Cable operators claim bigger share of revenue from free channels

Prithvijit Mitra | TNN | Updated: Apr 23, 2019, 08:05 IST Local operators claimed it was becoming difficult to attend to viewer's complaints

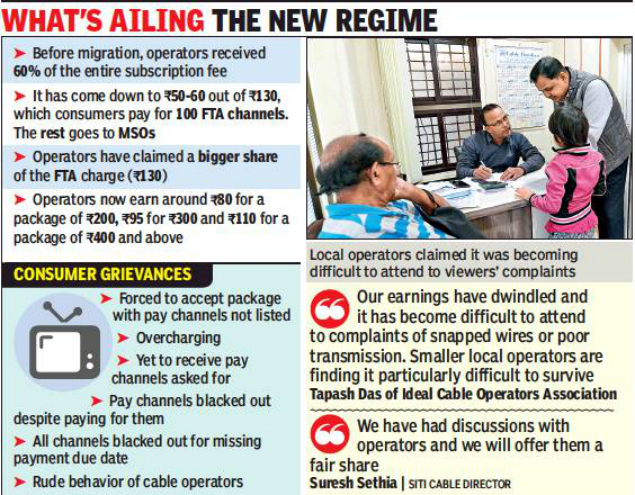

Local operators claimed it was becoming difficult to attend to viewer's complaintsKOLKATA: Cable operators across the city have sought a larger share of the revenue from free-to-air (FTA) channels, which, they claim is essential for them to survive post migration. In the previous regime, they would get 60% of the entire subscription fee. But it has come down to Rs 50-60 out of Rs 130 which consumers pay for 100 FTA channels. The rest goes to the multi-system operators (MSO). Cable operators claim it would be difficult for them to maintain services if their income isn’t augmented.

“Our earnings have dwindled and it has become difficult to attend to complaints of snapped wires or poor transmission. Smaller local operators with 1,000-2,000 subscribers are finding it particularly difficult to survive with reduced income. We have started negotiating with MSOs for a hike in FTA charge share,” said Tapash Das of the Ideal Cable Operators Association.

Apart from a bigger share of the FTA fee, MSOs also get a share in the network capacity fee — a charge of Rs 20 for every 25 channels over and above the 100 FTA channels – and an equal share of the pay channel price. While 80% of the price of pay channels goes to the broadcasters, the rest is shared by operators and MSOs. Operators now earn around Rs 80 for a package priced at Rs 200 and above, Rs 95 for a package priced at Rs 300 and above and Rs 110 for a package that cost Rs 400 or more.

“The revenue-sharing arrangement prescribed by TRAI is unfair. It is aimed at throwing the smaller operators out of business. Operators provide service to consumers, not MSOs. From repairs to fee collection, everything is taken care of by them. While the bigger operators have managed to maintain services, the smaller ones have turned erratic. Consumers are already complaining about poor services and if this continues, the system will collapse in large parts of the city,” said Mrinal Chatterjee of MSO Bengal Broadband.

Kolkata’s largest MSO SITI Cable claimed they are open to negotiations with operators. “We have had discussions with operators and we will offer them a fair share,” said director Suresh Sethia. An industry insider, however, pointed out that a slight increase in the network capacity fee share may not be enough for small operators. “There are plenty with 1,000-2,000 subscribers who will have to bow out. The TRAI regulations on revenue sharing are heavily in favour of larger MSOs and operators,” he said.

“Our earnings have dwindled and it has become difficult to attend to complaints of snapped wires or poor transmission. Smaller local operators with 1,000-2,000 subscribers are finding it particularly difficult to survive with reduced income. We have started negotiating with MSOs for a hike in FTA charge share,” said Tapash Das of the Ideal Cable Operators Association.

Apart from a bigger share of the FTA fee, MSOs also get a share in the network capacity fee — a charge of Rs 20 for every 25 channels over and above the 100 FTA channels – and an equal share of the pay channel price. While 80% of the price of pay channels goes to the broadcasters, the rest is shared by operators and MSOs. Operators now earn around Rs 80 for a package priced at Rs 200 and above, Rs 95 for a package priced at Rs 300 and above and Rs 110 for a package that cost Rs 400 or more.

“The revenue-sharing arrangement prescribed by TRAI is unfair. It is aimed at throwing the smaller operators out of business. Operators provide service to consumers, not MSOs. From repairs to fee collection, everything is taken care of by them. While the bigger operators have managed to maintain services, the smaller ones have turned erratic. Consumers are already complaining about poor services and if this continues, the system will collapse in large parts of the city,” said Mrinal Chatterjee of MSO Bengal Broadband.

Kolkata’s largest MSO SITI Cable claimed they are open to negotiations with operators. “We have had discussions with operators and we will offer them a fair share,” said director Suresh Sethia. An industry insider, however, pointed out that a slight increase in the network capacity fee share may not be enough for small operators. “There are plenty with 1,000-2,000 subscribers who will have to bow out. The TRAI regulations on revenue sharing are heavily in favour of larger MSOs and operators,” he said.

Making sense of 2019

#Electionswithtimes

View Full Coverage

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE