IRDAI proposes 10-20% hike in 3rd-party motor insurance

Rachel Chitra | TNN | May 21, 2019, 06:21 IST Representative image

Representative imageBENGALURU: The Insurance Regulatory and Development Authority (IRDAI) on Monday announced its intention to increase third-party motor insurance rates on average by 10-20% for bikes, cars and taxis. The insurance regulator held the premiums steady only for luxury motorcycles and cars, may be because it had raised rates for this category by more than 100% last year. The premiums generally had been cut by 10-20% last year. So, the proposed increase now brings them more or less back to what prevailed prior to that cut.

Third-party insurance rates for trucks too are proposed to be raised by 10-20%. Truck associations have been lobbying for lower rates.

Insurers say motor insurance has been an unprofitable segment for all. Given the everyday realities of rash driving, signaljumping, and poor road infrastructure, India has one of the highest fatality rates in the world — 11.6 per 1,00,000 people in 2018. This means big payouts by Indian insurers. “In the last decade, the combined loss ratio for motor and health has always been above Rs 100. For every Rs 100 collected for a policy, we spend Rs 10-20 more in paying claims,” says ICICI Lombard chief of underwriting & claims, Sanjay Datta.

At the same time, given the low penetration of vehicle insurance despite it being mandatory, any move to increase rates may only discourage people from buying insurance. “A sizeable number of vehicles plying on the road don’t have mandatory third-party motor insurance. The compliance rates are abysmal. At any petrol bunk, you can get a fake insurance policy for your bike, car or autorickshaw. If we keep raising rates, how many will buy original policies?” asks an official with a public sector insurer.

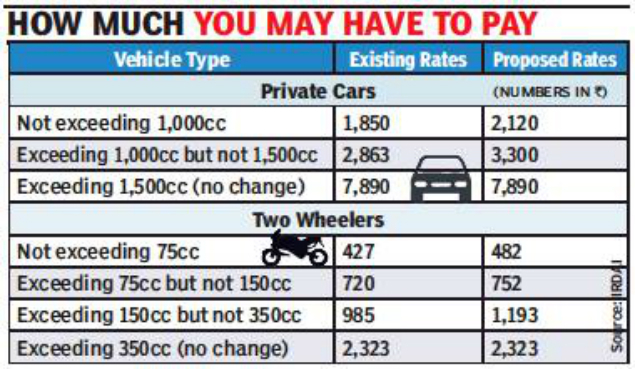

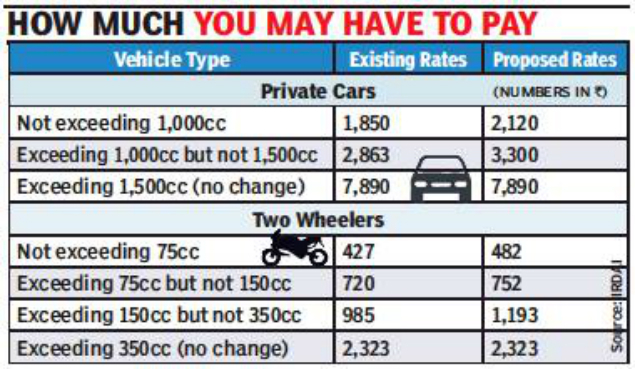

IRDAI’s latest proposal is to raise premiums for small mopeds, scooties and two-wheelers with engine capacity below 75cc by 13% to Rs 482. For scooters and motorbikes with engine capacity of 75-150cc — the most popular segment on Indian roads — the rate will be increased by 4.4% to Rs 752. For small car owners (below 1,000cc), the proposal is to raise rates by 15% to Rs 2,120, and for sedans (1,000-1,500cc) by 15.2% to Rs 3,300. Autorickshaw rates are proposed to be raised by 24% to Rs 3,914, and private cab rates — for all categories of cars — by 6.1%.

Third-party insurance rates for trucks too are proposed to be raised by 10-20%. Truck associations have been lobbying for lower rates.

Insurers say motor insurance has been an unprofitable segment for all. Given the everyday realities of rash driving, signaljumping, and poor road infrastructure, India has one of the highest fatality rates in the world — 11.6 per 1,00,000 people in 2018. This means big payouts by Indian insurers. “In the last decade, the combined loss ratio for motor and health has always been above Rs 100. For every Rs 100 collected for a policy, we spend Rs 10-20 more in paying claims,” says ICICI Lombard chief of underwriting & claims, Sanjay Datta.

At the same time, given the low penetration of vehicle insurance despite it being mandatory, any move to increase rates may only discourage people from buying insurance. “A sizeable number of vehicles plying on the road don’t have mandatory third-party motor insurance. The compliance rates are abysmal. At any petrol bunk, you can get a fake insurance policy for your bike, car or autorickshaw. If we keep raising rates, how many will buy original policies?” asks an official with a public sector insurer.

IRDAI’s latest proposal is to raise premiums for small mopeds, scooties and two-wheelers with engine capacity below 75cc by 13% to Rs 482. For scooters and motorbikes with engine capacity of 75-150cc — the most popular segment on Indian roads — the rate will be increased by 4.4% to Rs 752. For small car owners (below 1,000cc), the proposal is to raise rates by 15% to Rs 2,120, and for sedans (1,000-1,500cc) by 15.2% to Rs 3,300. Autorickshaw rates are proposed to be raised by 24% to Rs 3,914, and private cab rates — for all categories of cars — by 6.1%.

Download The Times of India News App for Latest Business News.

Make sense of the 2019 Lok Sabha Elections and results on May 23 with TOI. Follow us to track latest news, live updates, news analysis and cutting-edge data analytics. Track live election results, big trends and fastest updates on counting day with India's largest news network.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE