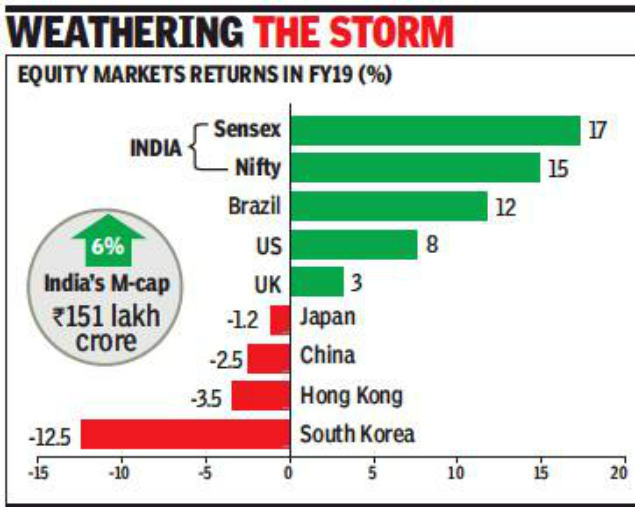

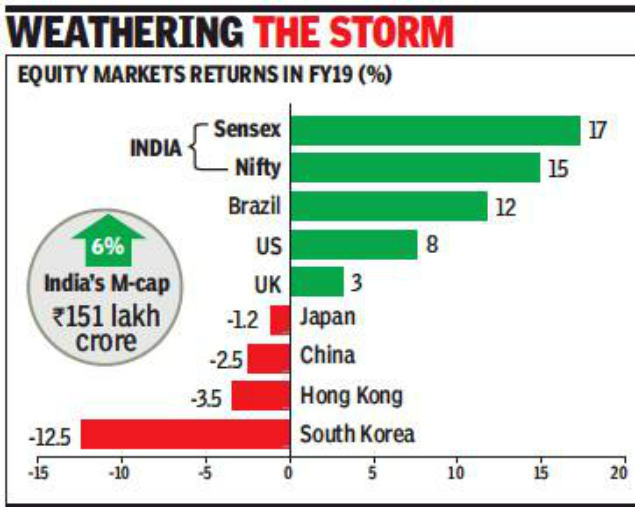

Indian capital markets beat global peers with over 15% return in FY19

Agencies | Apr 15, 2019, 07:12 IST Representative image

Representative imageNEW DELHI: Indian capital markets outperformed several major global markets, including the developed ones like the US and the UK as well as developing economies like China and Brazil, with double-digit returns in the fiscal ended March 2019 despite numerous global and domestic headwinds, data shows. The Indian market benchmark indices also improved on their own performance in the previous fiscal, with the sensex (17%) giving relatively better returns than the NSE’s Nifty (15%) in 2018-19.

An analysis of equity markets returns for these countries shows that the Indian benchmark indices had underperformed those in the US, Brazil, Japan, South Korea and Hong Kong in 2017-18, though the performance was better than the UK and China even in that year. With positive performance by benchmark indices and increasing fund raising from the market, the size of the capital markets in India also continued to expand during 2018-19, with the market capitalisation rising by over 6% to over Rs 151 lakh crore.

Besides, mutual fund asset under management grew by 11.4% to nearly Rs 24 lakh crore and Foreign Portfolio Investors’ asset under custody expanded by 8.6% to close to Rs 30 lakh crore. This is despite the fact that 2018-19 was relatively a difficult and challenging year on account of global and domestic headwinds.

Fund-raising from the capital markets also continued its positive trend during 2018-19, with funds raised through debt and equity rising by 5.3% to nearly Rs 9 lakh crore. The double-digit returns came in despite subdued sentiments at times in view of certain negative developments since September 2018, particularly on the fixed-income securities front.

On the mutual fund front, debt-oriented funds witnessed net outflows on the back of certain developments in debt market since September 2018. But, equity-oriented mutual funds continued to receive positive net inflows across all months during 2018-19 and other mutual funds received positive net inflows in 10 out of 12 months of the financial year.

An analysis of equity markets returns for these countries shows that the Indian benchmark indices had underperformed those in the US, Brazil, Japan, South Korea and Hong Kong in 2017-18, though the performance was better than the UK and China even in that year. With positive performance by benchmark indices and increasing fund raising from the market, the size of the capital markets in India also continued to expand during 2018-19, with the market capitalisation rising by over 6% to over Rs 151 lakh crore.

Besides, mutual fund asset under management grew by 11.4% to nearly Rs 24 lakh crore and Foreign Portfolio Investors’ asset under custody expanded by 8.6% to close to Rs 30 lakh crore. This is despite the fact that 2018-19 was relatively a difficult and challenging year on account of global and domestic headwinds.

Fund-raising from the capital markets also continued its positive trend during 2018-19, with funds raised through debt and equity rising by 5.3% to nearly Rs 9 lakh crore. The double-digit returns came in despite subdued sentiments at times in view of certain negative developments since September 2018, particularly on the fixed-income securities front.

On the mutual fund front, debt-oriented funds witnessed net outflows on the back of certain developments in debt market since September 2018. But, equity-oriented mutual funds continued to receive positive net inflows across all months during 2018-19 and other mutual funds received positive net inflows in 10 out of 12 months of the financial year.

Download The Times of India News App for Latest Business News.

Making sense of 2019

#Electionswithtimes

View Full Coverage

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE