In terms of sectors, the IT sector was the top gainer on account of a weak rupee. The rally was led by NIIT, Infosys, Tech Mahindra, and TCS

S&P BSE Sensex fell by 341 points from its intraday high of 39,041 as investors preferred to book profits ahead of earnings. Valuation premium and the recent surge in crude oil prices also put investors on the sidelines.

Crude oil prices are trading at a 5-month high driven upwards by OPEC’s ongoing supply cuts, US sanctions against Iran and Venezuela, fighting in Libya as well as strong US jobs data, said a Reuters report. Brent Crude has rallied over 30 percent in 2019.

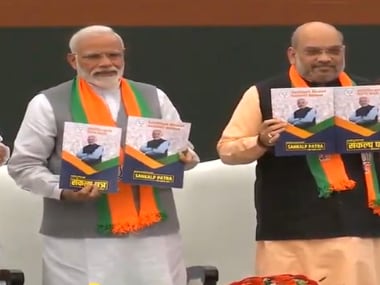

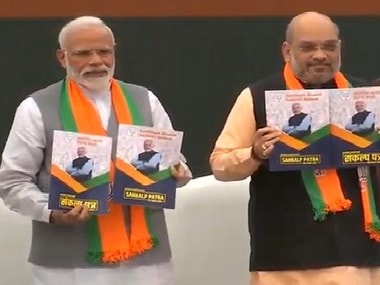

There was a feeling among the participants that markets fell after ruling BJP released its manifesto for the general elections, but experts feel that wasn’t the case.

BJP manifesto touched upon doubling farmers’ income by 2022. The government also announced pension for small and marginal farmers on reaching 60 years of age. It was largely on predicted lines.

“The BJP manifesto was very clear in term of the development work which the government is likely to undertake in the next five years. I personally feel that the manifesto was predictable but the large part of the correction was largely on account of profit booking as Nifty valuations have surged to P/E of 29x. Hence, investors can use rallies to book profits,” Ritesh Ashar - Chief Strategy Officer - KIFS Trade Capital told Moneycontrol.

“Crude oil is something which is a worry but probably not now. I think we have provisions in place and we can digest it up to $75/bbl. However, it will be a cause of concern when crude starts trading at $80/bbl,” he said.

In terms of sectors, the IT sector was the top gainer on account of a weak rupee. The rally was led by NIIT, Infosys, Tech Mahindra, and TCS.

On the other hand, profit booking was seen in realty, oil & gas, and metal stocks.

The S&P BSE Mid-cap index slipped 0.72 percent while the S&P BSE Smallcap index closed 0.39 percent lower.

Stocks in news:

OMC remained in focus as Brent crude traded at a 5-month high. This had caused stocks like IOC, BPCL, and HPCL to bleed. HPCL was down 3.9 percent, followed by IOC that fell 3.8 percent, and BPCL closed 1.9 percent lower.

NIIT and NIIT Tech:

NIIT Technologies lost over 3 percent and NIIT rose nearly 20 percent after Baring Private Equity Asia acquired 30 percent stake from promoters including NIIT and announced an open offer for another 26 percent stake.

Shares of Torrent Pharmaceuticals fell nearly 3 percent after the company received certain observations from USFDA.

Kernex Microsystems (India) added 5 percent even as the company received show cause notice from Directorate General of GST Intelligence Hyderabad Zonal Unit.

Global Update:

Asian markets ended mixed as Shanghai Composite fell to 3,244.8, while Hang Seng ended up 0.32 percent at 30,077.15.

Nikkei shed 0.21 perecnt at 21,761.65, while Kospi ended marginally higher at 2,210.60

European markets are trading marginally lower ahead US earnings season.