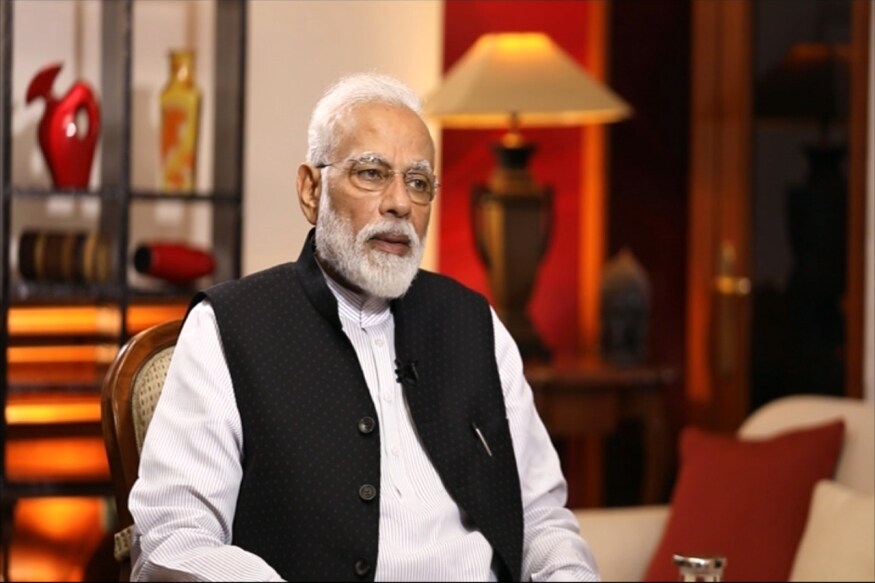

NRIs can be impacted by an election outcome one way or the other.

Vishal Dhawan

With the election season in full swing, there are multiple opinions on what is going to happen after the announcement of the election results and its impact on financial markets and investment portfolios. Listening to all the commentary while sitting thousands of miles away is even more challenging for NRIs who cannot cast their votes and directly influence the outcome. But, they can be impacted by an election outcome one way or the other.

Irrespective of the party that they support personally, they need to separate “Who will I like to see form the government and lead the nation?” from “What should I be doing in case of certain outcomes?” The good news is that the impacts of election results matter less than what all of us seem to believe. Data from the last four decades show that investors focus on more important things like global flows of money, how global oil prices move, and company earnings growth. These tend to have much longer term impacts rather than election outcomes that tend to cause temporary movements.

In fact, there has been a significant consistency over multiple elections over the years, wherein the first couple of years of governments tend to be more favourable for investors as governments tend to be more prudent and focus on the economy, rather than focussing on getting elected back to power.

It is important to remember that, like most other things in life, there is no perfect way to predict what an election outcome will be. Opinion polls and exit surveys are possible indicators of what may happen but may not reflect what will actually happen. One also needs to remember that the national parties control outcomes only in a few states. The elections in other states depend on a combination of factors including electoral tie-ups, extent of voter turnout etc. Thus, investors will need to keep in mind that trying to run a strategy focussed on a singular outcome may be fraught with risk. In addition, states are now controlling a large amount of spending unlike earlier times where the central spending drove the economy. So, the impacts of central government policies have reduced to a certain extent.

One also needs to remember that, over the years, policies across governments have been fairly consistent, with promises made at the time of election getting tempered once elections are won, to become more pragmatic and prudent.

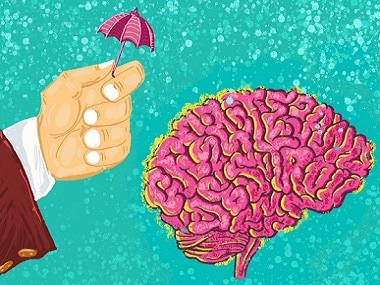

Election outcomes could impact different asset classes differently. For example, the impact on the fixed income portfolio is significantly lower than that on equities or real estate. Any prudent investment portfolio will tend to have a strategic asset allocation that is driven by the nature of the financial goals that are to be achieved, along with the appropriate investment time horizon. Trying to shift this asset allocation significantly because of a singular event like an election is not suggested.NRIs could consider going slightly overweight or underweight on a particular asset class for a particular outcome which they assign a higher probability to. But, trying to adjust it dramatically for elections or predictions of certain election outcomes is certainly not recommended. Ultimately, the market timing is not a sustainable source of portfolio returns. It is very rare to get both of it right whilst buying and selling.

This timing concern also tends to take on a very important dimension for NRIs when they are planning to remit monies to India and are, therefore, trying to decide on whether to hold back the remittance or accelerate the remittance due to the possible movement of the INR in case of a particular election outcome.

Ultimately, we believe that the movement of any financial market is driven by multiple variables, with elections being just one of them. NRIs would be much better off tracking how companies’ earnings grow and how valuations in equity markets look like to get a better perspective on equities as an asset class. Similarly, tracking oil price movements and its possible repercussions on inflation in India, along with its resultant impact on the current account deficit, may have much more significant implications on the value of the Indian Rupee. Real estate trends are better dictated by demand and supply, rather than by which party comes to power.

Therefore, have a robust asset allocation, diversify geographically to cover single country risks and enjoy conversations around election outcomes. Don’t materially alter your investment strategy though.

The author is a certified financial planner and founder of Plan Ahead Wealth Advisors, a SEBI registered investment advisory firm.You can now invest in mutual funds with moneycontrol. Download moneycontrol transact app. A dedicated app to explore, research and buy mutual funds.