Auto sales crash 12% in Q1, worst since 2008-09 global financial turmoil

Highlights

- The auto industry is in the red across categories of passenger vehicles, two-wheelers, commercial vehicles and three-wheelers

- The industry is calling it an 'unprecedented crisis' and said job losses have started as companies cut production and new investments

(Representative image)

(Representative image)NEW DELHI: The crisis in the auto sector has worsened. Hit by a slowing economy, credit crunch and rising unemployment across major cities, auto sales in April-June declined the most in last 41 quarters, since the global economic meltdown in second half of 2008-09.

The auto industry, which is in the red across categories of passenger vehicles, two-wheelers, commercial vehicles and three-wheelers, is calling it an “unprecedented crisis” and said job losses have started as companies cut production and new investments.

Weak rural market has added to problem. Earlier, rural India had generally remained insulated from woes of the economy and helped the industry sail through when larger cities struggled. For high volume categories such as two- and three-wheelers, rural segment accounts for nearly 50% of sales.

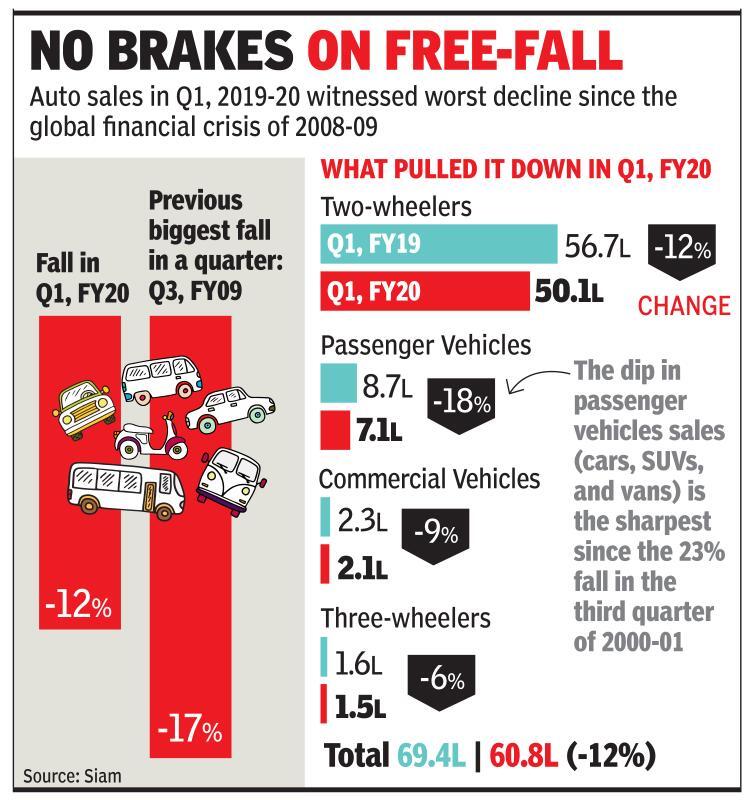

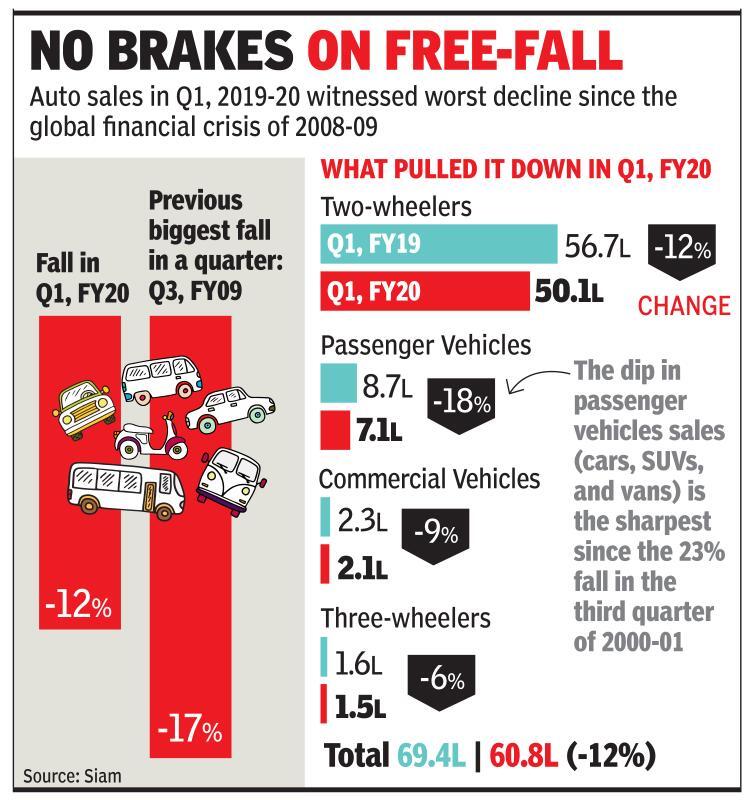

According to industry body Siam, automobile sales across various categories slipped by 12% in April-June 2019-20 quarter, witnessing the biggest fall since 17% decline in third quarter (October-December) of 2008-09.

“This is probably the worst. I have never seen this kind of a prolonged slowdown ever, as numbers are down across product categories and vehicle types,” Rajan Wadhera, head of Siam, who is also the president of automotive business of Mahindra & Mahindra, said. “Job cuts have started, as can be seen in closure of dealerships and production withdrawals at factories. We cannot survive for long,” Wadhera added, reiterating the industry’s request for a cut in GST rate from the current 28%.

For April-June quarter, decline in passenger vehicle sales (at 18%) is the sharpest since 23% fall in the third quarter of 2000-01.

The industry is nervous, and feels that a turnaround may not be easy to achieve, especially as upcoming safety and emission (BS6) norms will mean prices of vehicles will go up. “Uncertainty over monsoon, high interest cost, tight liquidity and apprehensions surrounding BS6 introduction in a few months have steered the slowdown,” N Raja, deputy MD at Toyota Kirloskar Motors, said.

What is worrying for the auto companies is that the crunch comes even as new models have been rolled out, and discounts and freebies have been steep. Models such as Hyundai’s Venue mini SUV and Santro hatch, Maruti’s new WagonR and Nissan’s Kicks could not do much to rescue the industry.

