Highlights

- Experts insist that the low return from gold in the short term is an aberration and, like other asset classes, gold return too will move back to its historical mean,

- This means that gold could be a good bet to diversify your investment portfolio,

NEW DELHI: Gold sales, most likely, will hit a high on Tuesday. It's Akshaya Tritiya and many Indians (those who can afford it) consider buying gold auspicious. Jewellers have been reporting double-digit sales growth on the day in the last few years.

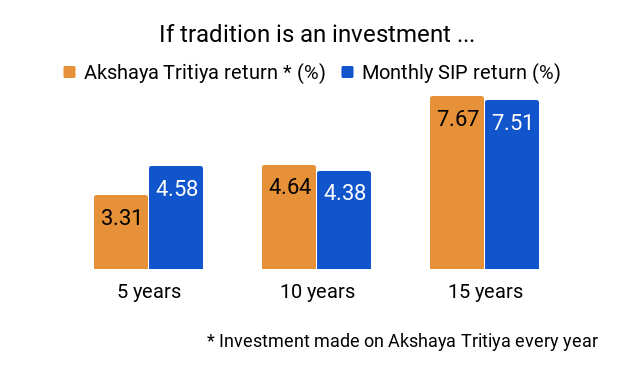

NEW DELHI: Gold sales, most likely, will hit a high on Tuesday. It's Akshaya Tritiya and many Indians (those who can afford it) consider buying gold auspicious. Jewellers have been reporting double-digit sales growth on the day in the last few years.Tradition as investment: If you are one of those who has been buying gold on this day every year, here's something to feel happy about. Though, gold has not generated any meaningful return over the past 5-7 years, it doesn't look as bad in the long term. Compared to Systematic Investment Plans (SIPs) of mutual funds that allow you to invest regularly, this is what returns from your gold investments look like:

Is it a good time? Experts insist that the low return from gold in the short term is an aberration and, like other asset classes, gold return too will move back to its historical mean. This means that gold could be a good bet to diversify your investment portfolio.

With global central banks, including the RBI, on a gold buying spree and interest rates low, international gold price is also expected to strengthen. However, experts advise investors to restrict their exposure to gold to 10% of their overall portfolio.

What to buy? If you are looking at your Akshay Tritiya gold as an investment, avoid buying jewellery as a part of your investment is lost in making charges and gold purity-related issues. Gold bars or coins are a better option but they involve high transaction costs—both at the time of buying and selling. Investing small sums is another problem with bars and coins. Paper gold—bonds and ETFs—is a better option.