MOSCOW, ST. PETERSBURG – JLL presents the Q1 2019 results of the branded hotel market in Moscow, Moscow Region and St. Petersburg.

“According to the market players’ expectations, 2019 should bring everybody ‘back to reality’ after the World Cup haze vanishes, as well as become the resilience test of the international community’s interest to Russian cities. The start of the year on the two main hotel markets in Russia does not give any reasons to worry,” – says Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS.

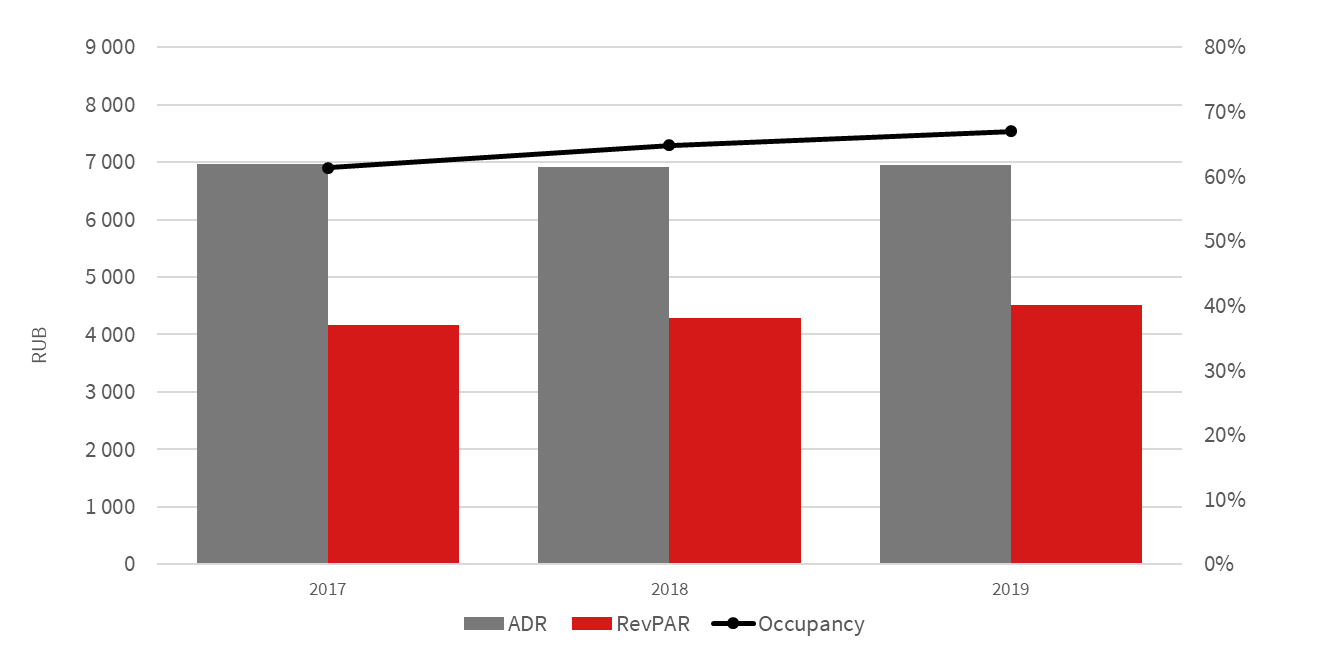

In Q1 2019, Moscow hotels continued to enhance their operational results compared to the same period in years before. The occupancy grew by 2 ppt and reached a record 67% coupled with a modest increase in ADR – less than 1%, up to RUB 7,000. As a result, Moscow hotels’ RevPAR rose by 5%, to RUB 4,500.

