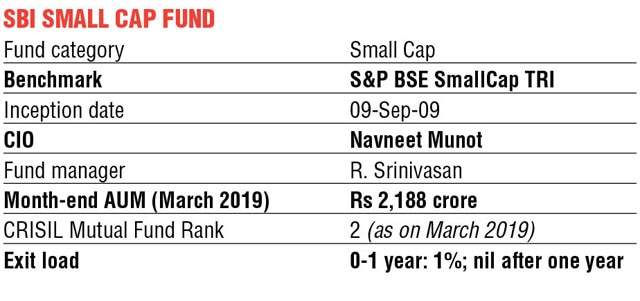

SBI Small Cap Fund (erstwhile SBI Small & Midcap Fund) provides an opportunity for long-term growth in capital along with liquidity by investing predominantly in a well-diversified basket of equity stocks of small cap companies. The fund has been ranked 2 in the small cap funds category of Crisil Mutual Fund Ranking (CMFR) for the past three quarters ended March 2019. R Srinivasan has been managing the fund since November 2013. He is the head of equities at the fund house and has over 25 years of experience in financial services. He manages two open-ended equity schemes at the asset management company with assets under management (AUM) of Rs 6,823 crore as of May 2019. The fund’s month-end AUM jumped almost three times from Rs 782 crore in June 2016 to Rs 2,188 crore in May 2019.

Trailing returns

The fund outperformed its peers (the small cap funds category in CMFR March 2019) and the benchmark (S&P BSE SmallCap TRI) across all the trailing periods. Its seven-year return was 25.1% compared with the benchmark’s 13.2% and the peer group’s 19.4%.

An investment of Rs 10,000 in the fund on September 9, 2009 (since inception) would have grown to Rs 50,372 (17.98% CAGR) on June 19, 2019, versus the benchmark’s Rs 21,699 (8.24% CAGR) and the category’s Rs 39,280 (15.01% CAGR).

SIP returns

A monthly investment of Rs 10,000 through a systematic investment plan (SIP) for nine years since July 2010 would have grown to Rs 28.48 lakh (XIRR 20.8%) on June 19, 2019. A similar investment in the benchmark would have grown to Rs 16.70 lakh (XIRR 9.48%).

Risk-reward matrix

During the past three years, the fund delivered higher returns, while keeping its volatility in line with that of the peers and lower than the benchmark’s.

Portfolio analysis

The fund has a tilt towards small cap stocks allocation ranged from 65.14% to 92.92% during the past three years. Meanwhile, its exposure to large-cap and mid-cap stocks averaged 2.93% and 11.03%, respectively. The fund invested across 28 sectors during the past three years. The major contributors were industrial products, consumer durables and auto ancillaries. Laggards included paper, media and entertainment and construction.

The fund invested in 89 stocks in the past three years and held six stocks consistently with average exposure of 17.6%. The fund manager generated significant alpha for the portfolio by investing in stocks such as Graphite India and Orient Refractories which increased over seven times and 1.5 times, respectively, before exiting these stocks. Other key contributors to the fund’s performance included Gabriel India (auto ancillaries), Solar Industries India (chemicals), and Relaxo Footwears (consumer durables).