Mutual funds' Zee group exposure hits investors

Rachel Chitra, Partha Sinha | TNN | Updated: Apr 11, 2019, 10:17 ISTHighlights

- On Monday, Kotak MF told its investors that it would not be able to pay those who are invested in FMPs, which matured this week, because of exposure to debt papers issued by companies belonging to the Zee group

- HDFC MF, which also has exposure to Zee group’s debt papers, told investors in some of its FMPs that it was extending the date of redemption by a little over a year to April 29, 2020

(Representative image)

(Representative image)BENGALURU/MUMBAI: Financial troubles at the Zee (Essel) group have started to hurt investors in fixed maturity plans (FMPs) of leading mutual fund (MF) houses. On Monday, Kotak MF told its investors that it would not be able to pay those who are invested in FMPs, which matured this week, because of exposure to debt papers issued by companies belonging to the Zee group. HDFC MF, which also has exposure to Zee group’s debt papers, told investors in some of its FMPs that it was extending the date of redemption by a little over a year to April 29, 2020.

As the name suggests, an FMP is an MF scheme that indicates a fixed return to investors after a pre-set time period, which could vary from a few months to a few years. FMPs of more than three years also offer lucrative post-tax returns and hence a large number of investors use these schemes as a substitute for bank fixed deposits. The last time FMPs had faced a problem in paying back investors at maturity was about a decade ago, towards the end of the global financial crisis.

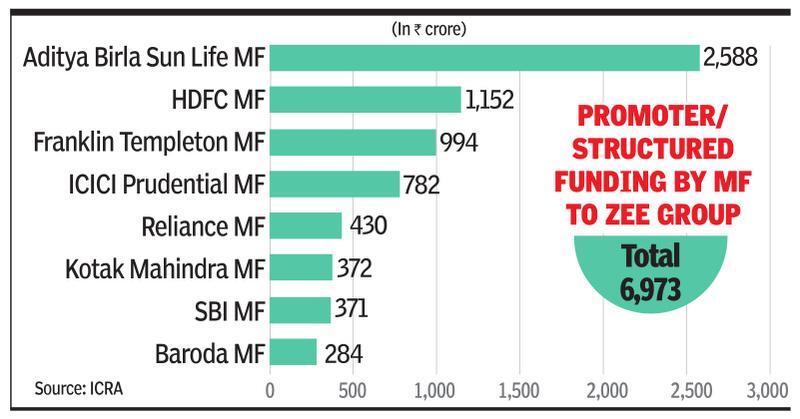

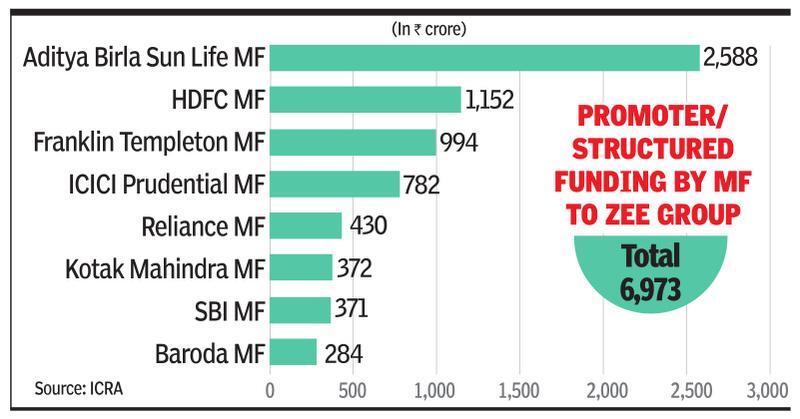

According to a report by domestic ratings and analytics major ICRA, as of end-February, the MF industry’s total exposure to Zee group’s debt papers was nearly Rs 7,000 crore. Of the top fund houses, Aditya Birla Sun Life MF’s exposure was Rs 2,588 crore, followed by HDFC MF (Rs 1,152 crore), Franklin Templeton MF (Rs 994 crore), ICICI Prudential MF (Rs 782 crore), Reliance MF (Rs 430 crore), Kotak Mahindra MF (Rs 372 crore), SBI MF (Rs 371 crore) and Baroda MF (Rs 284 crore).

