There has never been dearth of quality and alpha-generating stocks in the market irrespective of cycles. Hence, investors may still invest in quality stocks, said an expert

The market has turned rangebound for more than a week now despite consistent inflow of foreign money. The benchmark indices hit record highs in March - a sharp run up of 10 percent from February 19 lows.

Foreign institutional investors pumped in more than Rs 60,000 crore since February backing the up move in indices.

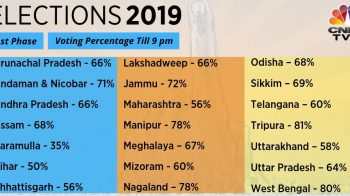

Investors and traders have now turned cautious as the voting for general elections started on April 11.

Other reasons for nervousness are deteriorating consumption trend and Skymet's projection of below normal monsoon.

"At the current level, the market has priced in most positives but healthy corporate earnings could help the market inch higher. Our key concern are sustainability of the FII inflows and recovery in corporate earnings. Change in the political environment could pose challenges," Rajeev Srivastava, Head Retail Broking, Reliance Securities told Moneycontrol.

There has never been dearth of quality and alpha-generating stocks in the market irrespective of cycles. Hence, investors may still invest in quality stocks, Srivastava added.

Brokerages initiated coverage on these 10 stocks in April with a buy call.

Brokerage: Edelweiss

Sobha: Buy | Target: Rs 682 | Return: 36%

We like Sobha for its strong execution skills, high-quality land bank, strong corporate governance and industry tailwinds for organised players.

We expect Sobha to be major beneficiary of pick up in real estate demand, and gain market share in post-RERA period. GST rate cuts and receding liquidity crisis anchored by its strong execution skills and high brand recall are some other positives.

Our NAV stands at Rs 684 per share with 40 percent of value derived from ongoing & future projects (net of debt), 14 percent from its contractual & manufacturing businesses, 39 percent from land bank and balance 8 percent from the refundable JDA deposits, brokerage said.

Brokerage: JM Financial

HDFC AMC: Buy | Target: Rs 1,850 | Return: 19%

We believe HDFC AMC's strong brand pull (benefitting from parentage), relatively higher proportion of equity assets and continued delivery on fund performance make it one of the best plays to capitalize on the financial savings opportunity in the country, JM Financial said.

Cholamandalam Financial Holding: Buy | Target: Rs 620 | Return: 29%

Cholamandalam Financial Holding (CFH), promoted by the Murugappa group, came into existence post the demerger of its manufacturing business into 'Tube investments of India Limited'.

Currently, it is an NBFC classified as a core investment company (CIC), with a significant shareholding in Cholamandalam Investment & Finance Limited (46.2 percent stake), Cholamandalam MS General Insurance Company (60 percent stake) and Cholamandalam MS Risk services Limited (49.5 percent stake).

Positives - completion of the corporate restructuring (demerger), a simplified holding structure, credible parentage, high corporate governance standards, vast opportunity and scalability of major businesses (NBFC/GIC) and a high implied holding company discount.

We anticipate steady compounding of its major investments, which in turn will drive up the valuation of the company. We initiate coverage on CFH and assign a 'buy' rating with a target price of Rs 620 per share, said the brokerage house.

Crompton Greaves Consumer: Buy | Target: Rs 275 | Return: 18%

The brokerage has put a March 2020 target price of Rs 275 32xFY21E (20 percent discount to Havells) on the stock - a potential upside of 19 percent.

"Contrary to popular perception, we believe Crompton has had a great track record in the past and is likely to deliver steady growth in future," the brokerage said.

It continues to work judiciously on a) innovative products and premiumisation in existing categories (anti-dust Fans, Air 360, Mini Crest pumps, Anti- bacterial LED bulb), b) revival / new launches of categories (water heaters, air cooler), c) brand building (A&P spend stepped up to 2.6 percent of revenues in FY17; 1.0 percent in FY17) and d) distribution (go to market- expected to cover 70-75 percent of target regions over next 18 months).

The brokerage believes that Crompton is attractively priced given its excellent return profile, cash flow conversion and stronger bottom-line growth (lower ESOP / consultant fees and incremental supplier discounting). Key risks include slower-than-expected macro recovery.

Brokerage: Motilal Oswal

Aditya Birla Fashion and Retail: Buy | Target: Rs 260 | Return: 17%

ABFRL holds a healthy and diversified portfolio mix consisting four leading menswear brands, Pantaloons in the value-fashion retail format, men/women’s innerwear through Van Heusen’s brand extension, and women’s fast-fashion venture – Forever 21.

