CHENNAI: Hosting ‘customers meetings’ at star hotels and flaunting ‘success’ stories to trick gullible investors into multi-level marketing (MLM) pyramids is passé. Spending crores on promoting non-banking finance schemes that invest in shares or forex and give high returns, too, is passé.

The latest financial fraud, involving more money than MLM pyramids could muster, are online daily interest schemes that offer ‘direct bank transfer’ of interest in the accounts of ‘investors’ every day or week or month.

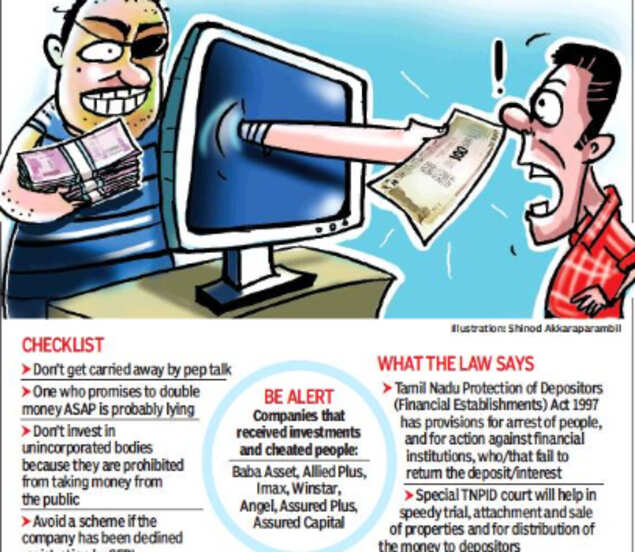

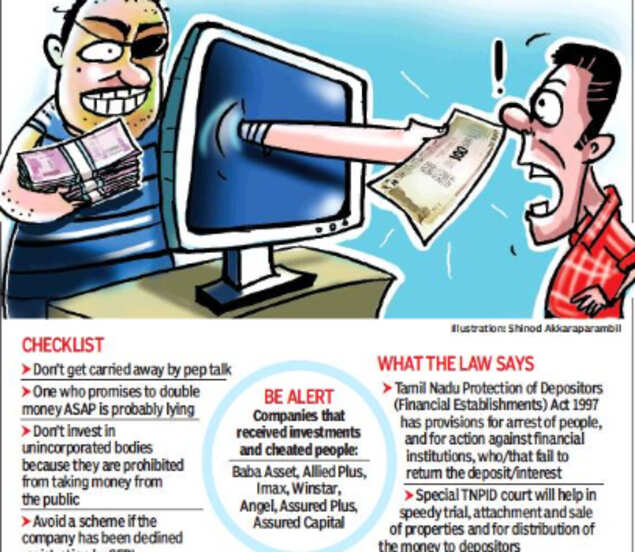

In the past two weeks, around 2,000 complaints have flooded the economic offences wing (EOW) at Guindy against Baba Asset, Allied Plus, Imax, Angel, Assured Plus and Assured Capital. These firms offered to pay interest every day or every week to people who deposited anything above `50,000. While the combined monetary loss suffered is in the region of `20 crore, police said at least one lakh people in Tamil Nadu have lost `1,000 crore in the past six months to online scamsters.

Due to jurisdictional constraints, EOW personnel have referred the cases to central crime branch of Chennai police, and now, on realising that the transaction was online, cyber crime personnel are on the move.

These operators function in a grey area which Tamil Nadu Protection of Depositors (Financial Establishments) (TNPID) Act 1997 has not covered. As they are registered in other states, and operated only via internet, there are apprehensions among law enforcing agencies as to the applicability of the special law.

“We need a cyber-crime unit to access computers for evidence. The economic offences wing cannot invoke special laws, including Information and Technology Act. Therefore, these cases have been forwarded to the city police and CB-CID,” an officer told TOI. However, former special public prosecutor of TNPID court in Chennai, Kasthuri Ravichandran, said EOW had power to slap cases against these fraudsters under TNPID Act. “When I was SPP of TNPID court, we booked a case against a Mumbai trader who collected `60 crore from people in Tamil Nadu in 2009. We prosecuted him under the TNPID Act.”

Nevertheless, the ease with which the scamsters were able to sell the idea of ‘daily interest’ or ‘weekly interest,’ and doubling of deposits within a period of about six months, has bamboozled police. “There are no pamphlets or hoardings explaining the scheme and the scamsters have not given any written acknowledgement for receiving payments from depositors/investors, except, of course, the online transaction proof. There is no assurance or written undertaking indicating the period within which the principal sum would be returned to investors,” an investigation team member told TOI.

In spite of such loopholes, people took the word-of-mouth account of friends and relatives and kept investing in the daily interest schemes. “There are cases of some people promptly receiving interests. My cousins were receiving weekly payments and encouraged me to make deposits,” said a woman who finally decided against doubling her deposit within six months. The arrest of R Balachander, a resident of Saidapet, has given police an inside account of the way the scheme works. He has been accused of cheating more than 30 people of `3.62 crore. He floated a firm -- Assured Capital Service -- and promised to double the investments of depositors by investing their money in shares.

