State Bank, NIIF team up to finance infra projects

The scope of the MoU includes equity investments, project funding, bond financing, renewable energy support and take out finance for operating assets

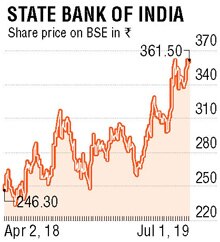

State Bank of India State Bank of India

India’s largest lender State Bank of India (SBI) and government- backed National Investment and Infrastructure Fund (NIIF) have joined hands to boost availability of capital for infrastructure projects.

On Monday, a memorandum of understanding (MoU) was inked by the two sides. The scope of the MoU includes equity investments, project funding, bond financing, renewable energy support and take-out finance for operating assets. The objective is to aid in filling the gap at a time when the availability of equity and debt financing for infrastructure has moderated.

This move will help SBI and NIIF to review opportunities to unlock capital from operational projects, thereby creating room for fresh lending and addressing asset-liability mismatches. In addition to focusing on takeout financing, including through the IDF route, the partnership will also explore new avenues of financing renewable energy projects.

BRICK BY BRICK |

|

In a statement, Sujoy Bose, managing director and CEO, NIIF, said, “The availability of post-construction take-out equity and debt financing for developers and builders of infrastructure projects will play an important role in the infrastructure development cycle in India. NIIF’s partnership with SBI will allow us to design large-scale long-term financing solutions to address this need.”

In a statement, Sujoy Bose, managing director and CEO, NIIF, said, “The availability of post-construction take-out equity and debt financing for developers and builders of infrastructure projects will play an important role in the infrastructure development cycle in India. NIIF’s partnership with SBI will allow us to design large-scale long-term financing solutions to address this need.”

On the development, Rajnish Kumar, chairman, SBI, said, “Today on auspicious occasion of 64th Bank’s Day, SBI and NIIF have joined hands to provide a suite of financing solutions to infrastructure sector. The initiative will address concerns relating to availability of equity and long-term debt funding options to large scale projects thereby stimulating infrastructure development.”

During the last fiscal, SBI extended loans of about Rs 51,000 crore to 47 infrastructure projects.