The rapid fall in the share price of Dewan Housing Finance Ltd (DHFL) has hit the big bull of Dalal Street, Rakesh Radheshyam Jhunjhunwala, badly. Since April 1, 2019, Jhunjhunwala has lost over Rs 100 crore in lieu of the fall in the DHFL stock.

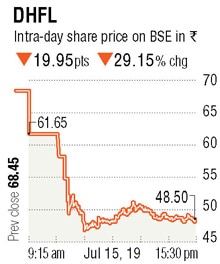

The stock slumped over 30% on Monday as it touched a 52-week low of Rs 46.70, after the company reported a huge loss on Saturday and warned investors that its days may be numbered. It closed at Rs 48.50 apiece, down 29.15% from its previous close.

Jhunjhunwala held 1 crore shares, or 3.19%, in DHFL at Rs 149.05 per share as on April 1. The total value of his stake at the beginning of this fiscal was Rs 149.05 crore.

HIT BY BEARS |

|

Taking advantage of the fall in share price, Jhunjhunwala bought 13.34 lakh shares in the non-banking financial services firm, raising his stake to 3.19% at the end of September quarter compared to 2.76% in the June quarter.

Taking advantage of the fall in share price, Jhunjhunwala bought 13.34 lakh shares in the non-banking financial services firm, raising his stake to 3.19% at the end of September quarter compared to 2.76% in the June quarter.

The stock has been under pressure since September last year after reports of DSP Mutual Fund forced to sell the commercial paper of DHFL at a discount started pouring in.

Since September 3, when its stock clocked a 52 week high of Rs 690 apiece, the company lost Rs 20,131.74 crore in market capitalisation.

The company has lost market capitalisation worth around Rs 3,155 crore in the current fiscal so far. DHFL share price has fallen 67% during this period.

On Saturday, the company reported a net loss of Rs 2,223 crore for the quarter ended March 31, dented by additional provisioning of Rs 3,280 crore, against a profit of Rs 134 crore in the corresponding period last fiscal.

The capital adequacy ratio was reduced to 10.24% following National Housing Board observation, while its total loan book outstanding stood at Rs 89,387 crore as on March 31.

In a statement issued to BSE, DHFL said while the sectoral stress is well known for months, DHFL has withstood intense pressure and continues to remain strong and solvent. DHFL has also cleared a significant amount of obligation to the tune of Rs 41,800 crore since September 2018.

"We are closely working with the stakeholders/creditors to ensure that there is a comprehensive resolution, without any hair cut to the lenders, as has been speculated by few sections of the media," the statement further said.

DHFL owes a total of over Rs 1 lakh crore, with Rs 35,000 crore to the banks while over Rs 60,000 crore is the current outstanding to the debt market, where banks, mutual funds, insurance companies and other investors have invested in the NCDs of the company. In the last six months, DHFL has been able to repay Rs 300 crore of debt in the corporate debt market after banks bought their portfolios selectively.

On Saturday, commenting on the company's financial performance, Kapil Wadhawan, chairman & managing director, DHFL, said, "Since the last 9 months, with single-minded focus, we have met all our financial obligations and are looking to return to business normalcy at the earliest. In the backdrop of a significant slowdown in disbursement and loan growth post-September 2018, the financials of the company have been quite strained for the quarter impacting the overall performance of the year. The company is in an advanced stage of submitting its resolution process under the inter-creditor agreement as entered into by banks. As already announced, the inter-creditor agreement will examine and firm up the terms of the resolution process by July 25, 2019, and make it operational before September 25, 2019."

However, in a note accompanying the quarterly results, which was announced after a three-month delay, DHFL said, "The company's ability to raise funds has been substantially impaired and the business has been brought to a standstill with there being minimal/virtually no disbursements. These developments may raise a significant doubt on the ability of the company to continue as a going concern."

The note further said that the unsecured inter-corporate deposit (ICD) aggregating Rs 5,653 crore were outstanding as at March 31, 2019, and includes ICDs of Rs 5,025 crore granted during the year. Of these, ICDs aggregating Rs 328 crore have since been repaid while ICDs aggregating Rs 4018 crore are expected to be repaid shortly. Balance ICDs aggregating to Rs 1,307 crore are being converted into secured term loans.

The firm has also seen a series of rating downgrades by global rating agencies which resulted in a further kneejerk effect on its stock prices. On June 6, both Icra and Crisil downgraded the rating on DHFL commercial paper worth Rs 850 crore to "default" from "A4" due to the firm's delay in debt servicing some of its NCDs on account of liquidity stress.