Government may use acquisition route for general insurers

Surojit Gupta | TNN | Updated: May 29, 2019, 11:04 ISTHighlights

- An acquisition of government shares in the other two entities will also help the Centre raise some funds and bolster its disinvestment corpus

- The plan was part of the government’s overall strategy of consolidation in the public enterprises space

Image used for representation.

Image used for representation. NEW DELHI: The government is exploring the option of acquisition among the three public sector general insurance companies as part of a consolidation exercise, and a final call will be taken by the new government, sources said on Tuesday.

So far, the NDA had talked about mergers in the state-run insurance company space as it plotted a strategy to improve the financial health of these companies and raise much-needed resources for the government.

The department of investment and public asset management (Dipam) met on Tuesday to discuss the strategy for the three public sector general insurance companies. “Various options were discussed. Whether it is going to be acquisition or merger — the decision will be taken by the new Cabinet,” said an official aware of the developments.

If the government opts for acquisition by the financially strongest company among the three, it would be the third such instance after acquisition of HPCL by ONGC, the country’s largest oil and gas producer, along with state-run Power Finance Corporation’s (PFC’s) acquisition of Rural Electrification Corporation (REC).

An acquisition of government shares in the other two entities will also help the Centre raise some funds and bolster its disinvestment corpus.

Finance minister Arun Jaitley in his 2018-19 budget speech had said that three public sector general insurance companies — National Insurance, United India Insurance and Oriental Insurance — would be merged into a single entity and subsequently listed. The plan was part of the government’s overall strategy of consolidation in the public enterprises space.

Last year, Dipam had asked the department of financial services to get the issue of merger of the three companies examined and prepare a fresh road map as there was a view that rushing into a decision would not be prudent.

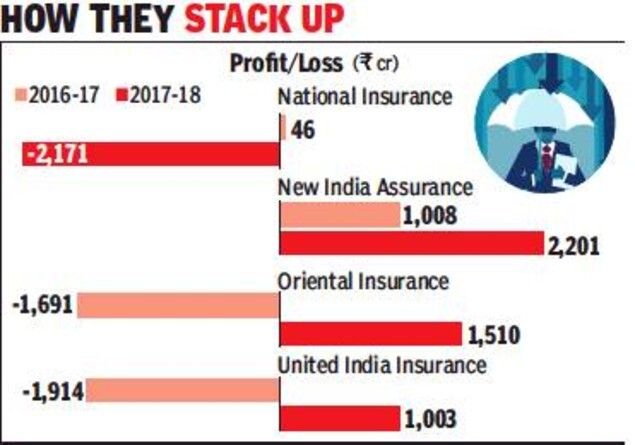

Latest results show that National Insurance reported a loss of over Rs 2,000 crore. Among the rest two, Oriental Insurance’s profit was higher than United India Insurance’s in 2017-18. But the financial health of the insurance companies has been a matter of concern, triggering talks of recapitalisation.

The government is keen to wrap up transaction involving the three companies in the current fiscal year. Officials at Dipam are looking at a timeline of October for completing the transaction.

So far, the NDA had talked about mergers in the state-run insurance company space as it plotted a strategy to improve the financial health of these companies and raise much-needed resources for the government.

The department of investment and public asset management (Dipam) met on Tuesday to discuss the strategy for the three public sector general insurance companies. “Various options were discussed. Whether it is going to be acquisition or merger — the decision will be taken by the new Cabinet,” said an official aware of the developments.

If the government opts for acquisition by the financially strongest company among the three, it would be the third such instance after acquisition of HPCL by ONGC, the country’s largest oil and gas producer, along with state-run Power Finance Corporation’s (PFC’s) acquisition of Rural Electrification Corporation (REC).

An acquisition of government shares in the other two entities will also help the Centre raise some funds and bolster its disinvestment corpus.

Finance minister Arun Jaitley in his 2018-19 budget speech had said that three public sector general insurance companies — National Insurance, United India Insurance and Oriental Insurance — would be merged into a single entity and subsequently listed. The plan was part of the government’s overall strategy of consolidation in the public enterprises space.

Last year, Dipam had asked the department of financial services to get the issue of merger of the three companies examined and prepare a fresh road map as there was a view that rushing into a decision would not be prudent.

Latest results show that National Insurance reported a loss of over Rs 2,000 crore. Among the rest two, Oriental Insurance’s profit was higher than United India Insurance’s in 2017-18. But the financial health of the insurance companies has been a matter of concern, triggering talks of recapitalisation.

The government is keen to wrap up transaction involving the three companies in the current fiscal year. Officials at Dipam are looking at a timeline of October for completing the transaction.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE