A majority of potential premium smartphone buyers in India are contemplating to upgrade to a new phone in the next 12 months according to a report by Counterpoint Research.

As per Counterpoint Research’s India Premium Smartphone Consumer Survey which is based on 800 respondents from the top cities in India, the replacement cycle among premium smartphone users having a phone worth Rs 20,000 ($280) or more is around 25 months. Samsung and OnePlus are the two top choices in the premium segment and Samsung users replace their devices faster than their OnePlus counterparts.

According to the survey, around half of the respondents are willing to spend Rs 40,000 ($580) or more for their next smartphone. One in every five respondents insists on buying a phone worth Rs 60,000 ($870) or more, while eight per cent can spend Rs 80,000 ($1,150) or more.

“The Indian market has been growing at a healthy rate. There is a close competition between Samsung and OnePlus in the premium segment. Our survey reveals Samsung users replace their smartphones slightly faster than average while OnePlus users hold onto their devices for a bit longer. Almost six out of ten Samsung users are interested in replacing their smartphone within the next year. About four out of every ten users of OnePlus plan to buy a new smartphone in the next year,” Pavel Naiya, Senior Analyst at Counterpoint Research said in the report.

While Apple struggles to gain momentum in the premium segment in the country, Smartphone brands from China such as OPPO, Huawei and Vivo are trying hard to break into the segment.

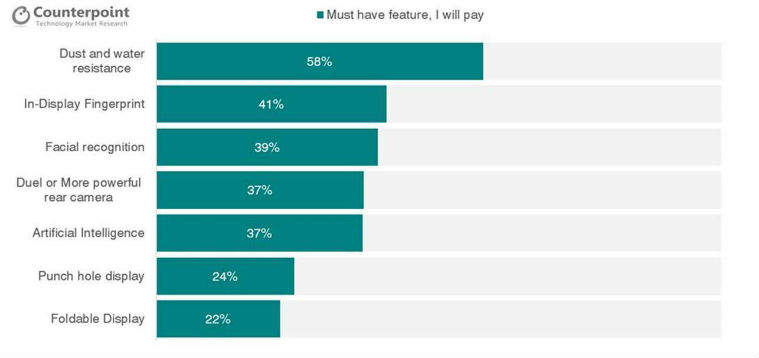

Another part of the survey indicated all the must-have features for which customers are willing to pay more while buying their next device. The topmost feature among these is the dust and water resistance.

Also Read|Apple pulls down global premium smartphone market by 8 per cent in Q1 2019: Counterpoint

“In-display fingerprint, facial recognition, dual or more cameras, and AI capabilities came up as key features, where almost four out of every ten respondents thought that these are a ‘must have’ in their future premium smartphones. Longer battery life along with fast charging, higher memory storage, new designs, and multiple cameras are the other key features which will influence future purchase decisions. Punch hole displays and foldable displays are yet to make any significant impact on consumers minds in India.” Tarun Pathak, Associate Director at Counterpoint Research said.