Indiabulls Housing Finance to buy back Rs 2,285 crore NCDs

The company has raised approximately Rs 58,000 cr since Sep 2018

Indiabulls Housing Finance Picture for representational purpose , Istock

Indiabulls Housing Finance Ltd (IBHFL) will be buying back all the non-convertible debentures (NCDs) valuing up to Rs 2,285 crore.

“Considering the strong cash position of the company, IBHFL has decided to conduct buyback of all its NCDs maturing during July and August 2019,” a company official told DNA Money.

“The aggregate amount outstanding under these NCDs is Rs 2,285 crore,” the official said.

TROULBES EASING |

|

At present, IBHFL’s liquidity situation is “strong” as it raised approximately Rs 58,000 crore since September 2018 apart from having a cash buffer of Rs 28,000 crore.

At present, IBHFL’s liquidity situation is “strong” as it raised approximately Rs 58,000 crore since September 2018 apart from having a cash buffer of Rs 28,000 crore.

Moreover, the non-banking finance company (NBFC) does not have any exposure towards Dewan Housing Finance Ltd as well as Reliance ADAG Group.

As per regulatory filing on Thursday, IBHFL made “timely payment of interest and principal on secured redeemable NCDs issued by the company on private placement basis” that are due on Friday (today). The payment was made on Thursday.

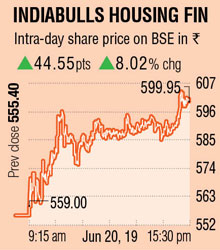

Post these two announcements on Thursday, IBHFL’s share price went up to Rs 606.80 during intra-day trade. The price settled at Rs 599.95 per scrip. Or 8.02%, higher than the day’s opening.

After a petition was moved in the Supreme Court earlier this month to seek action against IBHFL, promoter Sameer Gehlaut and the company’s directors for alleged misappropriation of money, stocks of most of the Indiabulls Group companies had come under pressure. However, after a few days the petitioner withdrew the petition.

The petition filed by one Abhay Yadav, who is a milk seller and holding just four shares of the second largest home finance company since May 9, 2019, and two others, had alleged that the company had misappropriated Rs 98,000 crore of public money, a charge termed as “frivolous and bizarre” by the company, had sought an urgent hearing in the matter.

According to Karvy, the registrar of Indiabulls, the petitioners Yadav and Shekhar own just four and two shares of the company, respectively. Earlier this fiscal, IBHFL had announced a merger with Lakshmi Vilas Bank. Post-merger, the company would be named Indiabulls Lakshmi Vilas Bank and will also be among the top eight private banks in India.

The share swap ratio for the merger has been fixed at 1:0.14, which means that for every 100 shares of Lakshmi Vilas Bank, 14 shares of IBHFL will be issued.