The annual Automotive News ranking of the top global suppliers reveals that as the industry's main players build revenue, transform and change direction, they remain in much the same order of size as they were a year ago.

Bosch, Denso, Magna, Continental and ZF Friedrichshafen remain the world's five biggest suppliers, in the same order on the Automotive News list as a year ago. Only two of the top 10 - Valeo and Faurecia - changed rankings last year. They swapped positions on the list, with Faurecia No. 9 and Valeo No. 10.

The main reason suppliers, for the most part, are keeping their spots as the biggest of the big? Wealth.

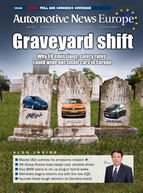

The cost of playing in the game has gone up in the past few years, and only the biggest and richest can afford the rising costs of acquiring the technologies that will make the industry's vision become a reality.

"You can't buy anything related to autonomous vehicle software technology now that's not in the billions of dollars," said Dietmar Ostermann, U.S. automotive advisory leader at PwC, which tracks global automotive merger and acquisition activity globally. "So if you want to be in the autonomous game, the size of your company matters massively."

Mergers and acquisitions have roiled the segment as suppliers jockey for a seat at the table to come.

Ostermann admits to being astonished at the amount of money that technology vendors are selling for in the world market, as big suppliers add to their portfolios. According to PwC, the combined value of supplier mergers and acquisitions has nearly tripled from a decade ago. It averaged around $20 billion a year for 10 years, Ostermann said. From 2014-17, it averaged about $50 billion to $60 billion, before jumping to a record $97.5 billion last year.

"Technology is the dominating factor in supplier strategy," he said. "A few years ago, suppliers were on an M&A drive because automakers were moving to global platforms with global architectures, and suppliers needed to quickly merge and create more global capabilities to supply in all regions.

"The real need now is to be able to support electric vehicles, connected cars and autonomous driving."

The desire to beef up with connectivity and autonomous capabilities has triggered acquisitions for software companies and electronics innovators, small and large, in and out of the traditional car business.

Last year, there were 20 deals each worth more than $1 billion - twice the level of activity of the past three years. The sector recorded 903 merger-acquisitions during the year. Among those that reported a deal value, the average size was $286.8 million.

The quest for more technology is also focused on older auto parts. Even as EVs rise on the horizon, automakers are asking suppliers to help make internal combustion engines more competitive, smaller and lighter, requiring turbocharging and direct injection. The same lightweighting effort is driving opportunity among steel, aluminum and composite material suppliers.