One would assume that a fund that is actively managed, where the fund manager actively manages the fund would outperform a passive fund, which just tracks the underlying index. Data, however, suggests otherwise.

And there are a number of takeaways for the retail investor from this fact.

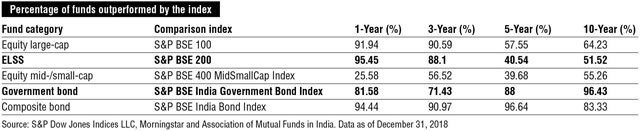

“Index strategies follow transparent rule based methodologies,” says Koel Ghosh, head of business for S&P Dow Jones Indices (S&P DJI) in South Asia, about the fact that funds that are actively managed frequently trail their benchmark index. For example, some 91.94% of equity large cap funds have underperformed the S&P BSE 100, their underlying benchmark index, according to data compiled by S&P. A similar story is seen in other categories such as ELSS where 95.45% of funds have underperformed the S&P BSE 200 – their benchmark index.

Index funds are passive (they mirror a benchmark index) and hence they have lower costs due to no investment management fee, no active research related fees, and no active trading costs. “The index delivers market beta and a consistent strategy that allows it to stay true to its index objective,” explains Ghosh.

There are multiple reasons for underperformance of a supposed passive fund over an actively managed fund, where there is a fund manager overlooking investment decisions, according to experts.

“The movement in Nifty has been concentrated,” says Tanvi Kanchan, head – corporate strategy, Anand Rathi, about the underperformance.

The top five stocks that have a weight of 37% of Nifty have contributed to 214% of Nifty returns in 2018, whereas in previous years the contribution has been average around 63%. This shows that 2018 was the year of a concentrated rally, not seen in previous years, and allocation to stocks beyond these top five stocks would have dragged down the Nifty returns.

“Based on the above data, any fund manager who had less than 37% allocation to these stocks, witnessed negative alpha (returns),” says Kanchan.

From a different perspective, Securities and Exchange Board of India (Sebi) mandate to re-categorise funds led the equity fund industry to restructure and reconstruct their portfolios, resulting in some churn and volatility. However, this was a one-time activity, and now all funds have streamlined their portfolios to meet the regulatory requirements.

Then there is the human angle too, to the underperformance.

“If it is not the case (of an actively managed fund outperforming a passive fund), then it has got to do with the stock selection skills of the fund manager,” says Renjith RG, associate director, Geojit Financial Services. Factors where human miscalculation may occur include the selection of wrong stocks or sectors, delayed identification (of multi-baggers) or early exit from multi-baggers, lack of insights in understanding the trends and trend reversals in the market.

Also, for the midcap segment, there was underperformance as retail investors avoided this segment and thus there was no rally, says Kishor Ostwal, MD, CNI Research, about why certain segments of the market underperformed.

There was extreme volatility within the mid and small-cap universe. For example, in January 2018, Nifty mid cap underperformed Nifty 50 by 6.4%, while in July 2017, the underperformance was 1.4%, and in May 2017 the underperformance was 6.6%.

Even in the large-cap space, the performance of Nifty was concentrated within the top five Nifty stocks which contributed to 53% of the performance, according to market experts.

Strategy is the key for success experts emphasise, even over technology.

“Technology can play a role only execution of trades,” Ostwal says. Algo trade does not promise good returns, it merely gives you priority over other's trade. This does not help in performance.

“Active fund managers faced a major drawback in their strategy, last year to deliver alpha (good returns) on their portfolio,” Kanchan says.

And yes, index funds or passive investing are a major factor in the West (US and Europe is still to catch on in India, with a fair chunk of investors yet to be aware of this investing option.

“The Indian passive market is still in its nascent stages,” says Ghosh. While the global passive investment market has crossed $5 trillion, India has assets at approximately $15 billion. The growth in India was primarily fuelled by the government initiatives such as the CPSE ETFs and the EPFO's allocation to equity ETFs. Investor education is a key requirement to create awareness for this space and the benefits it carries.

Indian retail investors are gradually becoming aware towards investments into more managed assets and this can clearly be seen with regards to the quantum of fund flow into mutual funds. “However, even now a lot of investors are unaware of the various categories of funds and the scheme objective behind each,” says Kanchan.

Retail investors also do not do justice while investing. “In most cases it is seen that they exit after getting returns of 20% to 50%; conversely, when the stock prices fall they become passive investors by default as they do not exit by booking losses,” says Ostwal about the mistakes that retail investors in India typically make.

Underperformance for a short period of time should not be used to make long-term investment decision or undermine the importance of a streamlined investment approach.

“As time period increases and markets go through various cycles (consider an investment horizon of three years and above), the market performance gets diversified with most sectors and stocks contributing, thus providing alpha (returns) generating opportunities to investors,” Kanchan says.