Motilal expects healthy overall revenue/EBITDA CAGR of 14 percent/23 percent over FY19-21. EBITDA margin should expand ~125bp to 8.7 percent by FY21 on the back of (a) break-even in the innerwear and fast-fashion businesses, (b) steady uptick in Pantaloons’ private label mix (70-75 percent) and (c) the company’s strategy of franchisee-led store additions, which should provide an impetus to RoCE.

Godrej Agrovet: Buy | Target: Rs 610 | Return: 19%

In crop protection, Godrej Agrovet is focusing on multiple product launches with category expansion; it has guided for around 10 launches over the next 3-5 years with a potential of Rs 1,000 crore.

Growth in Astec will be driven by capacity expansion; Godrej Agrovet plans to invest Rs 35-40 crore every year over the next 3-4 years in triazole chemistry.

Demand for palm oil in India is not a constraint as >90 percent of the domestic demand is imported. To augment the supply of fruits for palm oil manufacturing, the government has introduced a program to promote its cultivation.

"Godrej Agrovet — India’s largest palm oil processor — is well placed to capitalize on this opportunity; we expect revenue/ EBITDA CAGR of 11 percent/ 12 percent over FY18-21," said Motilal Oswal.

"We expect consolidated revenue/ EBITDA CAGR (FY18-21) of 12 percent/ 16 percent to Rs 7,300 crore/ Rs 700 crore. We initiate coverage on Godrej Agrovet with 'buy' rating and SOTP-based target price of Rs 610."

Brokerage: Sushil Finance

Hikal: Buy | Target: Rs 230 | Return: 34%

With proven capabilities and management pedigree, Hikal offers a compelling value proposition as it continues to expand both the pharma and crop protection segments with separate focus and a calibrated approach.

This bodes well in the current scenario amid Chinese supply disturbances and easing of the Japanese markets which are likely to create opportunities for Indian API and CRAMs players.

Brokerage: Ashika Stock Broking

Mahanagar Gas: Buy | Target: Rs 1,301 | Return: 29%

Operating in business capital of India, Mumbai one of the densely populated markets, MGL has huge growth potential, as its current penetration standsat about 30 percent.

Further, favourable regulatory framework also supports its expansion plans.

"We expect strong free cash flows to continue to generate value for the shareholders. Valuing the stock with DCF methodology (FY28E) considering Cost of Equity at 8.6 percent and terminal growth rate of 3 percent, we initiate coverage on MGL with a 'buy' rating and a target price of Rs 1,301," said Ashika Stock Broking.

Equitas Holdings: Buy | Target: Rs 191 | Return: 43%

The brokerage believes Equitas Holdings will emerge as a significant value creator over the next 3-5 years, led by the management's focus on building strong base for future growth.

The company's loan book is expected to clock 40 percent CAGR over FY18-21E, led by strong growth in non-MFI portfolio along with healthy growth in MFI book. Post bottoming out in FY18, its RoAs is expected to cross 2 percent levels by FY21E.

We firmly believe Equitas Holdings will stand out amongst the SFBs over the next 5 years. Given the growth and profitability dynamics of the company; we expect RoAs /ROE to move towards 2 percent/18 percent levels by FY21E.

We expect the stock’s valuation of the company will improve towards other BFSI companies with similar growth profile and return ratios. We value Equitas Holdings at 1.9x FY21E Adjusted Book value and initiate coverage with a 'buy' rating with a target price of Rs 191.

Brokerage: Macquarie Research

Jyothy Laboratories: Outperform | Target: 250 | Return: 34%

We like JYL’s diverse product portfolio with a presence in mainstay categories that have a long runway for growth on the back of penetration and premiumization. The Henkel acquisition and turnaround demonstratemanagement’s execution skills and gives us confidence in JYL’s scalability in the long run.

Despite not being a market leader in most of categories, its strategy fordifferentiated product positioning and investments in power brands is leading to market share gains in key categories. We believe its focus on new product launches, higher A&P spend & IT-led distribution enhancement will boost volume growth. We are 9-11 percent ahead of consensus earnings for the next two years.

We build in around 21 percent PAT CAGR and 220bps increase in ROE in the next two years and initiate with an 'outperform' rating with Rs 250 target price.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.