On Monday, Kotak MF told some of its FMP investors that it will not be able to pay them full maturity amount since it has Zee group’s debt papers. Kotak’s FMP series 183 matured on April 10, which has a Rs 108-crore exposure to the Zee group’s debt, while the fund house’s FMP series 127, which matured on April 8, had a Rs 81-crore exposure. Currently, all the fund houses are working with Zee group officials to resolve the situation and protect the interest of MF investors.

According to industry estimates, about 55 FMPs have between 10% and 20% of their total funds invested in Zee group’s debt papers. Of these, about 40 FMPs are set to mature between now and June.

On its part, HDFC MF sent out a letter to investors that it was extending redemption date for its series 35 FMP, which is due for maturity on April 15. “The purpose of rollover/ extension is due to current interest rate scenario and portfolio positioning, the yields prevailing in the short maturity bucket present an option for investors to lock in their investments at current prevailing yields,” HDFC MF said in a notice.

A spokesperson for Kotak MF said that the fund house has taken personal guarantee of Subhash Chandra, the main promoter of the Zee group, over and above the shares of Zee group companies that the promoters had pledged for better security of its debt papers. “We have also secured upside sharing on a graded basis on stake-sale in Zee over and above the coupon rate of existing debentures. We are better secured and better rewarded than before by allowing more time to Essel group promoters to repay our debt,” the spokesperson said.

The Zee group said in a statement that it had entered into an arrangement with the lenders for a resolution deadline of September 2019. The group is working towards the same, which in turn had also saved losses to public. The Zee group reiterated that its lenders have shown immense trust and confidence, keeping the intrinsic value and core fundamentals of Zee Entertainment Enterprises as a company in mind.

The spokesperson from Kotak group also said that it was in the interest of financial prudence that it did not sell Zee shares in the open market. “We didn’t exercise the right to sell shares to recover our dues on January 25, 2019. A liquidation of about Rs 200 crore worth of Zee shares resulted in a price drop of more than 30%. In the collective wisdom of over 40 lenders who have lent more than Rs 13,000 crore, it was decided that if all of us exercised the option of selling the shares, the likely recovery of our dues will be far lower than actual dues. By panic-selling, we will convert notional loss to actual loss. All the lenders have collectively decided to give time to Essel group promoters for making an orderly exit of their assets to repay our debt,” the spokesperson said.

Investors, meanwhile, have expressed concerns. Financial adviser Manoj Nagpal took to Twitter to state, “FMPs have a maturity date and hence if it cannot liquidate their portfolio on the maturity date, they don’t have money to pay.” Nagpal expressed hope that investors would get paid. “Mutual funds will pay back — if and as much — when they get their money back. As of now, it is a delay but it is contingent if (Zee group) promoter pays back on resolution of problems. Ideally (and theoretically), the MF should have invoked pledge of Zee shares and returned investor’s money. But they have an unwritten understanding with promoter that they will not do this and give him six months,” he said.

Some people from the MF industry described the steps taken by the fund houses as a kind of “course correction” due to developments that were not under their control. “The rollovers and extensions are being thought about with the expectation that the Essel group would be able to pay back the fund houses and, in turn, investors will be able to realise the value of the investments that they were expecting when they had invested initially,” said an official with a top fund house. “If they rush to redeem, they may have to incur some losses and not realise the full value of their investments,” the official said.

As the name suggests, an FMP is an MF scheme that indicates a fixed return to investors after a pre-set time period, which could vary from a few months to a few years. FMPs of more than three years also offer lucrative post-tax returns and hence a large number of investors use these schemes as a substitute for bank fixed deposits. The last time FMPs had faced a problem in paying back investors at maturity was about a decade ago, towards the end of the global financial crisis.

