Christine Lagarde set to succeed ECB’s Draghi

Highlights

- Lagarde was nominated to succeed Mario Draghi as president of the ECB when his eight-year term ends on October 31

- Lagarde described the world economy as hitting a “rough patch” and advised central banks to continue to adjust their policies in response

IMF chief Christine Lagarde (File photo)

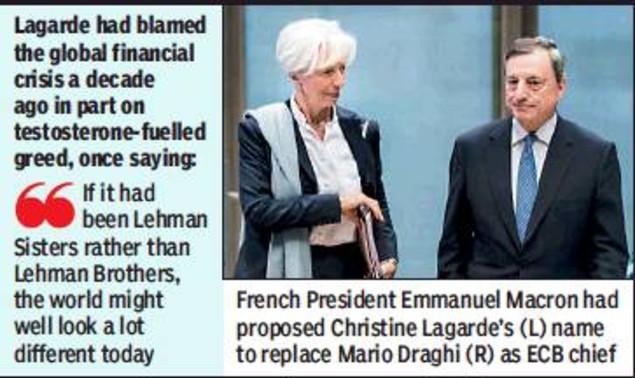

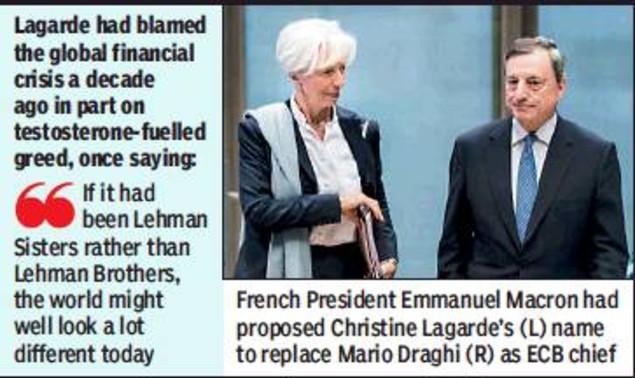

IMF chief Christine Lagarde (File photo) NEW DELHI: Christine Lagarde is set to swap the helm of the International Monetary Fund (IMF) for that of the European Central Bank (ECB), becoming the first woman to run euro-area monetary policy just as the bloc’s economy looks in need of fresh stimulus.

Lagarde was nominated to succeed Mario Draghi as president of the ECB when his eight-year term ends on October 31. European governments turned to the 63-year old one-time lawyer and former French finance minister on Tuesday after hours of negotiations over a package of top EU jobs.

In moving from Washington to Frankfurt, Lagarde will be tasked with driving monetary policy in a 19-nation economy, which Draghi has already signalled will need more help, likely in the form of lower interest rates and possibly with the resumption of quantitative easing. Inflation is running at barely half the ECB’s goal of just under 2% despite years of negative rates and 2.6 trillion euros ($3 trillion) of bond purchases.

Investors will likely bet that as a seasoned crisis-fighter, Lagarde will share Draghi’s taste for aggressive and innovative monetary policy, especially as her appointment means the more hawkish Bundesbank President Jens Weidmann misses out. Financial markets are already pricing an ECB rate cut by September, in line with predictions by ECB watchers at Bloomberg Economics and Goldman Sachs Group.

Lagarde last week described the world economy as hitting a “rough patch” and advised central banks to continue to adjust their policies in response. In June 2014, she said she would “certainly hope” the ECB would conduct quantitative easing if inflation stayed sluggish — months before it announced it would do so.

She also praised Draghi’s 2012 commitment to do “whatever it takes” to save the euro and recently echoed his call for governments to do more to battle future downturns. In March, she linked the need to fortify the euro area to the words of playwright Moliere: “The trees that are slow to grow bear the best fruit.”

Just last September, Lagarde dismissed speculation she could take over the ECB, telling the Financial Times she was a “ bit annoyed and fed up” with the suggestion and that she was “not interested” in the role. Only one economist surveyed last month predicted she would get the job, with Weidmann seen as the most likely winner in a tight race dominated by men.

France has now twice secured the presidency of the two-decade-old ECB. Draghi, an Italian, was preceded by Frenchman Jean-Claude Trichet, who replaced Dutchman Wim Duisenberg.

In common with Trichet, whose appointment was held up by a trial involving the bailout of Credit Lyonnais, Lagarde brings a history of legal wrangles. They culminated in a conviction of negligence in 2016 over her handling of a multi-million euro dispute linked to the same bank.

Lagarde’s appointment also means the ECB and the US Federal Reserve will be headed by former lawyers, a shift from the era when central banks were run by academic economists such as Ben Bernanke. That risks opening her up to criticism that she lacks the knowledge to set monetary policy.

Lagarde was nominated to succeed Mario Draghi as president of the ECB when his eight-year term ends on October 31. European governments turned to the 63-year old one-time lawyer and former French finance minister on Tuesday after hours of negotiations over a package of top EU jobs.

In moving from Washington to Frankfurt, Lagarde will be tasked with driving monetary policy in a 19-nation economy, which Draghi has already signalled will need more help, likely in the form of lower interest rates and possibly with the resumption of quantitative easing. Inflation is running at barely half the ECB’s goal of just under 2% despite years of negative rates and 2.6 trillion euros ($3 trillion) of bond purchases.

Investors will likely bet that as a seasoned crisis-fighter, Lagarde will share Draghi’s taste for aggressive and innovative monetary policy, especially as her appointment means the more hawkish Bundesbank President Jens Weidmann misses out. Financial markets are already pricing an ECB rate cut by September, in line with predictions by ECB watchers at Bloomberg Economics and Goldman Sachs Group.

Lagarde last week described the world economy as hitting a “rough patch” and advised central banks to continue to adjust their policies in response. In June 2014, she said she would “certainly hope” the ECB would conduct quantitative easing if inflation stayed sluggish — months before it announced it would do so.

She also praised Draghi’s 2012 commitment to do “whatever it takes” to save the euro and recently echoed his call for governments to do more to battle future downturns. In March, she linked the need to fortify the euro area to the words of playwright Moliere: “The trees that are slow to grow bear the best fruit.”

Just last September, Lagarde dismissed speculation she could take over the ECB, telling the Financial Times she was a “ bit annoyed and fed up” with the suggestion and that she was “not interested” in the role. Only one economist surveyed last month predicted she would get the job, with Weidmann seen as the most likely winner in a tight race dominated by men.

France has now twice secured the presidency of the two-decade-old ECB. Draghi, an Italian, was preceded by Frenchman Jean-Claude Trichet, who replaced Dutchman Wim Duisenberg.

In common with Trichet, whose appointment was held up by a trial involving the bailout of Credit Lyonnais, Lagarde brings a history of legal wrangles. They culminated in a conviction of negligence in 2016 over her handling of a multi-million euro dispute linked to the same bank.

Lagarde’s appointment also means the ECB and the US Federal Reserve will be headed by former lawyers, a shift from the era when central banks were run by academic economists such as Ben Bernanke. That risks opening her up to criticism that she lacks the knowledge to set monetary policy.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE