L&T set to control Mindtree after Nalanda gives up fight

Highlights

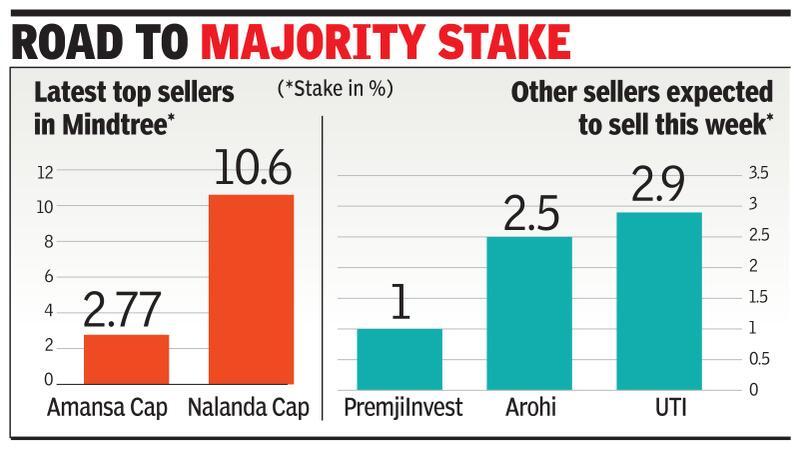

- L&T’s stake has touched 46% after Nalanda and other institutional investors like Amansa Capital (2.77%) sold shares

- Other investors such as UTI (2.9%), Arohi (2.5%) and PremjiInvest (1%) are expected to tender shares later this week, taking L&T past the majority mark

(Representative image)

(Representative image) MUMBAI/BENGALURU: Pulak Prasad-led Nalanda Capital has sold its entire 10.6% stake in Mindtree, paving the way for hostile acquirer

L&T to take control of the mid-tier IT services company

+ .

Nalanda — which had backed the Mindtree founders against L&T in Indian IT’s first hostile takeover — did a surprising U-turn over the weekend, possibly after coming under the market regulator’s lens, sources said. It tendered the entire stake in the ongoing open offer made by L&T.

TOI broke the story on its website on Monday morning.

L&T’s stake has touched 46% after Nalanda and other institutional investors like Amansa Capital (2.77%) sold shares. Other investors such as UTI (2.9%), Arohi (2.5%) and PremjiInvest (1%) are expected to tender shares later this week, taking L&T past the majority mark (see graphic).

Sebi had sought a reply from Nalanda after proxy advisory firm InGovern Research wrote to the regulator last week, expressing concerns whether the largest institutional investor in Mindtree was acting in concert with the founders. This piled up pressure on Prasad and Nalanda, which decided to offload shares hurriedly, sources said.

L&T declined to comment. Nalanda could not be reached for comments immediately.

InGovern had also raised concerns that if Nalanda believes there should be a higher price, then it should also make a counter-offer to the L&T bid, according to the letter seen by TOI. Nalanda had been asking some other institutional shareholders of Mindtree to push L&T to pay a better price after resisting the hostile takeover initially.

Nalanda, which manages public market assets worth about $2 billion, had also publicly come out in support of the Mindtree management, which included a signed article in this newspaper. Prasad’s retreat from the Mindtree battle showed that his investment thesis — to be an investor batting for promoter cum managements in mid-market public companies — is fraught with dangers in the aggressive world of M&As.

L&T has made the open offer at Rs 980 per share, and at Nalanda’s average investment price of Rs 260 per share the Singapore-based firm will be making a significant profit. Sources said some of the global sponsors invested in Nalanda also asked the fund to step back, especially since it had already made a handsome profit on Mindtree shares.

The investor selloff in Mindtree wasn’t surprising as the L&T offer price had rendered it the most expensive IT stock. There was also fear that the share price would collapse after L&T stops buying, with the July stock futures trading at around Rs 920 already.

Nalanda — which had backed the Mindtree founders against L&T in Indian IT’s first hostile takeover — did a surprising U-turn over the weekend, possibly after coming under the market regulator’s lens, sources said. It tendered the entire stake in the ongoing open offer made by L&T.

TOI broke the story on its website on Monday morning.

L&T’s stake has touched 46% after Nalanda and other institutional investors like Amansa Capital (2.77%) sold shares. Other investors such as UTI (2.9%), Arohi (2.5%) and PremjiInvest (1%) are expected to tender shares later this week, taking L&T past the majority mark (see graphic).

Sebi had sought a reply from Nalanda after proxy advisory firm InGovern Research wrote to the regulator last week, expressing concerns whether the largest institutional investor in Mindtree was acting in concert with the founders. This piled up pressure on Prasad and Nalanda, which decided to offload shares hurriedly, sources said.

L&T declined to comment. Nalanda could not be reached for comments immediately.

InGovern had also raised concerns that if Nalanda believes there should be a higher price, then it should also make a counter-offer to the L&T bid, according to the letter seen by TOI. Nalanda had been asking some other institutional shareholders of Mindtree to push L&T to pay a better price after resisting the hostile takeover initially.

Nalanda, which manages public market assets worth about $2 billion, had also publicly come out in support of the Mindtree management, which included a signed article in this newspaper. Prasad’s retreat from the Mindtree battle showed that his investment thesis — to be an investor batting for promoter cum managements in mid-market public companies — is fraught with dangers in the aggressive world of M&As.

L&T has made the open offer at Rs 980 per share, and at Nalanda’s average investment price of Rs 260 per share the Singapore-based firm will be making a significant profit. Sources said some of the global sponsors invested in Nalanda also asked the fund to step back, especially since it had already made a handsome profit on Mindtree shares.

The investor selloff in Mindtree wasn’t surprising as the L&T offer price had rendered it the most expensive IT stock. There was also fear that the share price would collapse after L&T stops buying, with the July stock futures trading at around Rs 920 already.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE