PROJECTING ECONOMIC growth to modestly inch up to 7% this year from a five-year low of 6.8% the previous year, the Economic Survey 2018-19 has underlined that private investment will be the key driver in accelerating and sustaining the GDP growth rate to 8%, and enabling India to turn into a $5-trillion economy by 2025.

The Survey, tabled in Parliament a day before Finance Minister Nirmala Sitharaman presents her debut Budget, offers some pointers to what may be expected Friday: a prescription to stick to the fiscal glide path, incorporating a sunset clause on incentives for small enterprises, and a suggestion for a taxpayer-friendly approach to tax policy.

Alongside a call for the need to catalyse a “virtuous cycle” of savings, exports and investments as the central drivers for growth, the Survey departs from the traditional “Anglo-Saxon thinking” by advocating a growth model for India that views the economy as being either in a virtuous or a vicious cycle, and thus never in equilibrium.

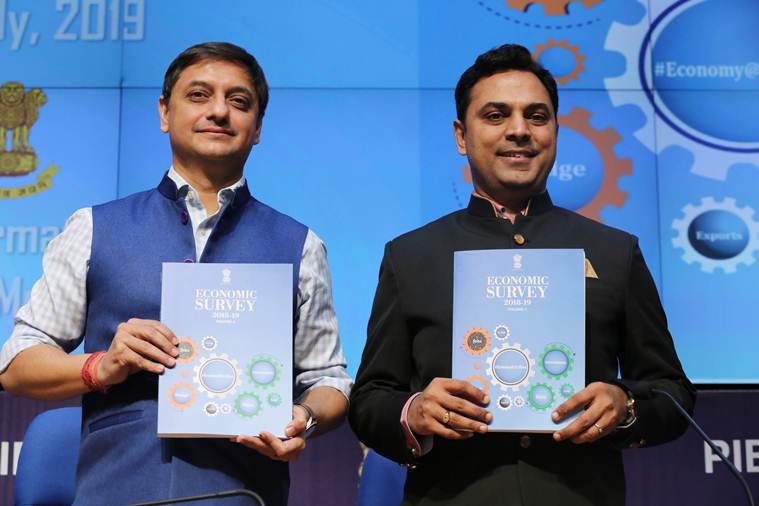

The Survey, the first by new Chief Economic Advisor Krishnamurthy V Subramanian, is more realistic in its assessments, especially with respect to the macro-economic prospects. It notes that economic growth will rebound from a five-year low this year, but would need “a huge boost” in spending and reforms to double the size of the economy over the next five years. This assessment is, however, in sharp contrast to his predecessor Arvind Subramanian’s first survey, which proclaimed that “India has reached a sweet spot — rare in the history of nations — in which it could finally be launched on a double-digit, medium-term growth trajectory”.

Read | As India ages fast, Economic Survey says need to raise age for retirement

Where the two are similar is in the flavour and feel, in resorting to acronym-based associations and a heavy play of theme-based schemes.

Among the more radical reform suggestions are those regarding incentives for taxpayers. Propagating the social norm that “paying taxes honestly is honourable”, the Survey suggests providing benefits to highest taxpayers. These may include expedited boarding privileges at airports, fast-lane privileges on roads and toll booths, and special “diplomatic” type lanes at immigration counters. Further, the highest taxpayers over a decade could be recognised by naming important buildings, monuments, roads, trains, initiatives, schools and universities, hospitals and airports after them.

A lingering theme in the Survey is that “policy making must keep real people as its focus”. Insights from behavioral economics need to be integrated into aspects of policy making in issues including gender equality, a healthy and beautiful India, savings, tax compliance and credit quality. This includes a transition from ‘Beti Bachao Beti Padhao’ to ‘BADLAV’ (Beti Aapki Dhan Lakshmi Aur Vijay Lakshmi), from ‘Swachh Bharat’ to ‘Sundar Bharat’, from ‘Give it up” for the LPG subsidy to ‘Think about the Subsidy’ and from ‘tax evasion’ to ‘tax compliance’.

The rise in retirement age for most of India’s working population from 60 years at present seems inevitable due to increase in life expectancy and fall in fertility rate, the Survey notes. Demographic projections show that India’s population growth will continue to decline over the next two decades, growing less than 1% during 2021-31 and under 0.5% during 2031-41, it said. Raising retirement age is in line with the experience of other countries and it helps plan in advance for pensions and other retirement provisions, it has said.

The Survey also emphasises the need to treat data as a public good and buttresses the need to further accelerate legal sector reforms and strengthen contract enforcement regulations, alongside a focus on better management of the environment and an electric vehicle push.

Underlining that the government faces significant challenges on the fiscal front on account of rising expenses on health and farm sector schemes and the slow growth on revenue collections, the Survey points to the revenue buoyancy of Goods and Service Tax as a key to raising resources going forward. It has also cautioned that resources for schemes such as Pradhan Mantri Kisan Samman Nidhi and Ayushman Bharat will have to be found “without compromising the fiscal deficit target as per the revised glide path”.

Also read | Economic Survey a bid to whitewash govt’s failures on economic front: Congress

The chapter on the incentive structure for small firms spells out the need to overhaul the system of incentives for Micro, Small and Medium Enterprise (MSME) sector and gear it towards, what the Survey terms as, ‘infant’ firms (firms that are small because they are young and have the potential to become big), rather than the focus on ‘dwarf’ firms (firms that remain small despite being old).

“While infant firms can grow to become large firms that are not only more productive and generate significant employment, dwarfs remain small and contribute neither to productivity nor to jobs,” it says. Incentives for infant firms should come with a sunset clause of less than 10 years, with necessary grand-fathering, along with deregulation in labour law restrictions to create significantly more jobs, as evident from Rajasthan. It has proposed rationalisation of tax policy for start-ups to encourage “innovative investments” in the Indian economy.

Calling for lower cost of capital, the Survey lays emphasis on investment as a key driver of growth in the economy. It has stressed the need to significantly lower the cost of capital as the real rate of interest has increased significantly in India over the years and is quite high in comparison to other countries, and that affects investment prospects. Fixed investment growth picked up from 8.3% in 2016-17 to 9.3%in 2017-18 and further to 10% in 2018-19, and lower interest rates in future are expected to push up private investment.

Explained | Economic Survey 2018-19 big ideas — Rationalise minimum wages architecture

“The #EconomicSurvey2019 outlines a vision to achieve a $5 trillion economy. It also depicts the gains from advancement in the social sector, adoption of technology and energy security,” Prime Minister Narendra Modi tweeted.

Savings cycle to retirement age

* FY20 GDP growth seen at 7%. For $5-trillion economy by FY25, India must sustain 8% growth

* Need for ‘virtuous cycle’ of savings, investment, exports. Private investment to be a key driver

* Incentivise smaller firms to grow big. Suggests a sunset clause of less than 10 years

* Desirable behaviour nudge: from Beti Bachao to Badlav, Swachh Bharat to Sundar Bharat

* Prepare for ageing by investing in healthcare, and increase the retirement age in a phased manner