Q1 Moscow branded hotel market results

Source: JLL, STR

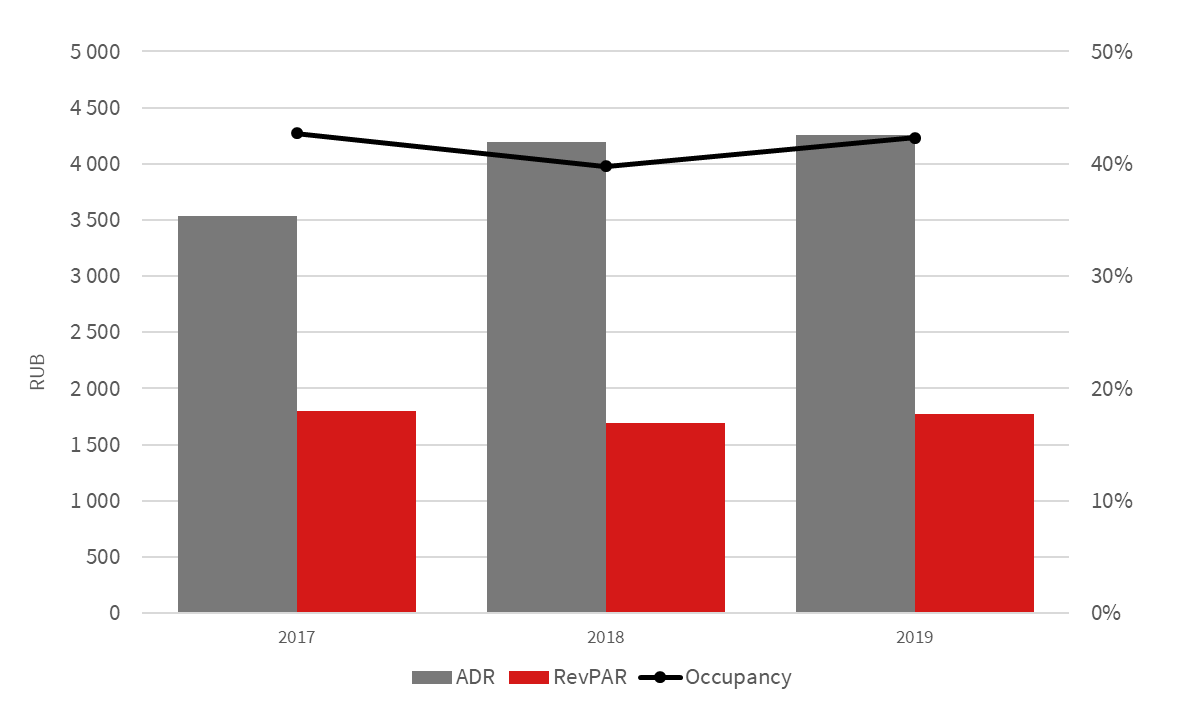

Generally similar situation has been evolving in St. Petersburg hotel market: the occupancy growth of 3 ppt vs. Q1 2018, allowing to fill 42% of total market room stock. A slight uptick in ADR by 1.4%, to RUB 4,300 resulted in a 5% growth of RevPAR, to RUB 1,800.

Q1 St. Petersburg branded hotel market results

Source: JLL, STR

In Moscow the leader in occupancy was the Upper Midscale segment with 74%, and the leader in this index’ dynamics was Upper Upscale (growth by 7 ppt, to 60%). The only drop was noted in the Midscale segment (by 3 ppt, to 63%). The highest percentage of rooms sold in St. Petersburg was in the Upscale segment – 59%, and the best dynamics – in Midscale (growth by 4 ppt, to 40%).

“Luxury hotels became the only segment of the Moscow market which recorded growth of all operational indices in the first three months of 2019. This included the highest among segments hike of ADR (by 4%, to RUB 18,600). Aided in the background by the occupancy recovery to 56%, RevPAR increased by 7%, to RUB 10,400,” - comments Tatiana Veller. – “The number of guests in the most expensive hotels of the Northern capital fell slightly: here occupancy decreased by 1.2 ppt, to 36%, compared to Q1 2018, however, they were ready to pay more: ADR grew by 3.5%, to RUB 12,000. As a result, RevPAR remained at the same level of RUB 4,300. It should be noted that Luxury was the only hotel segment in St. Petersburg where occupancy dropped in the beginning of the year.”

