The smartphone shipment numbers for the first quarter of 2019 had one surprise and many expected trends. Yes, Xiaomi was still ahead of Samsung at the top spot, but one company had grown doubled its numbers in a market which can be termed flat at best.

According to research firm Counterpoint’s numbers, vivo’s market share doubled from 6 per cent in first quarter of 2018 to 12 per cent. More surprisingly, while the overall Indian smartphone market grew by 4 per cent, vivo’s volume grew 119% per cent year-on-year, the firm said.

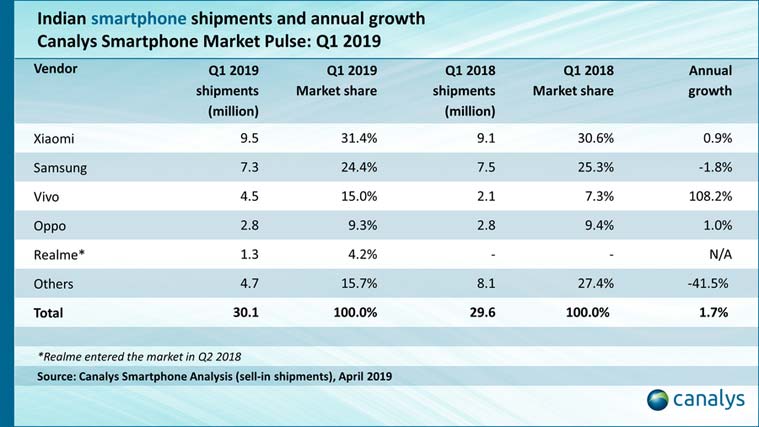

Canalys’ numbers reiterated the trend, showing vivo had a 108 per cent growth with the brand shipping 4.5 million units, and capturing 15 per cent market share in India. In contrast, the research firm said, Xiaomi only grew 4 per cent, while Samsung, though number two, was the only vendor in the top five to actually see a decline in shipments.

But, what can help a smartphone brand double its numbers? Nipun Marya, Director-Brand Strategy, vivo India, attributed it to “innovative products”. Being more specific, he said: “Our APEX phone, the popup selfie camera are just some of the examples. Then we have our V series with V9, V11, and V15, which primarily play in the Rs 20,000 to Rs 30,000 price mark. We have been number one in this segment for the last four quarters.”

Marya, in the telephonic interaction told indianexpress.com, that vivo has actually helped this particular price market grow. “Many of our offerings come with first in the category with features like pop-up camera, in-display fingerprint sensor,” he said.

Vivo’s success has also been boosted by a strong presence in the offline segment, which still accounts for a majority of sales in the Indian market. “We are present in 70,000 plus outlets in the country. A lot of them are being managed by us, by our promoters. So distribution has helped there,” said Marya, adding that offline channels account for a majority of the company’s market share.

Read more: India smartphone market Q1: Xiaomi on top, but Vivo saw highest growth

In the Rs 10,000-Rs 15,000 segment, where a majority of the volume still lies, vivo has its Y series. The company has also launched newer phones which are under Rs 10,000 like the vivo V91i which has a starting price of Rs 8,990. Typically, vivo played in the Rs 20,000 and above category, though it has expanded portfolio to include newer devices under Rs 10,000.

“So we did product restructuring six to nine months back. We have been more aggressive with our offerings in Rs 10,000-Rs 15,000 segment.We also have some products in the Rs 8,000 to Rs 8,500 price range,” Marya explained, adding that the company has not yet entered the Rs 5,000 to Rs 6,000 segment “where there is mass volume”. “The Rs 10k and above is still where we are playing.”

While vivo did not reveal which model was the best-seller in the quarter, some offline retailers that indianexpress.com spoke to said the Y series was the company’s bestseller. In a South Delhi store, a retailer said vivo’s Y91i was selling particularly well. The phone is priced at Rs 8,900 in the offline market. He also spoke of other Y series products, like Y93, Y95, too.

At another multi-brand store in South Delhi, we were told that while the vivo V15 Pro and vivo V15 had not done so well in the quarter, the Y series stood out. According to this store employee, vivo Y91i, Y95 and Y81i had sold the most, considering they were priced in the Rs 8,000 to Rs 14,000 range. He said with the V15 series, which is priced above Rs 20,000, it was harder to convince consumers, especially given that the major demand is in the under Rs 15,000 segment.

In Noida’s Sector 18 mobile market, however, dealers painted a different picture. Most insisted that the vivo V15 and V15 Pro were selling well. Another model that was highlighted was Y95, which, as one store employee pointed out, was the only phone in its price bracket of under Rs 15,000 which was also offering a 20MP selfie camera.

For dealers, it becomes easier to push vivo’s phones because they offer high-end features like the 20MP camera at a budget that convince customers. Another store employee said the Y series has more sales, though he insisted that the V15 had done well and claimed he had sold around 140 units of the two phones in the last month alone.

The market also had several posters promoting the V15 with a discounted price of Rs 21,990. The selfie camera which is 32MP and pops up out of the display is another unique point highlighted by the stores and on posters.

While V15 is the more premium category, the Y series is clearly what has helped the brand. This expanded portfolio as Marya called, has certainly helped vivo and analysts agree as well. “The earlier portfolio was on the higher side. The expanded portfolio has resulted in strong growth in the Rs 10-15k segment. They have seen more than 150 per cent growth in this segment with phones like Y93, Y81,” said Anshika Jain, analyst at Counterpoint Research (Counterpoint Technology Market Research). According to her, Y series has helped the brand grow significantly.

But it’s not just the slew of products that vivo, the company has also been aggressive with its marketing efforts. The IPL sponsorship, retailer recommendations, word of mouth, product placements in popular quiz Kaun Banega Crorepati (KBC), have also helped the brand with its push in the Indian market.

“In India, word of mouth of plays a very important role. In our V series, every generation we have seen more and more contribution. People who were buying vivo are coming back to buy vivo,” claims Marya. This marketing strategy is also acknowledged by analysts. “They did well in terms of IPL promotion and huge offline promotion of V series,” said Anshika Jain.

Canalys attributes the growth to its Y series. “Vivo’s Y series is the primary driver for its volume growth in India. But its success in India is attributed not only to the products, but also the years of on-going investment in the branding and marketing,” Shengtao Jin, research analyst at Canalys said in an email to indianexpress.com.

Jain said it would be wrong to look at this as a rising challenge for Xiaomi. The Redmi Note 7 series alone, she said, crossed a million shipments within a month of the launch. Plus, the Redmi Note 7 went on sale in March, by the end of the quarter. She expects the Indian smartphone market to see double digit growth in 2019 with more offline expansion plans from brands like Xiaomi and OnePlus.