The two-wheeler industry is also under deep stress, and 12% fall in sales in April-June quarter is the worst since 15% decline in third quarter of 2008-09. For scooters, 17% decline in the previous quarter is the sharpest since 35% fall in fourth quarter of 2000-01.

The auto industry, which is in the red across categories of passenger vehicles, two-wheelers, commercial vehicles and three-wheelers, is calling it an “unprecedented crisis” and said job losses have started as companies cut production and new investments.

Weak rural market has added to problem. Earlier, rural India had generally remained insulated from woes of the economy and helped the industry sail through when larger cities struggled. For high volume categories such as two- and three-wheelers, rural segment accounts for nearly 50% of sales.

According to industry body Siam, automobile sales across various categories slipped by 12% in April-June 2019-20 quarter, witnessing the biggest fall since 17% decline in third quarter (October-December) of 2008-09.

“This is probably the worst. I have never seen this kind of a prolonged slowdown ever, as numbers are down across product categories and vehicle types,” Rajan Wadhera, head of Siam, who is also the president of automotive business of Mahindra & Mahindra, said. “Job cuts have started, as can be seen in closure of dealerships and production withdrawals at factories. We cannot survive for long,” Wadhera added, reiterating the industry’s request for a cut in GST rate from the current 28%.

For April-June quarter, decline in passenger vehicle sales (at 18%) is the sharpest since 23% fall in the third quarter of 2000-01.

The industry is nervous, and feels that a turnaround may not be easy to achieve, especially as upcoming safety and emission (BS6) norms will mean prices of vehicles will go up. “Uncertainty over monsoon, high interest cost, tight liquidity and apprehensions surrounding BS6 introduction in a few months have steered the slowdown,” N Raja, deputy MD at Toyota Kirloskar Motors, said.

What is worrying for the auto companies is that the crunch comes even as new models have been rolled out, and discounts and freebies have been steep. Models such as Hyundai’s Venue mini SUV and Santro hatch, Maruti’s new WagonR and Nissan’s Kicks could not do much to rescue the industry.

The two-wheeler industry is also under deep stress, and 12% fall in sales in April-June quarter is the worst since 15% decline in third quarter of 2008-09. For scooters, 17% decline in the previous quarter is the sharpest since 35% fall in fourth quarter of 2000-01.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE