In an upward trend, a gap is produced when the highest price of one day is lower than the lowest price of the next day. Conversely, in a downward trend, a gap occurs when the lowest price of any one day is higher than the highest price of the next day.

Shabbir Kayyumi

A gap is defined as an unfilled space or interval. Gaps result from extraordinary buying or selling interest developing while the market is closed. On a technical analysis chart, a gap represents an area where no trading has taken place.

In Japanese Candlestick Charting gaps are referred to as windows. In an upward trend, a gap is produced when the highest price of one day is lower than the lowest price of the next day. Conversely, in a downward trend, a gap occurs when the lowest price of any one day is higher than the highest price of the next day.

Gaps are blank spaces on a price charts representing incidence of no shares being traded within a particular price range. Gaps are common, especially in the stock market and they provide information and insights about the underlying market dynamics.

• Gaps are important areas on a chart that can help a technical analysis trader better find areas of support or resistance.

• Once price gaps downward, the gap can act as resistance

• When prices gap upwards, the gap can act as support to prices in the future.

Gaps as Support and Resistance

Types of Gaps

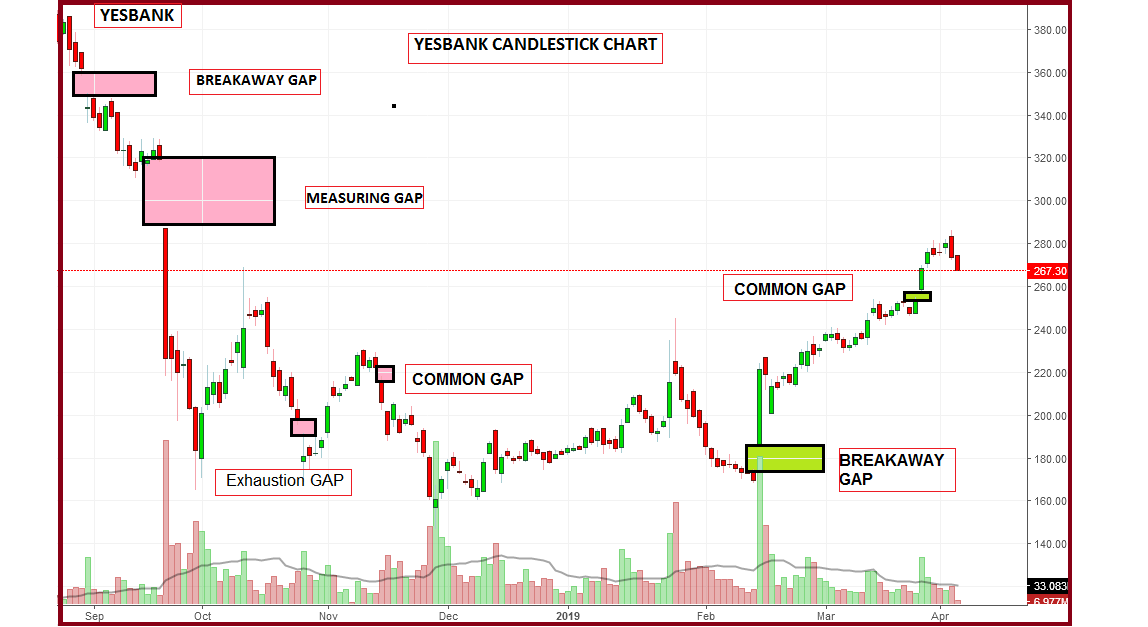

Common Gaps

Sometimes referred to as a trading gap or an area gap, the common gap is usually uneventful. These gaps are common and usually get filled fairly quickly. The price action at a later time (a few days to a few weeks) usually retraces at the least to the last day before the gap. This is also known as closing the gap.

Breakaway Gaps

Breakaway gaps are the exciting ones. These occur when the price action is breaking out of a trading range or congestion area. To understand gaps, one has to understand the nature of congestion areas in the market. A congestion area is just a price range in which the market has traded for some period of time, usually a few weeks or so. The area near the top of the congestion area is usually resistance when approached from below. Likewise, the area near the bottom of the congestion area is support when approached from above. To break out of these areas requires market enthusiasm, and either many more buyers than sellers for upside breakouts or many more sellers than buyers for downside breakouts.

Measuring Gaps

Measuring gaps are best described as gaps caused by increased interest in the stock. Measuring gaps to the upside typically represent traders who did not get in during the initial move of the uptrend and, while waiting for a retracement in price, decided it was not going to happen. Increased buying interest happens all of a sudden, and the price gaps above the previous day's high. This type of runaway gap represents a near-panic state in traders. Also, a good uptrend can have runaway gaps caused by significant news events that cause new interest in the stock.

Exhaustion Gaps

As its name sounds, an exhaustion gap occurs at the end of a trend. In the case of an uptrend, price makes one last attempt to move higher on a last gasp of breath; however, the trend is exhausted, and the higher price cannot be sustained. It is easy to detect an exhaustion gap in hindsight; however, distinguishing an exhaustion gap from a measuring gap at the time of the gap can be difficult because the two share many characteristics.

Conclusion

• Gaps are a significant technical development in price action and chart analysis, and should not be ignored.• Gaps can offer evidence that something important change has happened to the fundamentals or the psychology of the crowd that accompanies this market movement. A correct interpretation of this change leads to profitable trading.

The author is Head - Technical & Derivative Research at Narnolia Financial Advisors.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are her own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.