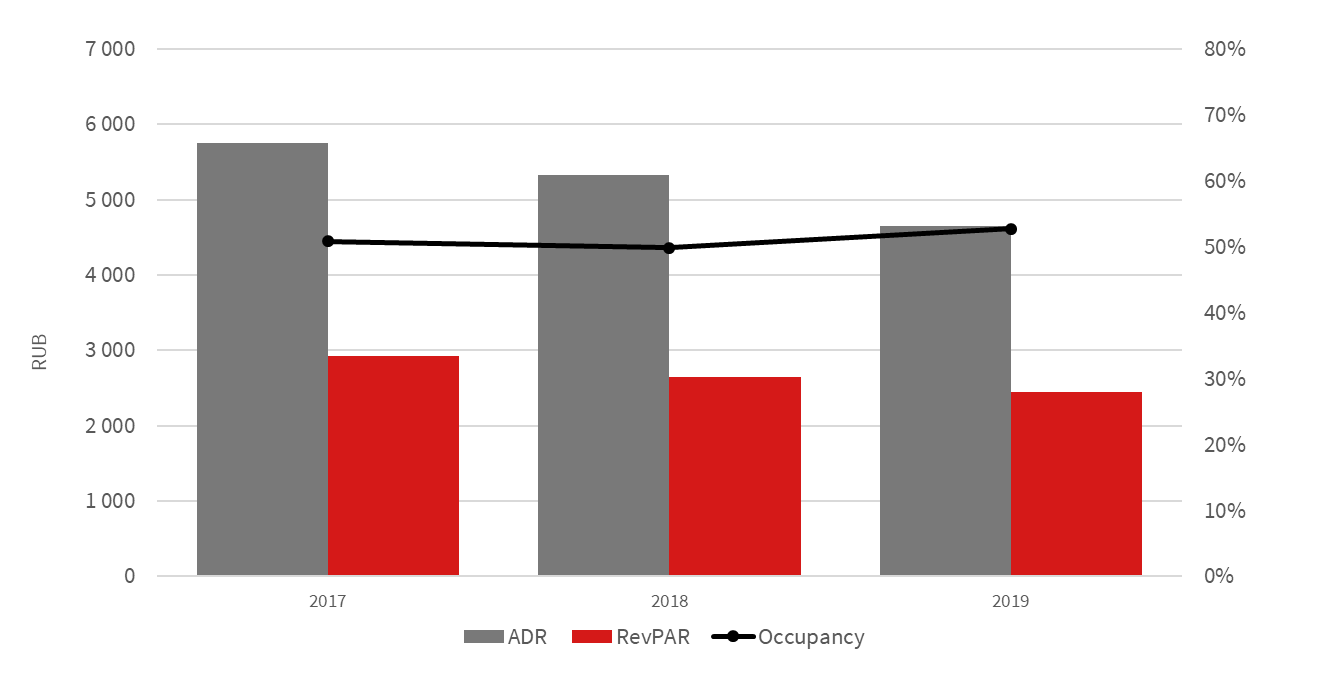

In Q1 2019, occupancy increased in the Moscow Region resorts by 3 ppt, to the highest in the last four years level of 53%, while losing 13% in the rate. ADR decreased to the lowest number in the same period, RUB 4,700, thus RevPAR fell by 7.5%, to RUB 2,500.

Q1 Moscow Region hotel market results

Source: JLL, STR

“So far, the industry is holding up well in comparison with 2018, however, the real challenge for branded hotels in both capitals will come in May-July this year. In Moscow we forecast the YoY decrease in both occupancy and – especially – the rate. Besides the record operational results of last year, the new hotel openings will continue, which will unavoidably influence on the capital market performance. In Moscow, 1,100 branded rooms will enter the market in 2019, of which 128 rooms of Holiday Inn Express Moscow Baumanskaya already started welcoming guests in Q1 2019. St. Petersburg has all chances to pleasantly surprise us this year, because the World Cup did not bring the expected operational results in 2018, and new branded rooms are also not planned for this year.” – concludes Tatiana Veller.