A joint effort of cyber crime and CB-CID alone could crack this fraud, as officials probing the cases would need to be adequately backed by technology and gadgets. Recovery possibility, as of now, remains remote, as the fraudsters have not created any assets that could be seized, auctioned and adjusted against the claims.

The latest financial fraud, involving more money than MLM pyramids could muster, are online daily interest schemes that offer ‘direct bank transfer’ of interest in the accounts of ‘investors’ every day or week or month.

In the past two weeks, around 2,000 complaints have flooded the economic offences wing (EOW) at Guindy against Baba Asset, Allied Plus, Imax, Angel, Assured Plus and Assured Capital. These firms offered to pay interest every day or every week to people who deposited anything above `50,000. While the combined monetary loss suffered is in the region of `20 crore, police said at least one lakh people in Tamil Nadu have lost `1,000 crore in the past six months to online scamsters.

Due to jurisdictional constraints, EOW personnel have referred the cases to central crime branch of Chennai police, and now, on realising that the transaction was online, cyber crime personnel are on the move.

These operators function in a grey area which Tamil Nadu Protection of Depositors (Financial Establishments) (TNPID) Act 1997 has not covered. As they are registered in other states, and operated only via internet, there are apprehensions among law enforcing agencies as to the applicability of the special law.

“We need a cyber-crime unit to access computers for evidence. The economic offences wing cannot invoke special laws, including Information and Technology Act. Therefore, these cases have been forwarded to the city police and CB-CID,” an officer told TOI. However, former special public prosecutor of TNPID court in Chennai, Kasthuri Ravichandran, said EOW had power to slap cases against these fraudsters under TNPID Act. “When I was SPP of TNPID court, we booked a case against a Mumbai trader who collected `60 crore from people in Tamil Nadu in 2009. We prosecuted him under the TNPID Act.”

Nevertheless, the ease with which the scamsters were able to sell the idea of ‘daily interest’ or ‘weekly interest,’ and doubling of deposits within a period of about six months, has bamboozled police. “There are no pamphlets or hoardings explaining the scheme and the scamsters have not given any written acknowledgement for receiving payments from depositors/investors, except, of course, the online transaction proof. There is no assurance or written undertaking indicating the period within which the principal sum would be returned to investors,” an investigation team member told TOI.

In spite of such loopholes, people took the word-of-mouth account of friends and relatives and kept investing in the daily interest schemes. “There are cases of some people promptly receiving interests. My cousins were receiving weekly payments and encouraged me to make deposits,” said a woman who finally decided against doubling her deposit within six months. The arrest of R Balachander, a resident of Saidapet, has given police an inside account of the way the scheme works. He has been accused of cheating more than 30 people of `3.62 crore. He floated a firm -- Assured Capital Service -- and promised to double the investments of depositors by investing their money in shares.

A joint effort of cyber crime and CB-CID alone could crack this fraud, as officials probing the cases would need to be adequately backed by technology and gadgets. Recovery possibility, as of now, remains remote, as the fraudsters have not created any assets that could be seized, auctioned and adjusted against the claims.

World Cup 2019

Trending Topics

LATEST VIDEOS

City

Fadnavis in trouble: Pending water bills of over Rs 7 lakh, BMC declares CM's bungalow defaulter

Fadnavis in trouble: Pending water bills of over Rs 7 lakh, BMC declares CM's bungalow defaulter  Group of men fire during public functions in Delhi, clips go viral

Group of men fire during public functions in Delhi, clips go viral  Jharkhand man dies; mob brutally thrashed him made him chant 'Jai Shri Ram'

Jharkhand man dies; mob brutally thrashed him made him chant 'Jai Shri Ram'  Delhi Metro: Services temporarily affected on Blue Line for few hours

Delhi Metro: Services temporarily affected on Blue Line for few hours

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Lok Sabha Election Schedule 2019Lok Sabha Election NewsDelhi Capitals teamMI team 2019Rajasthan Royals 2019RCB team 2019Maharashtra Lok Sabha ConstituenciesBJP Candidate ListBJP List 2019 TamilnaduShiv Sena List 2019AP BJP List 2019Mamata BanerjeeBJP List 2019 MaharashtraPriyanka GandhiBJP List 2019 KarnatakaAMMK Candidate List 2019BJP List 2019 WBLok Sabha Elections in Tamil NaduBSP List 2019 UPNews in TamilLok Sabha Poll 2019Satta Matka 2018PM ModiMahagathbandhanNagpur BJP Candidate ListChandrababu NaiduTamil Nadu ElectionsUrmila MatondkarNews in TeluguMadras High CourtTejashwi YadavArvind KejriwalTejasvi SuryaPawan KalyanArvind KejriwalYogi AdityanathJaya PradaSatta King 2019Srinagar encounter

Get the app