Sops for affordable housing, recapitalisation of public sector banks (PSBs) and creation of bigger banks through mergers are some of the measures that finance minister Nirmal Sitharaman is expected to announce while presenting her maiden Budget on July 5 in her bid to trigger demand growth, create jobs and lift farmers out of distress.

The first Budget in PM Narendra Modi's second term has drawn anticipation among the industrial class that it will re-introduce reforms to revive the animal spirits of the economy. The lower sections expect some welfare schemes to be announced while the focus is on spurring agricultural growth and reducing water woes challenging the rural economy.

In the banking sector, the Budget is likely to allocate funds for recapitalisation of PSBs. Considering that four banks are yet to exit from the prompt corrective action (PCA) framework, it is expected that they will be provided growth capital.

"Since four banks are yet to exit from the PCA, the government will have to allocate finance to recapitalise them, both for growth and also for regulatory requirements. With restrictions put on their growth, these banks were unable to garner funds to meet the capital requirements," said a senior banker, whose bank is yet to come out of PCA.

With the non-banking financial companies (NBFCs) hit by a liquidity crisis, banks are stepping up their lending activities. The effort is to fill the gap left by NBFCs, which were lenders to micro, small and medium enterprises (MSME). Banks need capital, which will be partly tanked by the capital and overseas markets and deposits. But these sources are dependent on the market conditions, thus making it imperative for the government to chip in to fuel credit growth.

With the non-banking financial companies (NBFCs) hit by a liquidity crisis, banks are stepping up their lending activities. The effort is to fill the gap left by NBFCs, which were lenders to micro, small and medium enterprises (MSME). Banks need capital, which will be partly tanked by the capital and overseas markets and deposits. But these sources are dependent on the market conditions, thus making it imperative for the government to chip in to fuel credit growth.

The other expectation is to hike the interest component of affordable housing that attracts exemption from taxes. The current limit for everyone is Rs 1.5 lakh. "There is an expectation that this limit should be enhanced for the affordable housing segment," said another banker.

Consolidation of banks to make some of them bigger is also likely to find a mention in the Budget. After the consolidation of State Bank of India and its associates, and the merger of Vijaya Bank and Dena Bank with Bank of Baroda, the government is likely to continue its consolidation drive in the banking sector to create bigger and stronger banks.

"Public sector banks under the PCA are likely to be merged with other relatively better ones. Hence, if the government was to go ahead with its plan for consolidation of the PSBs, we expect a capital infusion announcement to the tune of Rs 35,000-45,000 crore in the upcoming Budget. We hope this capital infusion to enable the merger of some of the PSBs and support a domestic credit growth of 12-13% for FY2020, enabling them to meet the enhanced regulatory capital requirements," said Anil Gupta, vice-president & sector head – financial sector ratings, Icra.

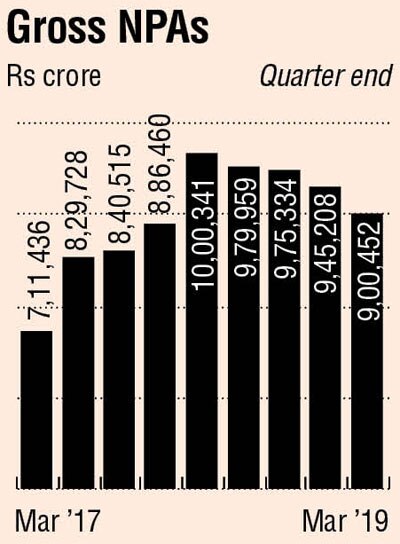

With the capital infusion of Rs 1.96 lakh crore during FY2018 and FY2019, the core equity capital position of PSBs improved to 9.2% as of March 2019 compared to 8.4% a year ago. "PSBs will still require growth capital, which shall remain at around Rs 35,000-45,000 crore during FY2020. This, however, will be driven by the GoI's intention to take five PSBs (including IDBI bank) out of the RBI's PCA framework, in the absence of which the government's capital obligation is likely to reduce significantly," Gupta said.

These apart, the recent funding issues for NBFCs have impacted their ability to disburse fresh loans, which is also reflected in the slowing consumer demand, which is likely to affect the growth of other sectors. Though banks, including the PSBs, have supported many of the NBFCs (including housing finance companies) by funding them against the purchase of their retail loan portfolios, additional measures need to be taken to provide refinancing lines for the sector. "Additionally, fiscal incentives for spurring housing demand by allowing full exemption of the interest paid on the purchase of a second house could be considered, even if it is for a temporary period. Such exemption can be extended on a selective basis to prevent speculation by considering the exemption for fully completed houses or with other suitable caveats. This may improve the cash flow of various real estate developers, which, in turn, can reduce the funding stress being witnessed by NBFCs (including HFCs)," Gupta said.

Budget Expectations

- Funds for recapitalisation of the PSBs.

- Growth capital for four banks under PCA

- Hike in exemption for home loan interest payment

- PSBs under PCA may be marge with relatively better ones