Jasper Infotech, which owns and operates online marketplace Snapdeal, posted much-improved results for the financial year 2018-19, as the Gurgaon-based company’s efforts to cut costs, shed assets and pivot to a pure marketplace model, has begun to pay dividends.

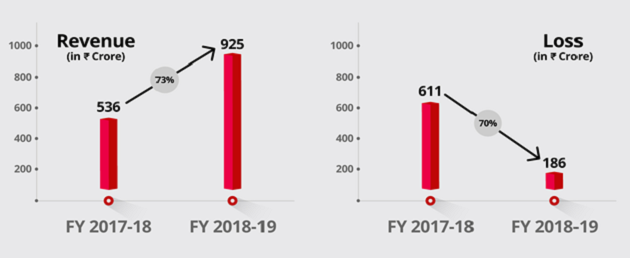

Jasper Infotech, which owns and operates online marketplace Snapdeal, posted much-improved results for the financial year 2018-19, as the Gurgaon-based company’s efforts to cut costs, shed assets and pivot to a pure marketplace model, has begun to pay dividends.In its filings with the Registrar of Companies (RoC), the SoftBank, Alibaba Group and Foxconn-backed company, which at its peak was valued at $6.5 billion, reported consolidated revenue of Rs 925.3 crore, a 73% jump from the year-ago fiscal, when it reported a top-line of Rs 535.9 crore.

Loss for the 12-month period ended March 31, 2019, came in at Rs 186 crore, on a consolidated basis, a three-fold drop from loss of Rs 611 crore in the previous fiscal, the company stated.

This is the second year in a row that Snapdeal has improved its bottomline, having embarked on a significant restructuring process, post the collapse of its merger discussions with larger rival Flipkart in mid-2017, and which was being orchestrated by its largest stakeholder, SoftBank.

Over the last 24 months, the company, with the exception of its core marketplace business, had sold off most of its assets, including its payments arm FreeCharge, to Axis Bank, one of India’s largest private lenders, as well as its logistics venture Vulcan, as it looked to shore up a sagging balance sheet.

Additionally, the Kunal Bahl and Rohit Bansal-founded company also pivoted to what was termed as “Snapdeal 2.0” model - a pure marketplace resembling Alibaba group’s Taobao, and which saw it focus largely on unbranded goods with high margins, and on categories which were not dependent on discounts.

“Our strategy is to focus on the needs of the value-conscious buyers in India – they constitute the bulk of our users. They are also the fastest-growing mega segment in Indian e-commerce and will be nearly 400 million strong over the next few years,” Bahl, chief executive of Snapdeal, wrote in a blog post on Tuesday.

The focus on the long-tail e-commerce segment, one that the likes of Flipkart and Amazon, India’s two top online retailers are yet to pointedly address, has seen Snapdeal reap rich dividends. In May, ET had reported that Snapdeal, for the period November 2018 to April 2019, had seen its web and mobile web traffic rise to 82 million, up from 68 million.

The company has also stated that more than 80% of its users come from tier-2 and tier-3 cities and beyond.

On a standalone basis, Snapdeal posted revenue of Rs 899.2 crore in fiscal 2019, up from Rs 527.5 crore a year ago, while loss narrowed by more than 71% to Rs 187.4 crore for the same period.

“Our transacting customers grew 2.2X and traffic surged 2.3X to 70 million unique users/month. And all this in a year when the e-commerce companies in India burnt through ~USD 2.5 billion in the pursuit of growth,” Bahl said in his post.

According to the CEO, the company’s selection has grown to over 200 million listings on the platform, while the last two years has seen it onboard over 60,000 new seller partners, adding over 50 million new listings. The company is estimated to be doing about 250,000 orders daily.