'Crorepati' executives at Infosys more than double

Shilpa Phadnis | TNN | Updated: May 21, 2019, 11:08 ISTHighlights

- A significant part of this increase was on account of the sharp spike in the company’s share price, which raised the value of the stocks that vested during the year

- Last week, Infosys said it would allocate 50 million shares, valued at Rs 3,700 crore then, to employees based on performance and shareholder value creation

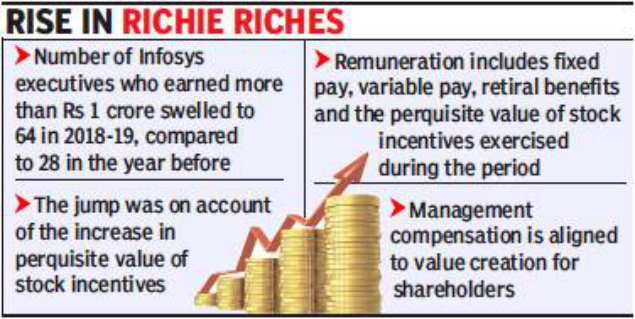

(Representative image)

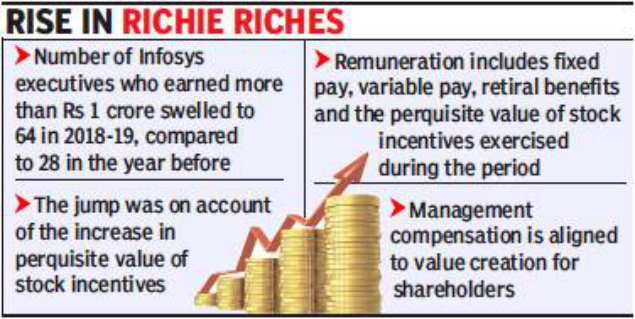

(Representative image) BENGALURU: The number of Infosys executives with compensation above Rs 1 crore rose sharply to 64 in 2018-19, from 28 in the previous year. Many more senior vice-presidents and vice-presidents became part of the crorepati club. A significant part of this increase was on account of the sharp spike in the company’s share price, which raised the value of the stocks that vested during the year.

For many senior executives, time-based stock incentives granted in 2017-18 and 2018-19 vested during the year. In addition, some senior executives have also seen expanded roles and responsibilities, and have seen corresponding increases in their compensation packages. Remuneration includes fixed pay, variable pay, retiral benefits and the perquisite value of stock incentives exercised during the period.

“Our compensation approach provides for competitive salaries for our employees benchmarked with the industry, which includes performance-linked rewards for senior executives with their compensation aligned to shareholder value,” Infosys said in a response to TOI’s query on the larger number of crorepatis.

“A significant part of the increase in remuneration in FY19 compared to FY18 was on account of the increase in perquisite value of stock incentives (the average stock price increased by more than 35% in FY 19 over FY18). This shows a clear alignment of management compensation to shareholders returns,” the company said.

The company, under the 2015 Stock Incentive Compensation Plan, offers share-based benefits to employees to retain talent. The purpose is also to align individual performance to the company’s objectives. Last week, Infosys said it would allocate 50 million shares, valued at Rs 3,700 crore then, to employees based on performance and shareholder value creation. The effort appears to be partly an attempt to rein in the company’s high attrition rates, which are hovering at 17-20%.

Infosys stock options created some of India’s early salaried millionaires. Infosys is said to have created 20,000-rupee millionaires and 500 dollar millionaires in the 1990s and 2000s. It had at one point stopped stock options, but subsequently reintroduced them.

On the latest allocation of 50 million shares, the company said the stock grants would be allocated to employees over a period of seven years. It said the grants would be based on challenging performance criteria that would include relative total shareholder return (TSR) against an industry peer group, relative TSR against domestic and global indices, and operating lead performance metrics such as total revenue, digital revenue growth, and operating margins.

For many senior executives, time-based stock incentives granted in 2017-18 and 2018-19 vested during the year. In addition, some senior executives have also seen expanded roles and responsibilities, and have seen corresponding increases in their compensation packages. Remuneration includes fixed pay, variable pay, retiral benefits and the perquisite value of stock incentives exercised during the period.

“Our compensation approach provides for competitive salaries for our employees benchmarked with the industry, which includes performance-linked rewards for senior executives with their compensation aligned to shareholder value,” Infosys said in a response to TOI’s query on the larger number of crorepatis.

“A significant part of the increase in remuneration in FY19 compared to FY18 was on account of the increase in perquisite value of stock incentives (the average stock price increased by more than 35% in FY 19 over FY18). This shows a clear alignment of management compensation to shareholders returns,” the company said.

The company, under the 2015 Stock Incentive Compensation Plan, offers share-based benefits to employees to retain talent. The purpose is also to align individual performance to the company’s objectives. Last week, Infosys said it would allocate 50 million shares, valued at Rs 3,700 crore then, to employees based on performance and shareholder value creation. The effort appears to be partly an attempt to rein in the company’s high attrition rates, which are hovering at 17-20%.

Infosys stock options created some of India’s early salaried millionaires. Infosys is said to have created 20,000-rupee millionaires and 500 dollar millionaires in the 1990s and 2000s. It had at one point stopped stock options, but subsequently reintroduced them.

On the latest allocation of 50 million shares, the company said the stock grants would be allocated to employees over a period of seven years. It said the grants would be based on challenging performance criteria that would include relative total shareholder return (TSR) against an industry peer group, relative TSR against domestic and global indices, and operating lead performance metrics such as total revenue, digital revenue growth, and operating margins.

Download The Times of India News App for Latest Business News.

Make sense of the 2019 Lok Sabha Elections and results on May 23 with TOI. Follow us to track latest news, live updates, news analysis and cutting-edge data analytics. Track live election results, big trends and fastest updates on counting day with India's largest news network.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE