As three of the country’s biggest fund houses, Reliance Mutual Fund, Kotak Mahindra Mutual Fund and HDFC Mutual Fund, grapple with the consequences of having invested in Essel Group companies Konti Infrapower and Edisons Utility three years ago, the books of these two entities show that the fund houses made a beeline to subscribe to the debt instruments of the two companies even as they reported losses and had negative net worth.

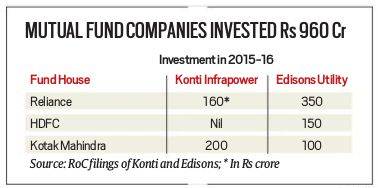

According to Registrar of Companies (RoC) documents, on aggregate, the three fund houses had invested at least Rs 960 crore in the two Essel group companies in 2015-16. While Reliance MF said it will not comment on individual investments, HDFC MF and Kotak MF said their investments in the two Essel Group firms were backed by the collateral of Zee shares.

The non-convertible debentures of these two companies were subscribed by Reliance Mutual Fund, Kotak Mahindra Mutual Fund and HDFC Mutual Fund in 2015-16 and have now turned illiquid. Not only were the two companies loss-making but the debt securities that Konti and Edisons subsequently subscribed to was of another Essel group entity, Pan India Infrastructure — also a loss-making entity.

Express Explained | Debt funds are supposed to be ‘safe’. So, why is there concern now?

In the year ended March 2016, while Konti Infra reported a net loss of Rs 53.3 crore on total revenue of Rs 5.83 crore, Edisons Utility reported a net loss of Rs 52.7 crore on total revenue of Rs 40,000. Documents of Konti accessed from its filings with the Registrar of Companies shows that while it offered a coupon rate of 11.1 per cent per annum on the non-convertible debentures subscribed by mutual funds, it, in turn, subscribed to debentures worth Rs 561 crore issued by Pan India Infraprojects that carried a coupon rate of only 0.1 per cent per annum for the first three years. Besides, Pan India Infra was also a loss-making entity.

Pan India Infrastructure reported a loss of Rs 6.79 crore on total revenue of Rs 1,696 crore in FY-16. In FY-17 the losses of Pan India widened further to Rs 60.4 crore on a revenue of Rs 1,782 crore.

The independent auditors’ report of Konti Infra for the year 2015-16 pointed more gaps in the company filings including complete erosion of net worth. Auditors drew attention “regarding the opinion of the board to prepare financial statements on going concern basis despite complete erosion of the net worth of the company, with an assurance from promoters and /or shareholders to give financial support from time to time as per the requirements to continue operations.” They further pointed towards interest-free advances given in the preceding years of Rs 49,53,317 for land and Rs 16,00,000 for other advances.

Documents of Konti Infra shows that while it allotted 100 debentures of Rs 1 crore each to four Fixed Maturity Plans (FMP) of Kotak Mutual Fund on March 11, 2016, it allotted 75 debentures of Rs 1 crore each to six schemes of Reliance Mutual Fund on the same day.

Similarly, documents of Edisons Utility show that as on March 31, 2016, Reliance Capital Trustee (Rs 350 crore), HDFC Trustee Company (Rs 150 crore) and Kotak Mahindra Trustee (Rs 100 crore) had subscribed to non-convertible debentures of Edisons Utility Works.

Responding to queries sent by The Indian Express, Reliance Mutual Fund said, “We do not comment on individual investments.”

HDFC MF spokesperson said, “Our investment in Essel Group promoter/holding entities such as Edisons Utility is secured by pledge of shares of Zee Entertainment Enterprises Ltd (ZEEL) or Zee & Dish TV Ltd. As such entities are not operating companies generally, operating results are less relevant. Therefore in such cases, the main consideration is the collateral.”

Kotak Mutual Fund in its response said, “Our exposure to Konti Infra & Edisons Utility was fully secured by minimum 1.5x cover of Zee shares. The security in the form of Zee shares is provided by Cyquator Media Services Pvt. Ltd. (one of the main promoter entities of Zee which owns more than 25% in Zee valued more than Rs 10,000 crore). Cyquator is pledger for our exposure and hence it is also obligor along with Konti & Edison. Hence, this lending was based on the strong collateral provided by Cyquator.”

“There are other mutual funds such as HDFC MF and Reliance MF who have also lent to these two entities. The total Mutual Fund exposure to Essel Group is Rs. 7327 crore as on March 2019.” Responding to the fact that Konti had in turn subscribed to debentures of Pan India Infra offering a coupon of 0.1 per cent, Kotak MF said, “As far as we are concerned, the agreed yield between us and the issuing entity is the most relevant. The coupon rate of 0.1% is not material for us, as our debenture also was as zero coupon bond (ZCB) with a yield to maturity of 11.10%.”

Part of the Essel Group, Edisons is in the business of management consultancy, accounting, tax consultancy and auditing activities among others. Konti Infra which is also a part of the Essel Group is engaged in in-house facilities of safeguarding of properties, offices and carrying out security checks of guests visiting the offices, as per the terms agreed upon with companies under Essel Group.