Reliance Group chairman Anil Ambani has a battle at hand as he plans to rescue the promoters' pledged shares in some of the sister companies. If the debtors are not repaid, the promoters stand to lose control in at least three companies considering that over 95% of their shareholding is pledged with creditors.

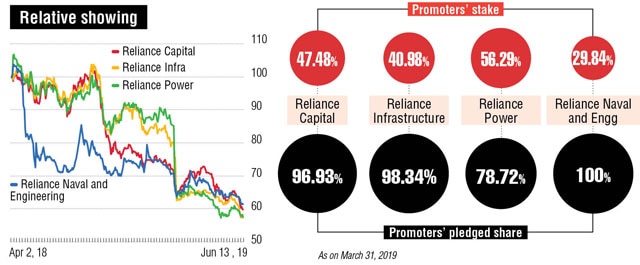

In Reliance Capital, the promoters have pledged 96.93% of their holding while in Reliance Infrastructure it is as high as 98.34%, as per data available till March-end 2019. The promoter holding in these two companies stand at 47.48% and 40.98% respectively, the data showed.

The promoter holding in Reliance Power was 56.29%, of which 78.72% shares were pledged. In Reliance Naval & Engineering, the entire promoter holding, standing at 29.84%, has been pledged with various creditors.

Reliance Innoventures Private Ltd (RIPL) is the ultimate holding company of Reliance-Anil Dhirubhai Ambani Group (ADAG). It has strategic holdings in various listed operating group companies through intermediate holding companies. It is also engaged in the business of electricity through windmills. It holds a majority of the promoter shareholding in Reliance Communications, Reliance Capital, Reliance Power and Reliance Infrastructure, directly and through subsidiaries.

The group is planning asset sales to recoup the shares, while timely asset sale is critical to servicing the debt. As per data till March 2018, the group's consolidated debt stood at Rs 1.72 lakh crore. The figures for the fiscal year ended March 2019 are not available as some of the group companies are yet to announce their fourth-quarter results.

A detailed questionnaire sent to Reliance ADAG on the shares pledged and the company's plans to pare debt did not elicit any response till the filing of this report.

"Going forward, Reliance Capital's ability to monetise its core and non-core investments and unlock value by divesting stake in group exposures in a timely manner to service repayment obligations, reduce debt levels and maintain profitability and liquidity profile will be the key rating sensitivities," Brickworks said in its rating rationale.

The group is in the final stages of selling its 42.88% stake in Reliance Nippon Life Asset Management Ltd, which is expected to bring in Rs 6,000 crore. Reliance is also selling its FM radio business to Jagran Prakashan for over Rs 1,000 crore. Reliance Capital has a debt of Rs 18,000 crore in the bond market.

Adding to the group's woes, PwC, the auditor of Reliance Capital and Reliance Home Finance refused to complete the auditing work. While PwC complained that the company was not forthcoming with the information, the company refuted allegations calling it baseless.

"PwC's observations are completely baseless and unjustified. PwC has acted prematurely without even statutory discussions with the audit committee," Reliance Capital said in a regulatory filing.

Earlier this week, Ambani in a media conference call said: "Despite challenging conditions and no financial support from financiers, the group has repaid the principal of Rs 24,800 crore and made interest payments of Rs 10,600 crore between April 1, 2018, and May 31, 2019."

However, the company declined to give a break-up of the debt payment, or to whom it was repaid.

Reliance Communications, the telecom arm of the group, filed for bankruptcy in the National Company Law Tribunal (NCLT). Domestic banks have an exposure of over Rs 22,000 crore to RCom. "It is unlikely that any money will flow back to the banks from the liquidation process," said a banker.