Corruption can dent revenue collection to the extent of 2.75 percent of gross domestic product in emerging market economies.

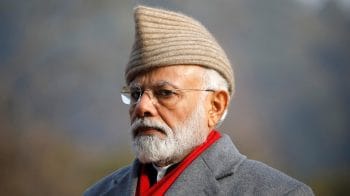

Rajesh Kumar

The BJP-led National Democratic Alliance had made corruption a major issue in the 2014 Lok Sabha election and promised to clean up the system if voted to power. Allegations of corruption were one of the biggest reasons for the defeat of the United Progressive Alliance in 2014. Five years later, in the Sankalp Patra of BJP, Prime Minister Narendra Modi, highlighting the achievements of the NDA government, noted: "The central government has waged a determined crusade against the scourge of corruption and black money. The culture of middlemen roaming in the corridors of power is now history. Decisions are guided by public interest of all Indians and not the self-interest of a select few."

The importance of containing corruption cannot be overstated in a developing country like India. Aside from being a roadblock in development, it also has fiscal implications. An analytical chapter in the latest Fiscal Monitor of the International Monetary Fund (IMF) shows that corruption can dent revenue collection to the extent of 2.75 percent of gross domestic product in emerging market economies. It also affects government expenditure and can lead to misallocation of fiscal resources. In this context, the IMF notes: "At the budget formulation stage, spending choices can be diverted to projects or activities that offer greater opportunities for kickbacks or spending that is exempt from some controls." It is possible that contracts are designed in a way that favours certain businesses.

At a broader level, it is not easy to contain corruption and rent-seeking. The NDA government has done well by implementing laws, such as the Benami Transaction Prohibition (Amendment) Act and the Fugitive Economic Offenders Act. It also decided to allocate natural resources through auctions. During the term of the previous government, allocation of natural resources and telecom spectrum was not done in a transparent manner.

However, more needs to be done to root out corruption. Among other things, this would require strengthening investigative and law enforcement capabilities. It does not help India's case when cases of corruption languish in courts for decades. The fear of getting caught in a long-drawn investigation also cripples decision making on the part of officials and affects economic outcomes. Therefore, it is important to strengthen the system so that it can differentiate between an act of corruption and a legitimate decision in a timely fashion.

Further, there is a need to bring more transparency in the system. It is also important that the government withdraws from commercial areas and creates more space for markets. This would curtail the discretionary powers of officials and minimise the scope of corruption.

On the spending side, strengthening audit capabilities will help. Further, the use of technology can also help reduce corruption and leakages. As the IMF highlights, the adoption of technology in social assistance programmes in India helped reduce costs by 17 percent without showing a decline in benefits. Therefore, it is important to continuously improve systems and make them more transparent. Among other things, this will enable higher tax collection and more efficient spending.

However, the elephant in the room is electoral finance. Lack of transparency in election finance is a big reason for corruption and generation of black money. For instance, since the announcement of the Lok Sabha election, the election commission has seized illegal liquor, drugs and cash worth over Rs 1,400 crore.

Clearly, unaccounted cash plays a big role in elections and this needs to stop. It will be difficult for a party in power to work fairly if it has to depend on contractors and businesses for illicit cash to finance the next election. India needs wholesale reforms in electoral finance to contain corruption in a meaningful way.