According to a report by domestic ratings and analytics major ICRA, as of end-February, the MF industry’s total exposure to Zee group’s debt papers was nearly Rs 7,000 crore. Of the top fund houses, Aditya Birla Sun Life MF’s exposure was Rs 2,588 crore, followed by HDFC MF (Rs 1,152 crore), Franklin Templeton MF (Rs 994 crore), ICICI Prudential MF (Rs 782 crore), Reliance MF (Rs 430 crore), Kotak Mahindra MF (Rs 372 crore), SBI MF (Rs 371 crore) and Baroda MF (Rs 284 crore).

On Monday, Kotak MF told some of its FMP investors that it will not be able to pay them full maturity amount since it has Zee group’s debt papers. Kotak’s FMP series 183 matured on April 10, which has a Rs 108-crore exposure to the Zee group’s debt, while the fund house’s FMP series 127, which matured on April 8, had a Rs 81-crore exposure. Currently, all the fund houses are working with Zee group officials to resolve the situation and protect the interest of MF investors.

According to industry estimates, about 55 FMPs have between 10% and 20% of their total funds invested in Zee group’s debt papers. Of these, about 40 FMPs are set to mature between now and June.

On its part, HDFC MF sent out a letter to investors that it was extending redemption date for its series 35 FMP, which is due for maturity on April 15. “The purpose of rollover/ extension is due to current interest rate scenario and portfolio positioning, the yields prevailing in the short maturity bucket present an option for investors to lock in their investments at current prevailing yields,” HDFC MF said in a notice.

A spokesperson for Kotak MF said that the fund house has taken personal guarantee of Subhash Chandra, the main promoter of the Zee group, over and above the shares of Zee group companies that the promoters had pledged for better security of its debt papers. “We have also secured upside sharing on a graded basis on stake-sale in Zee over and above the coupon rate of existing debentures. We are better secured and better rewarded than before by allowing more time to Essel group promoters to repay our debt,” the spokesperson said.

The Zee group said in a statement that it had entered into an arrangement with the lenders for a resolution deadline of September 2019. The group is working towards the same, which in turn had also saved losses to public. The Zee group reiterated that its lenders have shown immense trust and confidence, keeping the intrinsic value and core fundamentals of Zee Entertainment Enterprises as a company in mind.

The spokesperson from Kotak group also said that it was in the interest of financial prudence that it did not sell Zee shares in the open market. “We didn’t exercise the right to sell shares to recover our dues on January 25, 2019. A liquidation of about Rs 200 crore worth of Zee shares resulted in a price drop of more than 30%. In the collective wisdom of over 40 lenders who have lent more than Rs 13,000 crore, it was decided that if all of us exercised the option of selling the shares, the likely recovery of our dues will be far lower than actual dues. By panic-selling, we will convert notional loss to actual loss. All the lenders have collectively decided to give time to Essel group promoters for making an orderly exit of their assets to repay our debt,” the spokesperson said.

Investors, meanwhile, have expressed concerns. Financial adviser Manoj Nagpal took to Twitter to state, “FMPs have a maturity date and hence if it cannot liquidate their portfolio on the maturity date, they don’t have money to pay.” Nagpal expressed hope that investors would get paid. “Mutual funds will pay back — if and as much — when they get their money back. As of now, it is a delay but it is contingent if (Zee group) promoter pays back on resolution of problems. Ideally (and theoretically), the MF should have invoked pledge of Zee shares and returned investor’s money. But they have an unwritten understanding with promoter that they will not do this and give him six months,” he said.

Some people from the MF industry described the steps taken by the fund houses as a kind of “course correction” due to developments that were not under their control. “The rollovers and extensions are being thought about with the expectation that the Essel group would be able to pay back the fund houses and, in turn, investors will be able to realise the value of the investments that they were expecting when they had invested initially,” said an official with a top fund house. “If they rush to redeem, they may have to incur some losses and not realise the full value of their investments,” the official said.

Download The Times of India News App for Latest Business News.

Making sense of 2019

#Electionswithtimes

View Full Coverage

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE