A list of important headlines from across news agencies that could help in your trade today.

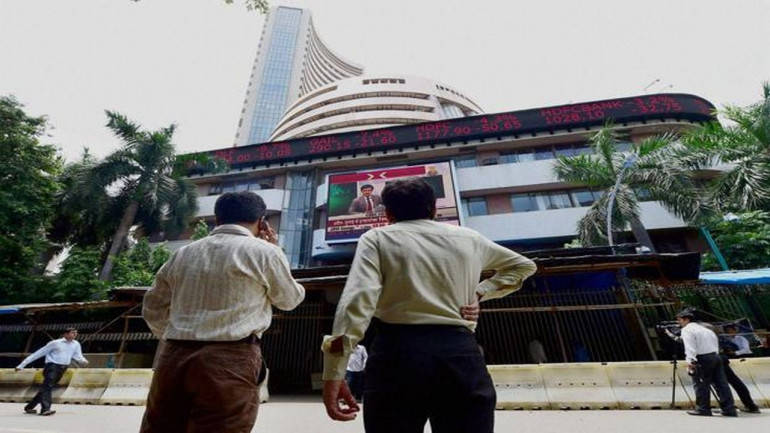

The market reversed more than half of previous day's gains in late sell-off and closed April F&O expiry session sharply lower on April 25 amid increase in crude oil prices.

The BSE Sensex fell 323.82 points to close at 38,730.86 while the Nifty50 slipped 84.40 points to 11,641.80 and formed bearish candle which resembles a Dark Cloud Cover kind of pattern on daily charts.

The reversal of gains and sharp sell-off indicated that the Nifty could break its crucial support of 11,550 levels, though near term uptrend status could be intact, experts said.

According to the Pivot charts, the key support level is placed at 11,578.47, followed by 11,515.13. If the index starts moving upward, key resistance levels to watch out are 11,750.97 and 11,860.13.

The Nifty Bank index closed at 29,561.35, down 299.45 points on April 25. The important Pivot level, which will act as crucial support for the index, is placed at 29,362.91, followed by 29,164.5. On the upside, key resistance levels are placed at 29,908.71, followed by 30,256.1.

Stay tuned to Moneycontrol to find out what happens in currency and equity markets today. We have collated a list of important headlines from across news agencies.

S&P 500 nudges lower as industrials drag

The S&P 500 closed just barely lower on Thursday, as a dive in industrial stocks and concerns about slowing global growth eclipsed gains in Facebook and Microsoft. The industrials sector fell 1.99 percent with hefty drags from 3M, United Parcel Service Inc and Raytheon Co after they reported disappointing results. Fedex Corp also slumped after UPS’s profit miss.

The Dow Jones Industrial Average fell 134.97 points, or 0.51%, to 26,462.08, the S&P 500 lost 1.08 points, or 0.04%, to 2,926.17, and the Nasdaq Composite added 16.67 points, or 0.21%, to 8,118.68.

Asia shares subdued, dollar pins hopes on US GDP

Asian shares got off to a subdued start on Friday, while the dollar held near two-year highs against the euro on speculation that data later in the day will show the US economy outperforming the rest of the developed world.

The rise in the yen and some mixed Japanese economic data nudged the Nikkei down 0.7 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.1 percent.

SGX Nifty

Trends on SGX Nifty indicate a flat to positive opening for the broader index in India, a rise of 5 points or 0.04 percent. Nifty futures were trading around 11,735 -level on the Singaporean Exchange.

Oil prices ease on expectation that OPEC will raise output

Oil prices dipped on Friday on expectations that producer club OPEC will soon raise output to make up for a decline in exports from Iran following a tightening of sanctions by the United States against Tehran.

Brent crude futures were at $74.09 per barrel at 0029 GMT, down 26 cents, or 0.4 percent, from their last close. US West Texas Intermediate (WTI) crude futures were at $64.82 per barrel, down 39 cents, or 0.6 percent, from their previous settlement.

