The index broke below its crucial 100-day exponential moving average (EMA) placed at 11,253 to form a bearish candle

Nifty that was trading in a narrow range for the most part of the day on May 13 witnessed tremendous selling pressure in the last hour of the trading session to push the index below 11,200.

The index fell for the ninth consecutive day in a row to post its longest losing streak for the first time in eight years, CNBC-TV18 reported.

The index broke below its crucial 100-day exponential moving average (EMA) placed at 11,253 to form a bearish candle. The next support could now be placed at its 200-day EMA placed around 11,035.

Nifty opened at 11,258 and rose to an intraday high of 11,300 before bulls lost steam. Bears pushed the index below 11,200 to touch its intraday low of 11,125 before closing the day at 11,148, down 130 points.

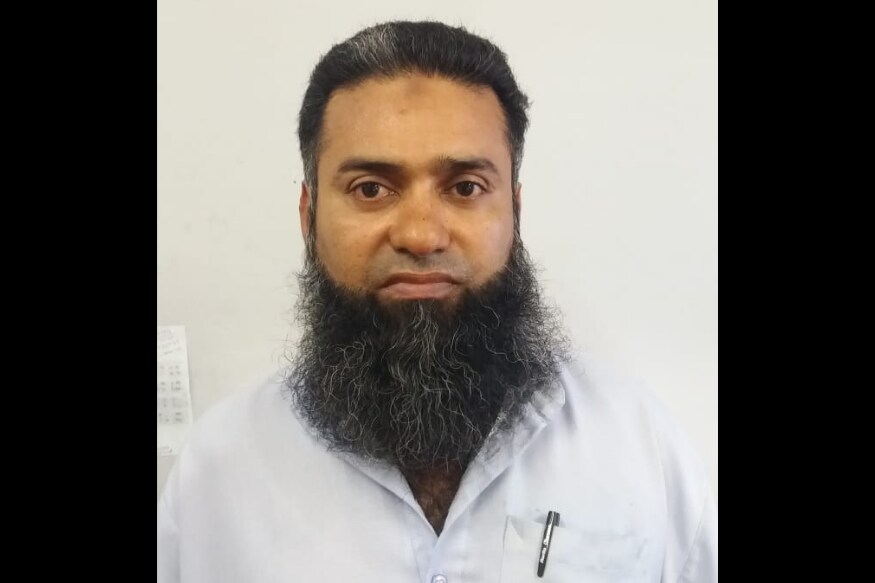

“Nifty50 appears to have decisively breached its 100-day EMA support of 11,228 as it registered a strong bearish candle after two days of consolidation around 11,250. With this breakdown it looks inevitable for Nifty to test its 200-DMA whose value is placed around 11,024,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“For time being upsides shall get capped around 11,300 whereas a close above 11,228 can be considered as the initial sign of strength which can then lead to sideways consolidation,” he said.

Mohammad further added that despite visible weakness traders are advised to remain neutral by squaring off their short positions as downsides from current levels look limited with nine days of consecutive negative closes.

India VIX moved up by 3.09 percent to 27.15. Higher VIX suggests that volatile swings could continue in the market ahead of the election outcome.

On the options front, maximum Put OI is placed at 11,000 followed by 10,500 while maximum Call OI is placed at 12,000 followed by 11,800 strikes.

Call writing was seen at 11,500 followed by 11,700 strikes while minor Put writing was seen at 11,200 strikes. Options band signifies a shift in a lower trading range between 11,000 to 11,600, suggest experts.

“The Nifty index continued its weakness for the ninth consecutive trading session as every bounce was being sold in the market. It formed a Bearish Candle on the daily scale and continued its lower highs-lower lows from past six trading sessions indicating weakness,” Chandan Taparia, derivative & technical analyst at Motilal Oswal Securities told Moneycontrol.

“Now till it remains below 11,350, weakness could continue towards 11,088 then 11,000 while on the upside, hurdle is seen at 11,320 -11,350,” he said.