The delay in interest payment by Dewan Housing Finance Corporation (DHFL) that led to credit rating downgrades poses a risk of contagion in the sector and the market unless the Reserve Bank opens a liquidity window for the beleaguered sector. Analysts said non-banking finance companies, which rely on wholesale funding, are the most vulnerable, a concern that sent shares of these lenders tumbling on Thursday.

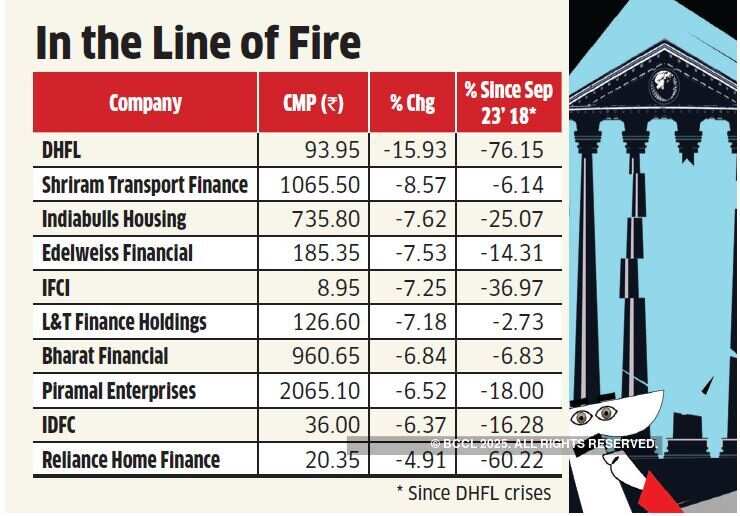

The delay in interest payment by Dewan Housing Finance Corporation (DHFL) that led to credit rating downgrades poses a risk of contagion in the sector and the market unless the Reserve Bank opens a liquidity window for the beleaguered sector. Analysts said non-banking finance companies, which rely on wholesale funding, are the most vulnerable, a concern that sent shares of these lenders tumbling on Thursday.DHFL dropped 15.9 per cent to Rs 93.90 on Thursday, a day after Crisil, Care and Icra downgraded its debt instruments to ‘default’ rating following a delay in interest payments. The event weighed down sentiment in other NBFCs also with Edelweiss declining 8.5 per cent, Reliance Capital falling 7.7 per cent and Indiabulls Housing tumbling 7.6 per cent.

“This default, as well as the recent default by IL&FS and downgrade of credit ratings of NBFCs, could accentuate contagion risk in financial markets,” CLSA said in a client note. “This will lead to tightness in bond markets and lower inflows into mutual funds, eventually resulting in higher costs and polarised allocation to high quality borrowers.”

The brokerage prefers banks over NBFCs with ICICI, IndusInd, HDFC and ICICI Lombard being its top picks in the sector.

Mutual fund debt schemes holding DHFL saw one of their worst single-day losses on June 4 after the housing finance company missed interest payment.

About 22 mutual funds together owned DHFL paper worth Rs 5,236 crore across 226 debt schemes as on April 30, 2019, as per data from Value Research. UTI Mutual Fund and Reliance Nippon Asset Management are among the largest fund houses holding DHFL paper. Nomura said Yes Bank, IndusInd Bank, Bank of Baroda and SBI have material exposure to DHFL at 0.4-1.4 per cent of their FY19 loans.

“Weak mutual fund debt inflows and potential risk of outflows following haircuts, imply continued pressure on aggregate funding to NBFCs/HFCs,” said Morgan Stanley in a note.

The brokerage said the event has made the market nervous and will impact NBFCs relying on wholesale funding the most.

The brokerage said the event has made the market nervous and will impact NBFCs relying on wholesale funding the most.CLSA said sectors like real estate, housing and automobiles, along with small and medium enterprises (SMEs), which have higher dependence on NBFCs, could be impacted.

The RBI may need to consider direct or indirect lines of liquidity to ease concern, the brokerage said. “A possible solution could be to provide a liquidity line to solvent NBFCs/HFCs so that the DHFL issue does not lead to a contagion,” Nomura said.