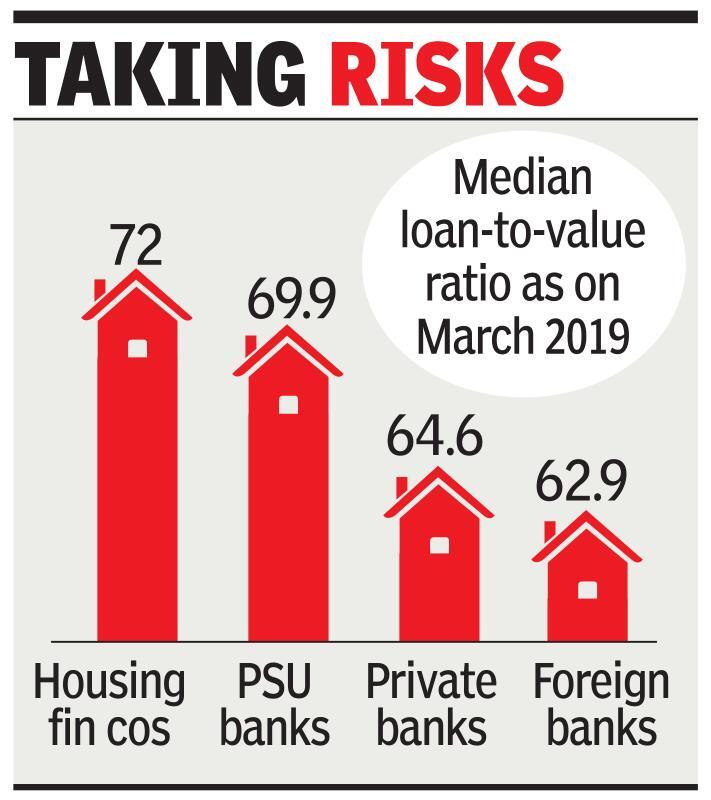

According to industry insiders, it is largely on high-value luxury properties that developers have been using this route to raise money before completion of the project. Speaking to TOI, a banker said that the move was positive for the industry as it would eliminate some of the regulatory arbitrage between housing finance companies (HFCs) and banks.

The NHB said that lenders will have to follow the directions under the circular for even those loans that have been sanctioned but are yet to be disbursed. HFCs will also have to put in place a system for monitoring the progress of construction of housing projects.

“In these troubled times of stalled and heavily delayed projects, construction progress has become the ‘Holy Grail’. Now, the progress of a project will be monitored and HFCs will only disburse loan amounts when they can verify this vital aspect to their satisfaction,” said Puri.

While lenders are free to provide loans for under-construction apartments, disbursal of housing loans has to be linked to the stages of construction and no upfront disbursal can be made. It is only in case of loans to housing provided by government or statutory authorities that HFCs can disburse the loans according to the payment stages without linking to the stage of construction, provided such authorities have no past history of non-completion of projects.

HFCs said that the Real Estate Regulation Act (RERA) already made it difficult for builders to sell unfinished flats. However, there have been cases of builders using the buyer’s creditworthiness to get home loans ahead of completion.

NHB had first cautioned against subvention schemes (where builder pays part of the interest) in November 2013. “Several complaints continue to be received by the NHB in relation to the aforementioned housing loan products. Further, instances of frauds having been allegedly committed by certain builders using subvention schemes have also been brought to the notice of the NHB,” the regulator said in a circular dated July 19.

“We have not been extending such loans,” said LIC Mutual Fund MD & CEO Vinay Sah. He added that this was aimed at discouraging risks of developer raising construction finance using home loans.

“This move by NHB throws up a red flag about various subvention schemes promoted by some developers, and will impact their liquidity and also discourage buyers who were largely attracted to a project due to these schemes,” said Anarock Property Consultants chairman Anuj Puri.

According to industry insiders, it is largely on high-value luxury properties that developers have been using this route to raise money before completion of the project. Speaking to TOI, a banker said that the move was positive for the industry as it would eliminate some of the regulatory arbitrage between housing finance companies (HFCs) and banks.

The NHB said that lenders will have to follow the directions under the circular for even those loans that have been sanctioned but are yet to be disbursed. HFCs will also have to put in place a system for monitoring the progress of construction of housing projects.

“In these troubled times of stalled and heavily delayed projects, construction progress has become the ‘Holy Grail’. Now, the progress of a project will be monitored and HFCs will only disburse loan amounts when they can verify this vital aspect to their satisfaction,” said Puri.

While lenders are free to provide loans for under-construction apartments, disbursal of housing loans has to be linked to the stages of construction and no upfront disbursal can be made. It is only in case of loans to housing provided by government or statutory authorities that HFCs can disburse the loans according to the payment stages without linking to the stage of construction, provided such authorities have no past history of non-completion of projects.

HFCs said that the Real Estate Regulation Act (RERA) already made it difficult for builders to sell unfinished flats. However, there have been cases of builders using the buyer’s creditworthiness to get home loans ahead of completion.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE