MUMBAI: The union budget evoked long faces rather than happy ones on Friday as respondents felt it brought little to the salaried class and senior citizens. There were no new taxes, but the rise in fuel prices made people wish that the income tax exemption slab had been raised.

The few bright spots were the impetus for clean energy through electrical vehicles and additional housing subsidy for homes costing up to Rs 45 lakh, although residential spaces within the city are scarcely available for even double that sum.

CM Devendra Fadnavis called it a visionary budget that would steer the nation towards a 5-trillion-dollar economy. “The micro-economic scenario is more inclusive with more stress on infrastructure creation with a whopping target of Rs 100 lakh crore in 5 years,” he said.

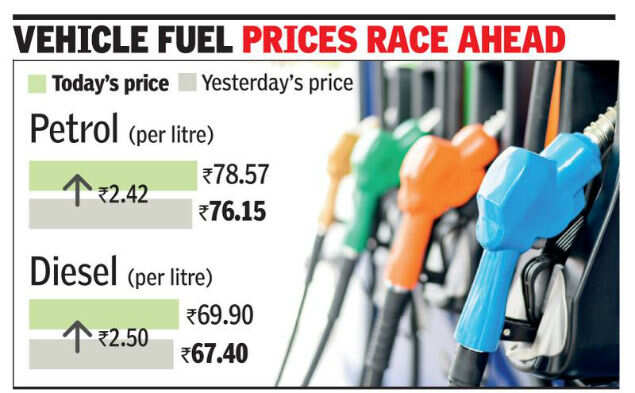

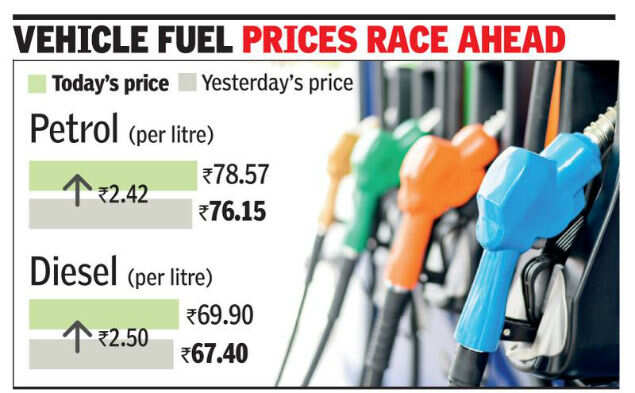

The common man is wary of the Rs 2 increase in excise cess on petrol and diesel, which will make everyday commodities, freight and transportation more expensive. “This will increase my monthly expenses by Rs 125 to Rs 150 (annually Rs 1,500 to 1,800),” Varun Kamath, who drives his car to office daily, said.

Transport unionist Bal Malkit Singh of the All India Motor Transport Congress said there were two budget blows. “An increase in diesel cess plus the new levy of 2% TDS on withdrawing more than Rs 1 crore in cash annually will cripple our sector that is the backbone of the economy,” he said.

Farmers and their union leaders said that despite talking about doubling farmer income by 2022 the government has made no provision to realise the election slogan. “In fact, with the increase in fuel prices, our input cost will go up. Coupled with the negligible increase in minimum support price (MSP) this year, we will continue to struggle,” Ajit Navale of the All India Kisan Sabha said.

Gold and silver will become more expensive with a rise in import duty of gold from 10% to 12.5%. The All India Gem and Jewellery Domestic Council (GJC) said the move was “not in tune with Make in India principles” and would have a negative impact on indigenous industry driven by 55 lakh skilled labour force and craftsmen. “Coupled with GST, this move will make gold expensive and encourage smuggling,” GJC chairman Anantha Padmanaban said.

Shaankar Sen, GJC vicechairman, said the government had exempted start-ups that receive funds or investment from scrutiny but not the gems and jewellery sector, which gets neither funds nor investments.

Imported books will be dearer. “About 40% of the books we sell are imported as their publishers lack publishing rights here,” Herin Keniya, store manager, Granth Bookstore, said.

Gandhians welcomed finance minister Nirmala Sitharaman’s announcement to prepare an online database of Gandhiji’s life and works, although the Sarvodaya Mandal in the city does exactly that. TRK Somaiya, its president, said: “Earlier too, the government had allotted Rs 5 crore to Ahmedabad’s Sabarmati Ashram to put all books by Gandhiji online. The ashram uploaded thousands of pages but the server became so heavy that readers could not download anything. We have an exhaustive website of Gandhiji’s books, written not only by him but also about him, which we built 20 years ago and manage within just Rs 2 lakh a year.”

