The benchmark indices ended the Budget day session a per cent lower, as the lack of stimulus to shore up the economy left investors disappointed. Additional tax on the ultra-rich and the proposal to raise public shareholding to 35 per cent also weighed on sentiment.

The Sensex closed at 39,513, down 395 points or 0.99 per cent, while the Nifty ended at 11,811, down 136 points or 1.14 per cent. This was the biggest fall registered by the indices Budget day in six years. The rupee ended marginally better at 68.42, compared to Thursday’s close of 68.50.

Analysts said the market was expecting the government to increase spending to boost the economy. Instead, the Centre said it plans to narrow the fiscal deficit target to 3.3 per cent from the 3.4 per cent set in February’s interim Budget.

“Markets could trade weak until the government provides a road map for growth and executes the same,” said Motilal Oswal, chairman and managing director of Motilal Oswal Financial Services.

Shankar Sharma, co-founder and chief global strategist of First Global, said the indices had already rallied and were due for correction. “The markets will react to economic data and earnings next. If there is an improvement on these fronts, we can expect the indices to rise,” he said.

At present, the Sensex and Nifty are just 2 per cent below their all-time highs logged a month ago. While they are hovering near their all-time highs, the broader market has seen turbulence on account of a bunch of issues, including weak corporate fundamentals, the looming crisis in the non-banking financial companies (NBFC) sector, and a deficient monsoon. Investors have also been spooked by the slowdown in the economy and rising corporate defaults.

At present, the Sensex and Nifty are just 2 per cent below their all-time highs logged a month ago. While they are hovering near their all-time highs, the broader market has seen turbulence on account of a bunch of issues, including weak corporate fundamentals, the looming crisis in the non-banking financial companies (NBFC) sector, and a deficient monsoon. Investors have also been spooked by the slowdown in the economy and rising corporate defaults.

“Overall, there are no items that may impact the stock markets in a significant way, in the long term. However, since the continuing slowdown in private-sector investment as well as the real estate sector is slowly impacting consumption, equity markets were hoping for more support to these segments for their recovery,” said Mihir Vora, chief investment officer of Max Life Insurance.

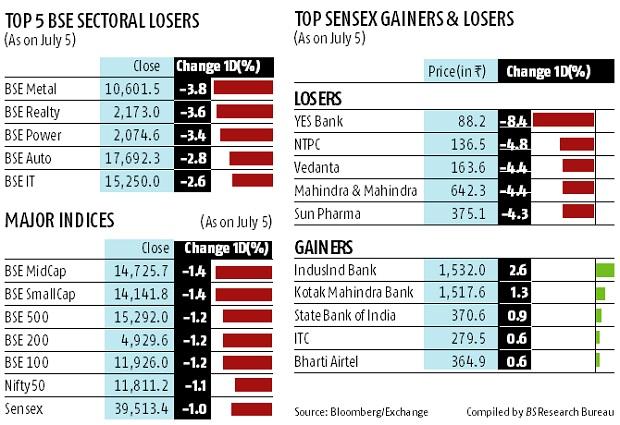

Barring three, all sectoral indices of the BSE ended the session in red, with the BSE IT Index declining the most.

IT stocks were battered after the government said it would impose additional 20 per cent tax on share buybacks. Cash-rich tech firms were resorting to share buybacks to avoid dividend distribution tax (DDT).

Except six, all other Sensex components declined. YES?Bank, NTPC and Mahindra & Mahindra declined the most at 8.36 per cent, 4.81 per cent and 4.41 per cent, respectively.

Vedanta and Sun Pharma fell over 4 per cent. IndusInd Bank rose 2.16 per cent and Kotak Bank by 1.32 per cent.