After a lean March quarter, tea companies are looking forward to another quarter of stress on their profitability.

The June quarter of the current fiscal for tea producers is expected to report lower profits than the same period last fiscal, feel industry experts.

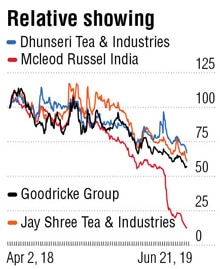

Amid price and cost pressure, many tea manufacturing stocks touched their 52-week low last week, including McLeod Russel India, once the largest tea producer of the country, which touched a new record low of Rs 17.10 on Friday, after rating agency Icra downgrade its bank facilities last week for the third time due to continued pressure on its liquidity profile. The company has a total debt of around Rs 1,600 crore as of March end, despite selling some of its gardens in India and Africa to pare debt.

According to D P Maheshwari, M D and CEO, Jayshree Tea and Industries, a B K Birla Group company, the entire tea producing organised industry is struggling to survive, thanks to higher wages coupled lower price realisation.

According to D P Maheshwari, M D and CEO, Jayshree Tea and Industries, a B K Birla Group company, the entire tea producing organised industry is struggling to survive, thanks to higher wages coupled lower price realisation.

"The industry has produced more crop this year, which will help to offset the drop in prices to an extent. But compared to the first quarter of fiscal 2019, the profitability of most tea producers in this quarter will definitely be impacted," Maheshwari said, adding that the cost has gone up Rs 50-60 per kg. Jayshree Tea scrips touched a record low of Rs 51 on Thursday.

The prices of Assam CTC (crush-tear-curl) for both first and second flush since March this year is down Rs 15-20 per kg from what it was last year, as per Maheshwari. On the other hand, the price of orthodox tea is Rs 20 more per kg this year, driven by demand in Iran, he said.

More domestic tea supply has a negative impact on the price, feels C K Dhanuka, MD and CEO, Dhunseri Tea and Industries.

"Supply of tea is way too much in the country. The government must ban new tea plantations, which is dominated by small tea growers and bought leaf factories. While they thrive on lower cost, the organised tea industry struggle to survive. If they continue to grow more tea, it will jeopardise the organised industry," Dhanuka said, adding that employment is generated by the organised sector and currently employs nearly three million people across North and South India.

Crop in Assam is higher 2-3% in the April-June period, said Atul Asthana, MD and CEO, Goodricke Group. Goodricke's shares, too, touched a 52-week low of Rs 170.35 on Thursday.

"Tea stocks are under pressure, though I do not know the reason behind the drop in share price. In terms of revenue, we expect the year to be better than last year, though profitability of companies will be severely impacted. The wage arrears are due since last year, which is a lump sum, and bonus payments have to be made in September. This will see a considerable cash crunch in the industry," Asthana said.

Goodricke has managed to stay profitable, and Asthana feels good corporate governance and good manufacturing practices can help a company to sail through even in difficult times.

Maheshwari said tea buyers and packeteers are offering lower prices, and more supply of low-quality tea is impacting prices of high-quality tea in the market.

Dhanuka of Dhunseri said liquidity has become a concern for most companies, as banks are not keen to finance tea manufacturing companies.

"The industry has to pay wages, arrears, bonus and some of the listed companies may have to liquidate their stocks to pay workers in the absence of availability of finance," Dhanuka said, adding that "everyone in the industry is bleeding".

"Profitability is gone. The organised industry will lose more in this June quarter than what it did last year," he said. Shares of Dhunseri Tea touched its 52-week low of Rs 181.50 on Friday.