The accident insurance cover will be similar to Pradhan Mantri Suraksha Bima Yojana

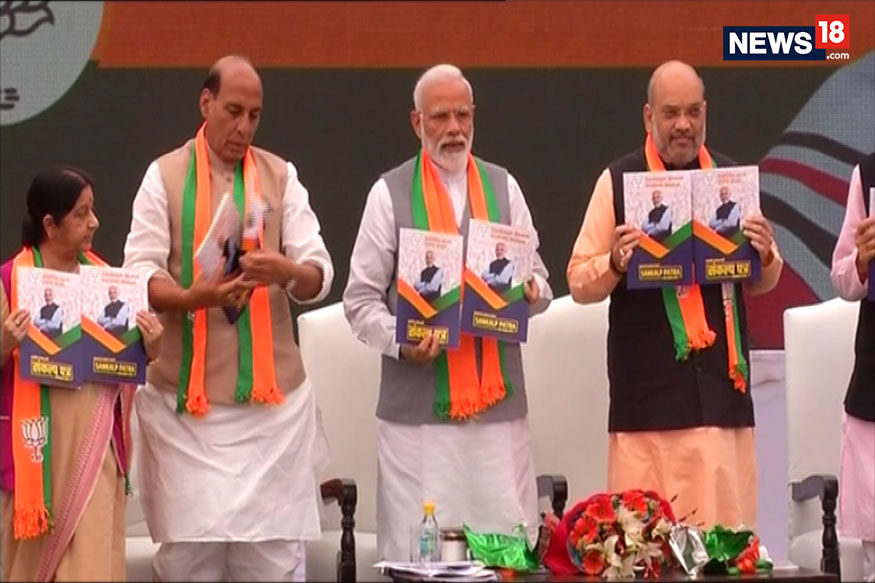

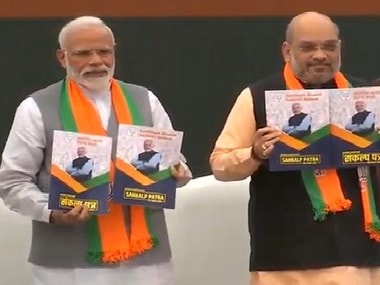

The Rs 10 lakh accident insurance scheme announced as part of the Bharatiya Janata Party (BJP) manifesto for the Lok Sabha 2019 is likely to be priced at a very nominal rate (below Rs 150) and will be beneficial for the small trader community. The BJP in its poll manifesto said they will provide this personal accident cover to all small traders registered under the Goods and Services (GST) tax regime.

Sources told Moneycontrol that more than 30 million traders could be benefited by this scheme. While the traders will pay a low premium, the rest would be subsidized by the government.

The contours of the scheme are expected to be similar to the Jan Suraksha Yojana, which has two insurance schemes.

The personal accident scheme (Pradhan Mantri Suraksha Bima Yojana) and term insurance scheme (Pradhan Mantri Jeevan Jyoti Bima Yojana) were launched in May 2015.

Both policies have a sum assured of Rs 2 lakh each and need to be renewed after one year. But their premiums are low at Rs 12 and Rs 330, respectively.

Similar to the auto-debit facility in these schemes, the personal accident cover for small traders is also likely to have transactions through bank accounts. While it was anticipated that this scheme would be launched in February during the budget session, it was later decided to make it a part of the party manifesto.

In the first five months of the schemes' launch, around 120 million policyholders were enrolled.

"Both exclusions and waiting period for this insurance will be minimal considering most of the small traders are the only earning members of their family," said a senior insurance official privy to the development. Both public and private sector insurers will be allowed to participate in the programme.

The total enrollments for the two insurance schemes under Jan Suraksha still remain high due to their auto-renewal feature, which allows the premium to be debited straight from the policyholder's bank account on annual basis.

As on April 23, 2018 (data only available till that date), there were 135 million subscribers under PMSBY and 53.3 million subscribers under PMJJBY.

Due to the fact that this is an auto-renewal scheme, once an individual has subscribed to the policy, the premium is deducted on an annual basis.

Apart from small traders, almost 3.5 million fishermen in the country will also be provided accident insurance. While the BJP manifesto did not mention the insurance amount, it is likely that they will be provided a cover between Rs 2-5 lakh free of cost.

Insurance officials had advised BJP officials that offering it at a premium Rs 100-150 per annual will be ideal.