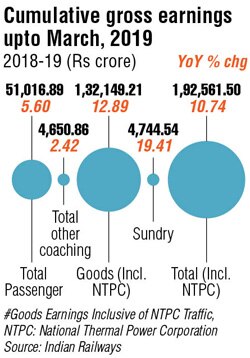

For the fourth successive year, Indian Railways (IR) has fallen short of its gross earnings target for 2018-19. This target was set during the revised estimates (RE) when the Interim Budget 2019-20 was presented last month. The RE of the earnings target of passengers, goods and other heads had anyway been lowered versus the Budget Estimates (BE). Latest data shows that even the lower gross earnings in RE have not been achieved. The 'Gross Earnings on Originating Basis' figures by the railways show gross earnings were at Rs 192,561.5 crore, almost 11% more than in 2017-18 but almost 2.5% lower than RE.

During 2018-19, the railways earned almost Rs 140 crore a day by transporting passengers, Rs 8 crore a day more than in 2017-18 but about Rs 2 crore a day less than the BE. In freight earnings, the gap between BE and actual earnings is wide; BE was Rs 550 crore per day while actual was a mere Rs 362 crore a day. In 2017-18, the transporter had earned Rs 320 crore a day.

The consistent shortfall in earnings versus target is happening as growth in passengers and freight has been sub-optimal in the last five years. Growth in passengers in 2018-19 was only 1.83%, with reserved category up by about 7% but non-reserved (which accounts for bulk of passengers) declining by 0.52%. Suburban passenger growth grew at under 3%, while freight haulage was up by about 5%.

In 2017-18, freight was up by about 5% and passenger growth remained virtually flat at 0.33%. In 2016-17, passenger growth was flat at 0.46%, while freight increased by almost 8%. In 2015-16, passenger growth declined by over 5%, freight remained flat. In 2014-15, freight was again flat, while passengers fell by over 2%. Before 2014-15, traffic from both freight and passengers was growing on a better note.

In 2017-18, freight was up by about 5% and passenger growth remained virtually flat at 0.33%. In 2016-17, passenger growth was flat at 0.46%, while freight increased by almost 8%. In 2015-16, passenger growth declined by over 5%, freight remained flat. In 2014-15, freight was again flat, while passengers fell by over 2%. Before 2014-15, traffic from both freight and passengers was growing on a better note.

Manish Agarwal, leader infrastructure at PwC, said, "Freight, long distance passengers and suburban passengers – each revenue stream of IR is under pressure. In freight, all commodities, except those transported long distance in bulk, have limited potential for increasing revenue. Long distance passengers are being wooed by airlines and buses as these modes offer more speed or flexibility. In suburban passenger segment, IR does not recover operating costs to keep fares affordable".

IR's operating ratio (OR) has also worsened over the last few years. OR denotes how much the railways spends to earn each rupee. In at least three of the last five years, this ratio was over 95%, 96.5% in 2016-17 and 98.4% in 2017-18. For 2018-19, it has been revised upwards from 92.8% to 96.2%. The operating ratio was much lower at 90.2% in 2012-13 and 93.6% in 2013-14. In 2014-15 though, it was 91.3%.

Worsening operating ratio and dwindling earnings mean the railways have to depend more on borrowings to undertake capex. Interim Budget figures show railways will need Rs 83,571 crore as extra budgetary support (EBS) versus Rs 79,297.52 crore in FY19 and Rs 55,498.14 crore in 2017-18, respectively. So in two years, the EBS has jumped by over Rs 28,000 crore.

Garima Kapoor at Elara Capital said, "Allocation for capex under NDA has been higher compared to UPA2 but this has been largely funded through EBS". However, the cross-subsidisation of passengers from freight earnings has been lower under NDA, she said, as unlike the UPA government, the NDA did not increase freight rates while keeping passenger fares constant.

Last month, as the IR managed to convince NTPC and Concor to cough up advance freight payments totalling Rs 13,000 crore, it was clearly evident that the IR wanted to show improved earnings and stick to the OR target.

...& ANALYSIS

- Rs 192,561.5 cr – Railways gross earnings in 2018-19

- Rs 83572 cr – Railways will need extra budgetary support in 2019-20