Rupee dives to 6-week low at 70.25 vs dollar

The rupee on April 25 slumped 39 paise to close at more than six-week low of 70.25 against the US dollar due to rising crude oil prices and a late sell-off in domestic equity markets. Besides, a strengthening dollar against some major currencies overseas also weighed on the home unit, forex dealers said.

At the Interbank Foreign Exchange, the rupee opened sharply lower at 70.06 and fell further to the day's low of 70.27 as crude oil prices breached the $75 per barrel mark for the first time this year.

Bank credit grows by 14.19%; deposits by 10.60%: RBI data

Bank credit rose by 14.19 percent to Rs 96.45 lakh crore while deposits grew 10.60 percent to Rs 125.30 lakh crore in the first fortnight ended on April 12,according to recent RBI data. In the year ago fortnight, deposits were at Rs 113.29 lakh crore and advances stood at Rs 84.46 lakh crore.

In the fiscal ended March 2019, bank credit had risen by 13.24 percent and deposits grew by 10.03 percent. This was the second consecutive double-digits credit growth after the same had declined to 4.54 percent in FY17 at Rs 78.41 lakh crore, which was the lowest since 1963, the RBI data said. On a year-on-year basis, non-food bank credit increased by 13.2 percent in February 2019 as compared with an increase of 9.8 percent in the year-ago period.

India's crude oil production drops 4% in FY19

The country's crude oil production fell over 4 per cent in the financial year 2018-19 after aging fields of state-owned Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) missed the target, official data showed on April 25.

India produced 34.2 million tonne of crude oil in the fiscal year ended March 31, down from 35.7 million tonne in the previous year, according to data released by the Ministry of Petroleum and Natural Gas here. ONGC output dropped to 21 million tonne from 22.25 million tonne in 2017-18, while OIL saw a 2.5 percent dip to 3.3 million tonne.

PE/VC fund inflows cross $7 bn-mark in March: Report

Venture capital/private equity investments doubled in March to $7 billion on an annualised boosted by a spurt in large transactions, says a report. Exits during the month were 34 percent lower at $465 million involving 13 transactions, a report by consultancy firm EY said on April 25.

March was the best month ever for PE and VC investments, it said, adding the $7-billion mark in the month was more than double of $3 billion in the previous year and over 30 percent higher than the previous high of $5.4 billion clocked in August 2017.

Thirteen large deals of $100 million-plus adding up to $6 billion helped boost the numbers, and Brookfields $1.9 billion buyout of RILs East-West Pipeline was the largest deal during the month.

18 companies to report Q4 numbers today

As many as 18 companies will declare their results for the quarter ended March which include names like Yes Bank, HDFC AMC, Hero MotoCorp, Piramal Enterprises and HDFC Life Insurance Company among others.

Tata Steel Q4 consolidated profit at Rs 2,295 cr

Tata Steel posted a consolidated net profit of Rs 2,295.2 crore for the quarter ended March 2019, down from Rs 14,688 crore posted in the same quarter last year. Consolidated revenue for the quarter grew 25.9 percent year-on-year (YoY) to Rs 42,423 crore in Q4FY19 from Rs 33,705 crore last year.

The consolidated earnings before interest, tax, depreciation and amortisation (EBITDA) for Q4FY19 grew 17.4 percent YoY to Rs 7,513.3 crore. However, EBITDA margin declined to 17.7 percent from 19 percent in Q4 last year.

Neogen Chemicals IPO fully subscribed; retail subscription at 3.15 times

The initial public offering of Neogen Chemicals has been fully subscribed on April 25, the second day of subscription. The public offer has been subscribed 2.09 times, as per data available on the National Stock Exchange. The IPO received bids for 90.47 lakh shares against issue size of 43.29 shares (excluding anchor investors' portion).

The reserved portion for qualified institutional buyers was subscribed 95 percent and for non-institutional investors was 1.12 times while retail individual investors' category has seen subscription of 3.15 times.

The Rs 132-crore IPO comprises a fresh issue of up to Rs 70 crore and an offer-for-sale of up to 29,00,000 equity shares including an anchor portion of 18,46,715 equity shares. Price range for the offer has been fixed at Rs 212-215 per share.

With inputs from Reuters & other agencies