The few bright spots were the impetus for clean energy through electrical vehicles and additional housing subsidy for homes costing up to Rs 45 lakh, although residential spaces within the city are scarcely available for even double that sum.

CM Devendra Fadnavis called it a visionary budget that would steer the nation towards a 5-trillion-dollar economy. “The micro-economic scenario is more inclusive with more stress on infrastructure creation with a whopping target of Rs 100 lakh crore in 5 years,” he said.

The common man is wary of the Rs 2 increase in excise cess on petrol and diesel, which will make everyday commodities, freight and transportation more expensive. “This will increase my monthly expenses by Rs 125 to Rs 150 (annually Rs 1,500 to 1,800),” Varun Kamath, who drives his car to office daily, said.

Transport unionist Bal Malkit Singh of the All India Motor Transport Congress said there were two budget blows. “An increase in diesel cess plus the new levy of 2% TDS on withdrawing more than Rs 1 crore in cash annually will cripple our sector that is the backbone of the economy,” he said.

Farmers and their union leaders said that despite talking about doubling farmer income by 2022 the government has made no provision to realise the election slogan. “In fact, with the increase in fuel prices, our input cost will go up. Coupled with the negligible increase in minimum support price (MSP) this year, we will continue to struggle,” Ajit Navale of the All India Kisan Sabha said.

Gold and silver will become more expensive with a rise in import duty of gold from 10% to 12.5%. The All India Gem and Jewellery Domestic Council (GJC) said the move was “not in tune with Make in India principles” and would have a negative impact on indigenous industry driven by 55 lakh skilled labour force and craftsmen. “Coupled with GST, this move will make gold expensive and encourage smuggling,” GJC chairman Anantha Padmanaban said.

Shaankar Sen, GJC vicechairman, said the government had exempted start-ups that receive funds or investment from scrutiny but not the gems and jewellery sector, which gets neither funds nor investments.

Imported books will be dearer. “About 40% of the books we sell are imported as their publishers lack publishing rights here,” Herin Keniya, store manager, Granth Bookstore, said.

Gandhians welcomed finance minister Nirmala Sitharaman’s announcement to prepare an online database of Gandhiji’s life and works, although the Sarvodaya Mandal in the city does exactly that. TRK Somaiya, its president, said: “Earlier too, the government had allotted Rs 5 crore to Ahmedabad’s Sabarmati Ashram to put all books by Gandhiji online. The ashram uploaded thousands of pages but the server became so heavy that readers could not download anything. We have an exhaustive website of Gandhiji’s books, written not only by him but also about him, which we built 20 years ago and manage within just Rs 2 lakh a year.”

World Cup 2019

Trending Topics

LATEST VIDEOS

City

Kolkata's Muslim majority Khidirpur area celebrates Rath Yatra with great fervour

Kolkata's Muslim majority Khidirpur area celebrates Rath Yatra with great fervour  Mentally challenged woman mercilessly thrashed by locals in Karnataka's Shimoga

Mentally challenged woman mercilessly thrashed by locals in Karnataka's Shimoga  Congress MLA Nitesh Rane instigates mob to throw mud water on engineer, tie him up as 'punishment' for bad roads

Congress MLA Nitesh Rane instigates mob to throw mud water on engineer, tie him up as 'punishment' for bad roads  On cam: Goons threatening residents in Bengaluru

On cam: Goons threatening residents in Bengaluru

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Lok Sabha Election Schedule 2019Lok Sabha Election NewsDelhi Capitals teamMI team 2019Rajasthan Royals 2019RCB team 2019Maharashtra Lok Sabha ConstituenciesBJP Candidate ListBJP List 2019 TamilnaduShiv Sena List 2019AP BJP List 2019Mamata BanerjeeBJP List 2019 MaharashtraPriyanka GandhiBJP List 2019 KarnatakaAMMK Candidate List 2019BJP List 2019 WBLok Sabha Elections in Tamil NaduBSP List 2019 UPNews in TamilLok Sabha Poll 2019Satta Matka 2018PM ModiMahagathbandhanNagpur BJP Candidate ListChandrababu NaiduTamil Nadu ElectionsUrmila MatondkarNews in TeluguMadras High CourtTejashwi YadavArvind KejriwalTejasvi SuryaPawan KalyanArvind KejriwalYogi AdityanathJaya PradaSatta King 2019Srinagar encounter

Get the app