Tiger Global Management has grabbed the top spot as a unicorn investor globally this year, while SV Angel made the most early-stage bets on billion dollar companies, according to a CB Insights report.

While 72% of unicorn backers have only invested in one unicorn, a term for companies valued at $1 billion or more, the study cites there are a few investors which have backed as many as 10, 20 and 40 unicorns.

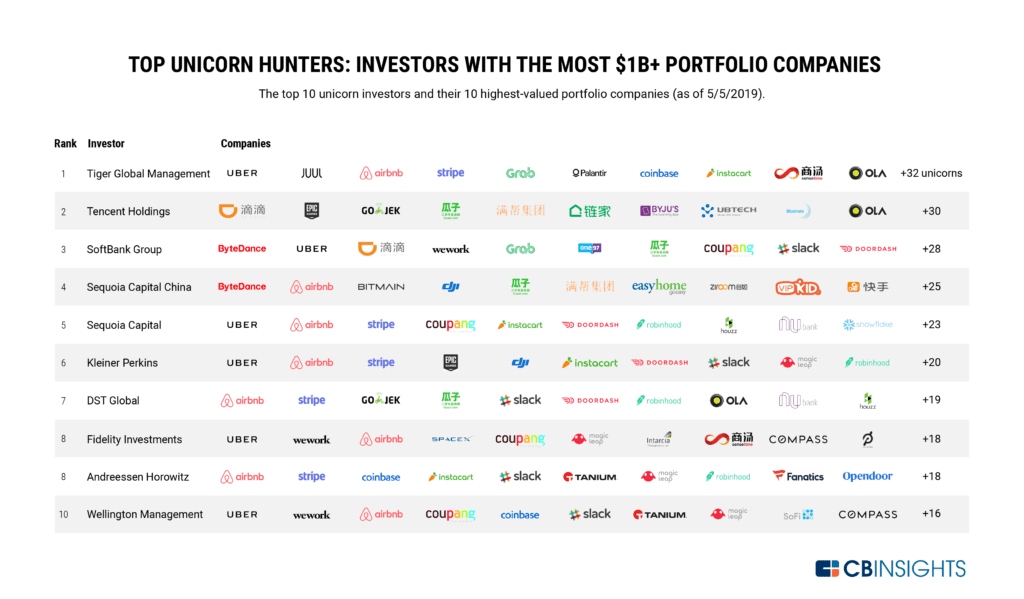

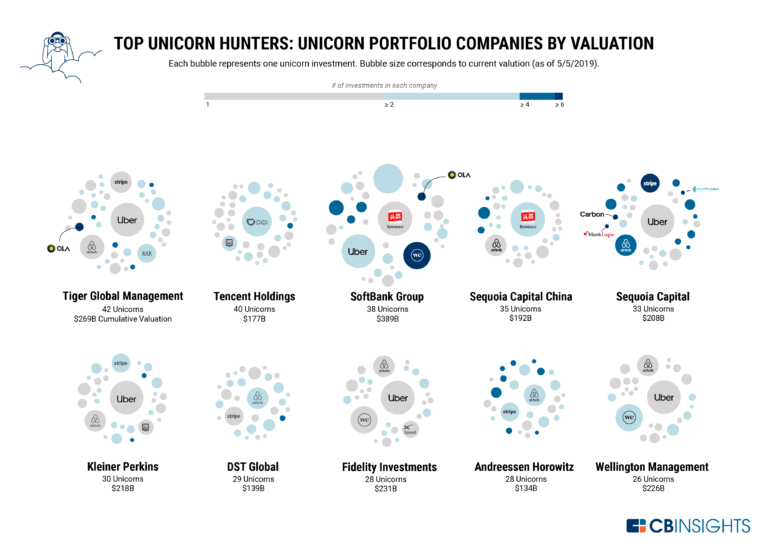

Tiger Global Management led the pack with 42 unicorns in its portfolio closely followed by China-based Tencent Holdings with 40 and Japan-SoftBank Group boasting of 38.

In terms of the valuation, however, SoftBank’s unicorn portfolio has the highest cumulative valuation at $389 billion — that’s 45% more than Tiger Global Management, and more than double Tencent Holdings’ collective valuation. Andreessen Horowitz’s unicorns have the lowest cumulative investment total at $134 billion.

Going by the companies which have seen most investments by top unicorn hunters, online hospitality marketplace Airbnb ($29B valuation) has been backed by at least 8 of the top 10 unicorn investors. Ride-hailing company Uber ($72B) has been backed by 6, and online payments startup Stripe ($22.5B) has been backed by 5.

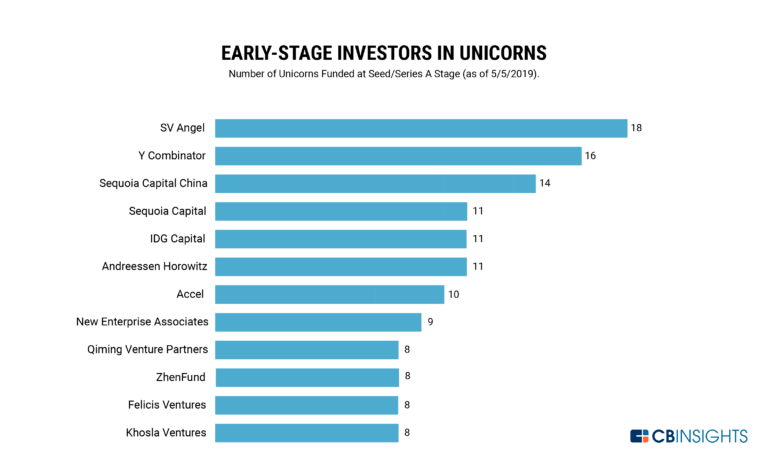

Investors which have backed these companies in early funding rounds have stood to gain most from their exits. SV Angel, for example, has retained its number 1 spot since CB Insight's last analysis in February 2017. Y Combinator and Sequoia Capital China are the other top early-stage investors. Meanwhile, Sequoia Capital has slipped in rankings from second to fourth place.

The report further cites the most effective investors as Y Combinator which has invested in 18 unicorns, with 16 being early-stage investments, followed by SV Angel (23 unicorns, 18 early-stage investments), and IDG Capital (18 unicorns, 11 early-stage investments). Also, among the top 10 unicorn hunters most companies are US-based followed by China.