Government to back homebuyers caught in insolvency cases

Prabhakar Sinha | TNN | Updated: May 17, 2019, 10:47 ISTHighlights

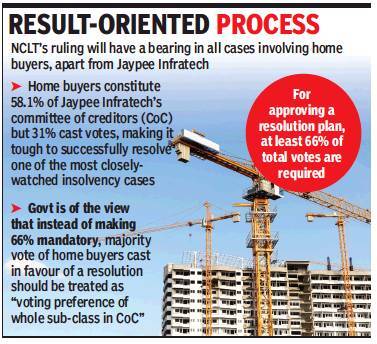

- Several resolutions, including the appointment of a resolution professional for Jaypee Infratech, have been hit as the mandated 66% vote has not been met

- This had prompted homebuyers to seek an interpretation of the law by the NCLT

(Representative image)

(Representative image)NEW DELHI: The government has decided to back homebuyers caught in insolvency cases and told the National Company Law Tribunal (NCLT) that the majority vote of homebuyers cast in favour of a resolution should be treated as “the voting preference of whole sub-class in Committee of Creditors (CoC)”.

In its affidavit before the tribunal, the ministry of corporate affairs (MCA) has said, “…considering the recommendation of Insolvency Law Committee (ILC) and larger public interest for actualising of the preamble of the Insolvency and Bankruptcy Code (IBC), viz, an outcome-based approach, which would facilitate resolution of Jaypee Infratech Limited (JIL) over liquidation, may be adopted.”

It went on to say that homebuyers should be treated as a sub-class within the ambit of the financial creditor.

Several resolutions, including the appointment of a resolution professional for Jaypee Infratech, have been hit as the mandated 66% vote has not been met. This had prompted homebuyers to seek an interpretation of the law by the NCLT.

In a similar case involving AMR Infrastructure, the NCLT had used the principle of ‘first past the post’ and recommended that once the majority threshold is crossed, it should be treated as the voting preference of the whole sub-class in CoC.

However, in AMR Infra, only buyers were the creditors. Therefore, it could not be applied in the Jaypee Infratech case, where banks and financial institutions are also creditors.

In case of AMR Infra, the principal bench of NCLTDelhi said in case of real estate (commercial & residential) comprising 100% voting share in CoC, a resolution would be deemed to be passed if it is voted by highest number of financial creditors in the class of real estate (commercial & residential).

In its affidavit, the MCA cited the AMR case and said, “Following the principle of ‘first past the post’, it was recommended that once the majority threshold is crossed, it should be treated as the voting preference of whole subclass in CoC.”

A new proposal on NBCC’s resolution plan is currently under voting, and with banks unlikely to back it in its present form, the move is expected to be defeated.

In its affidavit before the tribunal, the ministry of corporate affairs (MCA) has said, “…considering the recommendation of Insolvency Law Committee (ILC) and larger public interest for actualising of the preamble of the Insolvency and Bankruptcy Code (IBC), viz, an outcome-based approach, which would facilitate resolution of Jaypee Infratech Limited (JIL) over liquidation, may be adopted.”

It went on to say that homebuyers should be treated as a sub-class within the ambit of the financial creditor.

Several resolutions, including the appointment of a resolution professional for Jaypee Infratech, have been hit as the mandated 66% vote has not been met. This had prompted homebuyers to seek an interpretation of the law by the NCLT.

In a similar case involving AMR Infrastructure, the NCLT had used the principle of ‘first past the post’ and recommended that once the majority threshold is crossed, it should be treated as the voting preference of the whole sub-class in CoC.

However, in AMR Infra, only buyers were the creditors. Therefore, it could not be applied in the Jaypee Infratech case, where banks and financial institutions are also creditors.

In case of AMR Infra, the principal bench of NCLTDelhi said in case of real estate (commercial & residential) comprising 100% voting share in CoC, a resolution would be deemed to be passed if it is voted by highest number of financial creditors in the class of real estate (commercial & residential).

In its affidavit, the MCA cited the AMR case and said, “Following the principle of ‘first past the post’, it was recommended that once the majority threshold is crossed, it should be treated as the voting preference of whole subclass in CoC.”

A new proposal on NBCC’s resolution plan is currently under voting, and with banks unlikely to back it in its present form, the move is expected to be defeated.

Download The Times of India News App for Latest Business News.

Make sense of the 2019 Lok Sabha Elections and results on May 23 with TOI. Follow us to track latest news, live updates, news analysis and cutting-edge data analytics. Track live election results, big trends and fastest updates on counting day with India's largest news network.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE