Industrial output at 6-month high

TNN | Jun 13, 2019, 07:07 IST

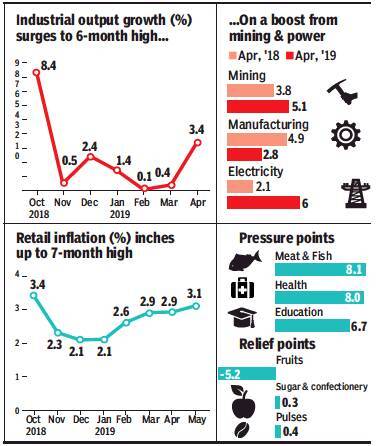

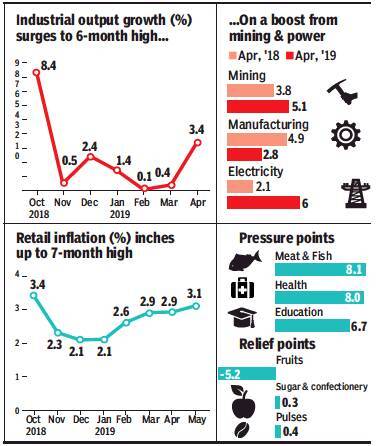

NEW DELHI: Retail inflation shot up to a seven-month high in May on the back of higher food and vegetable prices, while industrial output growth rose to a six-month high in April, prompting economists to say that there is a need to revive demand.

Data released by the National Statistics Office (NSO) on Wednesday showed retail inflation, as measured by the consumer price index (CPI), rose to 3.1% in May from previous month’s 3%, but well below the RBI’s target. Separate data showed the index of industrial production rose 3.4% in April — faster than the previous months’ upwardly revised 0.4%, but slower than the 4.5% in the year-ago period.

Last week, the RBI cut interest rates for the third time in a row to a nine-year low of 5.75% and changed its stance to accommodative. The rate cuts came against the backdrop of a slowdown in overall growth and highlighted the central bank’s commitment to prop up growth.

“While we expect monthly headline CPI inflation to gradually pick up over coming months on the back of a low base effect, we forecast it to continue to remain around 4% during FY20 (within RBI’s target),” said Madan Sabnavis, chief economist at Care Ratings, who also pointed to the risk of rising food inflation and the importance of the distribution of monsoon rains. “We expect RBI to cut interest rates by 25-50 bps (100 basis points = 1 percentage point) in FY20. However, this would be contingent upon normal rainfall and stable crude oil prices,” said Sabnavis.

Some economists said the budget should signal steps to revive demand. “With consumption slowing down markedly, as indicated by persistent negative growth in car sales, it is imperative that we revive demand. On a y-o-y basis, government expenditure has also seen a significant compression. On quarter-on-quarter basis, investment has declined significantly,” said Soumya Kanti Ghosh, group chief economic adviser at SBI. “Our expectations are such that the government would do better with reasonable fiscal deficit assumptions and should be very clear of the fiscal consolidation path,” said Ghosh.

Data released by the National Statistics Office (NSO) on Wednesday showed retail inflation, as measured by the consumer price index (CPI), rose to 3.1% in May from previous month’s 3%, but well below the RBI’s target. Separate data showed the index of industrial production rose 3.4% in April — faster than the previous months’ upwardly revised 0.4%, but slower than the 4.5% in the year-ago period.

Last week, the RBI cut interest rates for the third time in a row to a nine-year low of 5.75% and changed its stance to accommodative. The rate cuts came against the backdrop of a slowdown in overall growth and highlighted the central bank’s commitment to prop up growth.

“While we expect monthly headline CPI inflation to gradually pick up over coming months on the back of a low base effect, we forecast it to continue to remain around 4% during FY20 (within RBI’s target),” said Madan Sabnavis, chief economist at Care Ratings, who also pointed to the risk of rising food inflation and the importance of the distribution of monsoon rains. “We expect RBI to cut interest rates by 25-50 bps (100 basis points = 1 percentage point) in FY20. However, this would be contingent upon normal rainfall and stable crude oil prices,” said Sabnavis.

Some economists said the budget should signal steps to revive demand. “With consumption slowing down markedly, as indicated by persistent negative growth in car sales, it is imperative that we revive demand. On a y-o-y basis, government expenditure has also seen a significant compression. On quarter-on-quarter basis, investment has declined significantly,” said Soumya Kanti Ghosh, group chief economic adviser at SBI. “Our expectations are such that the government would do better with reasonable fiscal deficit assumptions and should be very clear of the fiscal consolidation path,” said Ghosh.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE