Passenger vehicle sales hit four-year low, road ahead looks bumpy

Rise only 2.7% in last fiscal; SIAM expects 3-5% growth in 2019-20

Passenger vehicles

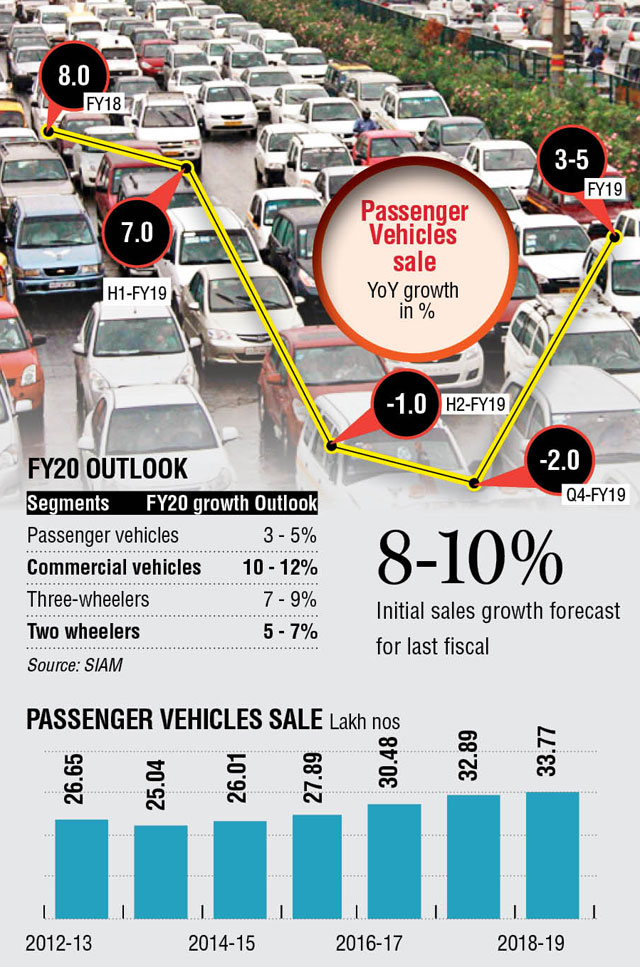

Passenger vehicle (PV) sales rose a mere 2.7% in 2018-19, the slowest in last four years, as per data from Society of Indian Automobile Manufacturers (SIAM), which has given a conservative growth outlook even for the current fiscal.

Despite new product launches and various discounts, the sales were subdued. Passenger vehicle sales in the last financial year stood at 33,77,436 units compared to 32,88,581 units in 2017-18, according to the data released by SIAM on Monday. The original forecast by the industry body had pegged the growth at 8-10%, which was later revised to 6%.

The is the weakest growth since 2013-14 when sales had declined by 6.7%.

And the challenges for the auto industry are far from over as this year will see General Elections year along with the transition to BS-VI technology from April 2020 and implementation of new safety norms. SIAM has predicted a modest sales growth of 3-5% for passenger vehicles for 2019-20.

The two-wheeler segment grew at 4.85% in 2018-19 and is expected to grow at 5-7% for the current year.

Commercial vehicles, which grew at 17.55% in 2018-19, are expected to see a lower growth of 10-12% in the current year.

Total two wheeler sales grew 4.86% to 2,11,81,390 units in 2018-19 compared with 2,02,00,117 units in 2017-18. Sales across categories grew by 5.15 % to 2,62,67,783 units in 2018-19 from 2,49,81,312 units in 2017-18.

Amidst the bleak outlook for the industry, SIAM has called for a reduction in Goods and Services Tax (GST) rate to offset the price increase of about 10-15% across vehicle categories due to BS-VI implementation. "We are in the election year. Historical data shows that the growth before elections remains subdued... However, other factors such as increase in insurance costs, liquidity crunch and high commodity prices also had a huge impact on growth rates," SIAM president Rajan Wadhera said.

"With BS-VI coming in, costs will go up, which will further affect the sales and when sales come down, obviously GST collections will come down. So it is not a win-win situation. The government should look at making GST for two-wheelers to 18% from 28% so that the increase in price can be offset. The impact of cars will be higher with BS-VI and other safety norms. We need serious consideration from the government to help make sure there is a win-win situation," he said.

The positive thing is that there is growth in all segments, though it isn't in high single-digit or double-digits and the industry recorded highest-ever sales and production in a financial year, Wadhera added. The change in insurance policy rules has also resulted an increase in two-wheelers prices by about 10%, which is expected to go up further with the introduction of BS-VI.

Sridhar V, partner, Grant Thornton India LLP, said the year has ended off on a fairly dull note across segments of vehicles, except for CV. Overall, the yearly sales have shown a growth of 5.2% primarily riding on a very good performance from CV right through the first half of the year, except for the last two quarters of the financial year, when it reflected single-digit growth. The growth of two-wheelers and passenger vehicles have been strained mostly for the second half, bordering on negative growth. "However, the year is expected to have added close to 1.2 million vehicles on the road. This situation is expected to continue over the first quarter and moving over to BS-VI can show positive effects on the demand for new vehicles."

In March, the PV sales declined by 2.96% to 2,91,806 units from 3,00,722 units in the same period the previous year. Two-wheeler sales fell 17.31% to 14,40,663 units as compared to 17,42,307 units in March 2018. Sales of commercial vehicles were up marginally at 1,09,030 units in March, SIAM said. Vehicle sales across categories registered a decline of 14.21% to 19,08,126 units from 22,24,224 units a year ago.

According to Shamsher Dewan, VP and sector head, corporate sector ratings, Icra, the demand environment is likely to remain subdued in the near term for CVs, especially in the wake of upcoming general elections and a high base. "However, a likely pre-buying and continued thrust on infrastructure sector will drive recovery in second half of the year," he said.

"The key positives from last fiscal's CV sales were the healthy demand for tipper trucks and intermediate commercial vehicles, supported by construction and e-commerce sector, respectively," Dewan added.