After record 2018, PE money ready for bumper 2019

BULLISH CALL: Bain & Co sees BFSI, consumer/retail and healthcare as attractive investment sectors in the future

Private Equity

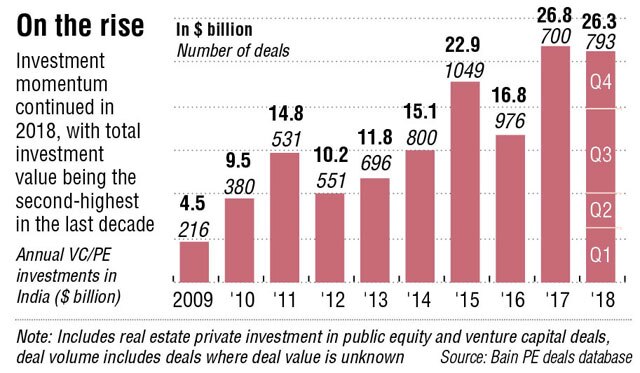

India's private equity (PE) market saw increased activity in 2018 with $26.3 billion investments spread across 793 deals, according to Bain & Company's latest report.

On the other hand, EY's data show that India received $35.8 billion in PE and venture capital (VC) investments during 2018, which is 37% higher than the previous high of 2017.

In 2018, there were 174 PE and VC exits valuing to $26 billion, according to EY. However, Bain & Co's 2019 India Private Equity Report noted there were 265 exits valued at nearly $33 billion in 2018.

Nearly half of 2018's exit value resulted from the $16 billion sale of Flipkart to Walmart. Irrespective of the Flipkart-Walmart deal, the overall exit momentum was high. "Consumer technology, IT and IT enabled Services (ITeS) and BFSI drove most of the exit values last year. These are also the sectors in which investments have grown during the past four to five years," said 2019 India Private Equity report.

Although the deal volumes went up in 2018 by 13% as compared to 2017, deal valuations declined marginally by 2% to $26.3 billion from the previous year's $26.8 billion.

A look at the bigger deals during 2018 shows that the top 15 deals constituted about 40% of total investment value in 2018. This is similar to the previous year, when the top 15 deals made up 50% of the total value. Notable large investments in 2018 included investments in HDFC Bank, Star Health and Allied Insurance, Swiggy, OYO Rooms, Paytm and Byju's.

Sector-wise, retail received the most investment followed by energy and healthcare.

Aided by regulations and tax breaks, a new asset class like Alternate Investment Funds and distressed-asset management has increasingly gained traction in the Indian market. Funds raised by AIFs more than doubled from approximately $2.4 billion in 2016 to approximately $5.5 billion in 2017 and are estimated to have exceeded $7 billion in 2018. The number of AIFs registered in India almost doubled from 268 in 2016 to 518 as of February 2019.

Vivek Soni, partner and national leader for Private Equity Services, said, "2018 has been one of the best years for PE/VC investments and exits, further improving on the record set in 2017. 2019 has also started on a strong note, with $11.4 billion of PE/VC investments in Q1 eclipsing the previous Q1 high (2018) by 37%. India now ranks amongst the most attractive emerging markets for General Partners and this continued fondness for India by Limited Partners, coupled with the record levels of dry powder raised or being raised globally, is very positive for the Indian PE/VC industry."

Going forward, the momentum will continue for some time globally and India is well positioned to attract a disproportionately higher share of this mountain of global private capital looking for alpha returns, he said. Political and policy stability permitting, by 2025, annual Indian PE/VC investment levels could potentially cross the threshold of $65 billion.

Bain & Company concurred. "We believe there is sufficient India-focused dry powder to ensure high-quality deals don't lack capital. Our surveyed funds identified BFSI, consumer/retail and healthcare as attractive investment sectors in the future. Consumer tech will also continue to see investments into scaled players."

In the coming months, funds expect further investment activity in BFSI and consumer/retail, even though the valuations are still perceived to be high. Healthcare is another sector of rising interest, with funds looking at players across the spectrum, including pharmaceuticals, equipment, single-specialty hospitals and clinics, diagnostics and others. Interest in technology and IT will be largely driven by rapidly growing enterprise tech companies that operate out of India and sell globally.

- There were 265 exits valued at nearly $33 billion in 2018, according to Bain & Co

- Although the deal volumes went up by 13% in 2018 as compared to 2017, deal valuations declined marginally by 2% to $26.3 billion