After a mixed bag in the recently concluded fourth-quarter earnings, stock market analysts believe the first quarter (April-June) earnings could more or less mirror the trend witnessed in the previous quarter.

Vinod Nair, head – research, Geojit Financial Services, said that some revamp in numbers are expected in the fourth quarter, led by financials. The expectation was also based on the earnings number of Q4FY18, which was low.

"We started on a decent note with IT, but the financial sector reported weak numbers initially. Q4 numbers were mixed, and the market was hoping for profit after tax (PAT) growth at 18-22% for Nifty companies. Profit margins reported in the fourth quarter were around 15%, which was low. I think the trend is likely to continue in the first quarter as well," said Nair.

According to him, while metals, auto and FMCG reported weak earnings, the financial sector reported below expected numbers. Information technology, on the other, reported a mixed set of numbers in the fourth quarter, he said.

"For next quarter, the expectation is high, but the first half is expected to be weak, whereas the second half will be positive," Nair further added.

Shiv Diwan, co-head, institutional equities, Edelweiss Securities, concur that global growth seems to have slowed down further, whereas interest rates are easing.

"We expect them (interest rate) to come down meaningfully. But domestic consumption remained soft. This trend will remain in the first quarter of FY2020, and recovery will come only in the second half of the fiscal," Diwan said.

On the other hand, Rahul Shah, VP – equity advisory group, Motilal Oswal Financial, expects better first quarter numbers compared to fourth quarter.

According to him, auto and select consumer companies reported a weak set of numbers in the previous quarter, but the performance is expected to revive post monsoon.

"We are expecting better numbers over the fourth quarter. Auto sales were impacted due to the NBFC crisis and liquidity constraint, followed by elections. But if we have a normal monsoon, auto numbers are expected to revive. Some consumer companies also reported muted growth which, too, is expected to see a revival post monsoon," he said.

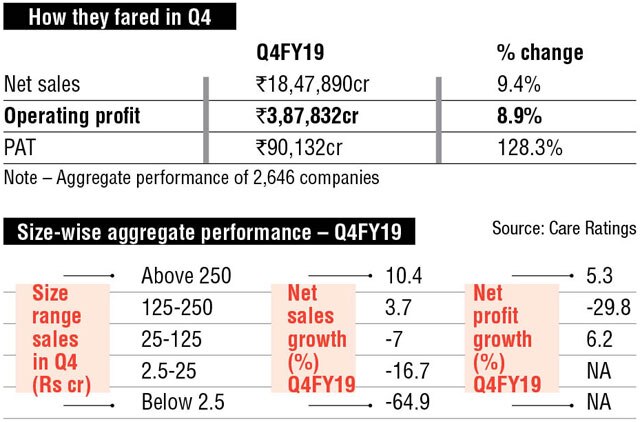

Motilal Oswal in a review report on Q4FY19 said domestic cyclicals continued driving earnings growth for the second consecutive quarter, led by financials, which contributed almost the entire earnings delta but still fell short of expectations. Sales/ebitda/profit growth for the Nifty came in at 10.2% /6.1% /15.8% versus expectations of 11.1% /3.4% /16.8%.

"For the Motilal Oswal universe, sales/EBITDA/profit growth stood at 10.6% /7.3% /23.6% against expectations of 11.5% /5.1% /29.4%. Sales growth for the MOFSL universe was the slowest since December 2016, dragged by commodities like metals and oil and gas. Ebitda growth stood in-line at 7%. Notably, the Ebitda margin for the MOFSL (ex-financials & oil marketing companies) universe shrank by 100bp to19.1%, dragged by automobiles, consumer, metals, oil and gas and telecom. On the other hand, cement and utilities delivered year-on-year (yoy) expansion in the operating margin," the report said.

Elara Securities in Q4FY19 review note said net sales, ebitda, and PAT for Nifty 50 grew by 9.8% yoy, 2.2% yoy, and 13.0% yoy, respectively, in Q4FY19.

"Overall profitability was 9% below our expectations, primarily due to the lower-than-expected bottom line from banks. Ex-financials, results were in line with our expectations (deviation of -0.4%). Major contributions to PAT growth came in from financials (lower slippages & improving credit demand) and utilities (strong industrial volume & customer switch in gas utilities). Auto (increase in raw material costs), telecom (competitive intensity) and metals are the laggards," it said.