UTI Equity Fund outperformed peers during seven, ten-year trailing periods

The fund's month-end assets under management (AUM) increased from Rs 4,819 crore in April 2016 to Rs 9,369 crore in March 2019

KNOW YOUR MF , Istock

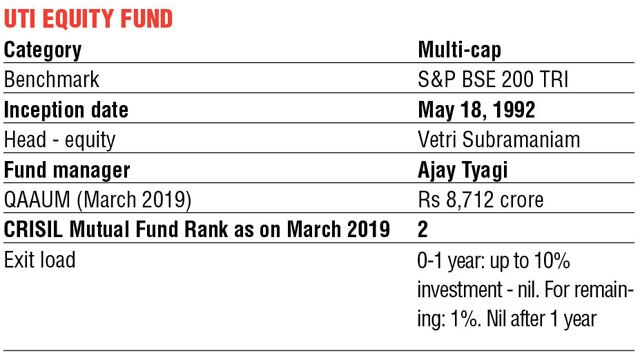

Launched in May 1992, UTI Equity Fund featured in the top 30 percentile of the multi-cap category of Crisil Mutual Fund Ranking (CMFR) for the three quarters ended March 2019. The fund is being managed by Ajay Tyagi since January 2016. He has been associated with UTI Asset Management since 2000. The fund's month-end assets under management (AUM) increased from Rs 4,819 crore in April 2016 to Rs 9,369 crore in March 2019.

The investment objective of the scheme is to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of companies across the market capitalisation spectrum.

Trailing returns:

The fund outperformed the benchmark (S&P BSE 200 TRI) and its peers (funds ranked under the multi-cap category in CMFR March 2019) during the past seven- and ten-year trailing periods.

An investment of Rs 10,000 in the fund on August 1, 2006, (since inception of the benchmark) would have grown to Rs 51,940 (13.77% compounded annual growth rate) on May 7, 2019, versus the benchmark's Rs 44,764 (12.45% CAGR) and the category's Rs 50,741 (13.56% CAGR).

SIP returns:

A monthly investment of Rs 10,000 through a systematic investment plan (SIP) for 10 years would have grown to Rs 23.04 lakh (XIRR 12.68%) on May 7, 2019. A similar investment in the benchmark would have grown to Rs 22.11 lakh (XIRR 11.9%).

Risk-reward matrix:

During the past three years, the fund delivered returns in line with peers with relatively lower volatility.

Portfolio analysis:

During the past three years, the fund maintained a predominant allocation to large-cap stocks (average 72.92%). Mid-cap and small-cap allocations averaged 18.78% and 6%, respectively, during the same period.

The fund took exposure to 19 sectors in the past three years. The major sector allocations included banks (23.34% of the portfolio) followed by software (14.01%), pharmaceuticals (11.86%), consumer non-durables (9.62%), and finance (8.41%).

HDFC Bank, Bajaj Finance, HDFC Ltd, IndusInd Bank, and Kotak Mahindra Bank have been the biggest contributors to the fund's performance during the past three years.

The fund invested in 72 stocks during the period and held 36 stocks consistently. All the above major contributing stocks except Bajaj Finance were held consistently during this period. Out of the 36 consistently held stocks, 19 outperformed the fund's benchmark, indicating effective stock selection and strong conviction by the fund management.