Government plans fresh set of tax sops for startups in budget

Highlights

- For long, startups have argued that ESOPs are an important tool for employee retention and often taxing them is not feasible

- DPIIT is discussing the possibility of giving angel tax benefits to Category II alternate investment funds (AIFs), a concession that is currently available to certain Category I investors

File photo for representation

File photo for representationNEW DELHI: The government is looking at a fresh set of tax benefits for startups to boost entrepreneurship and employment in the economy.

The department for promotion of industry and internal trade (DPIIT) and the revenue department have discussed a package of tax sops in the forthcoming budget, including simplified norms for levying a tax on employee stock option schemes (ESOPs) at the time of sale of shares, sources told TOI.

Currently, ESOPs are taxed at a time when an employee exercises the option and a tax on perquisites is levied between the exercise price and the fair market value at that time. Then, there is a capital gains tax when the employee finally sells the share. For long, startups have argued that ESOPs are an important tool for employee retention and often taxing them is not feasible.

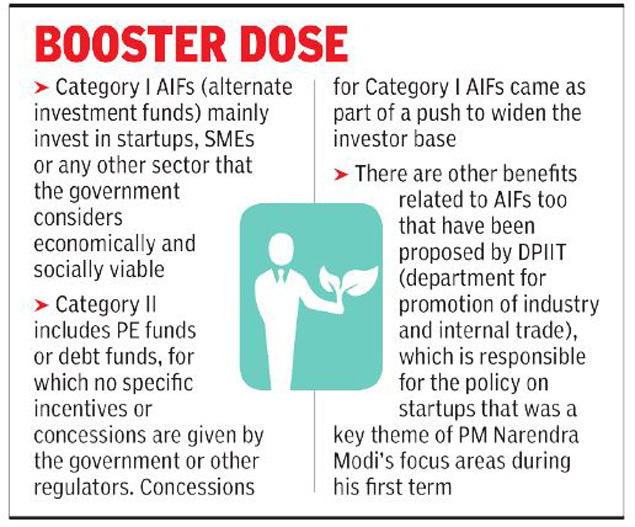

Besides, DPIIT is discussing the possibility of giving angel tax benefits to Category II alternate investment funds (AIFs), a concession that is currently available to certain Category I investors.

The department is seeking other benefits for AIFs to provide a thrust to fund startups. For instance, it has suggested that, just like profit of AIFs is a pass through for limited partners, the loss should also get the same treatment.

Similarly, there is a proposal for a GST exemption for fund managers based in India as the levy does not apply to those offshore. But this proposal is unlikely to be accepted and in any case GST-related issues are now outside the ambit of the budget.

The department for promotion of industry and internal trade (DPIIT) and the revenue department have discussed a package of tax sops in the forthcoming budget, including simplified norms for levying a tax on employee stock option schemes (ESOPs) at the time of sale of shares, sources told TOI.

Currently, ESOPs are taxed at a time when an employee exercises the option and a tax on perquisites is levied between the exercise price and the fair market value at that time. Then, there is a capital gains tax when the employee finally sells the share. For long, startups have argued that ESOPs are an important tool for employee retention and often taxing them is not feasible.

Besides, DPIIT is discussing the possibility of giving angel tax benefits to Category II alternate investment funds (AIFs), a concession that is currently available to certain Category I investors.

The department is seeking other benefits for AIFs to provide a thrust to fund startups. For instance, it has suggested that, just like profit of AIFs is a pass through for limited partners, the loss should also get the same treatment.

Similarly, there is a proposal for a GST exemption for fund managers based in India as the levy does not apply to those offshore. But this proposal is unlikely to be accepted and in any case GST-related issues are now outside the ambit of the budget.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE